We hope that after 5 years of not being competitive in the data center AMD comes back with a bang in 2017. There are two main story lines when it comes to AMD server plans in 2017 and they are CPU and GPU. We think that AMD has a great chance of capturing decent market share by the end of 2017 and have momentum heading into 2018.

x86 Compute: 15% Market Share Awaiting AMD

With AMD re-entering the x86 server market there is a sizable share of the market that will likely buy AMD solely to put pricing pressure on Intel by having an alternative supplier. AMD Zen should be competitive enough with Intel’s Skylake-EP. For ARM platform vendors such as Cavium and Qualcomm AMD’s re-entry is a significant threat. Companies that want an alternative to Intel will not have to port code to ARM then go through the growing pains associated with switching architectures. Instead, they can simply buy AMD and run existing code.

There is a good chance AMD can capture a sizable chunk of the market providing Zen is truly competitive. Intel is chasing FPGA integration for accounts such as with Microsoft so AMD does have an opportunity to grab market share. We hope that the Naples server platform lives up to its hype and is truly competitive. If AMD is willing to bleed margin to gain market share it could make a major shift in the market in 2017. There is a large application class of general purpose virtualization and web hosting type applications that Zen may have an easy time servicing.

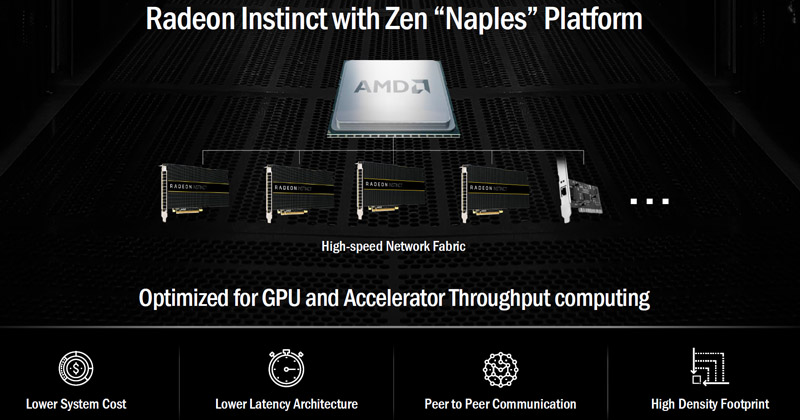

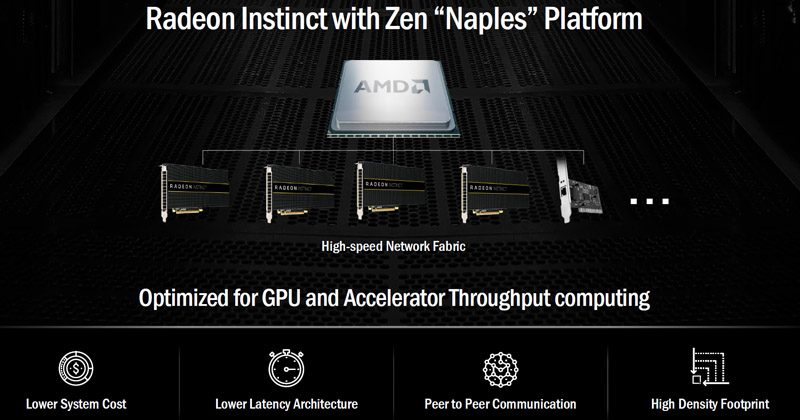

One of the major challenges we see for AMD is in the interconnect. While both AMD Naples and Intel Purley are set to have 10GbE connectivity, Intel has Omni-Path that is going to be a monster in 2017. Omni-Path is going to be not just a low-cost Knights Landing option but a low-cost Skylake-EP option as well. With on-package integration for this generation even a casual industry observer can see where Intel is planning to go with this technology in 2018 and beyond. At SC16 the large server vendors were saying Omni-Path is the wave of the future when out of Mellanox’s earshot. The negative to Omni-Path is that it is not Ethernet so integration of today’s gear is harder than the onboard 10GbE Naples will have.

Machine Learning/ AI

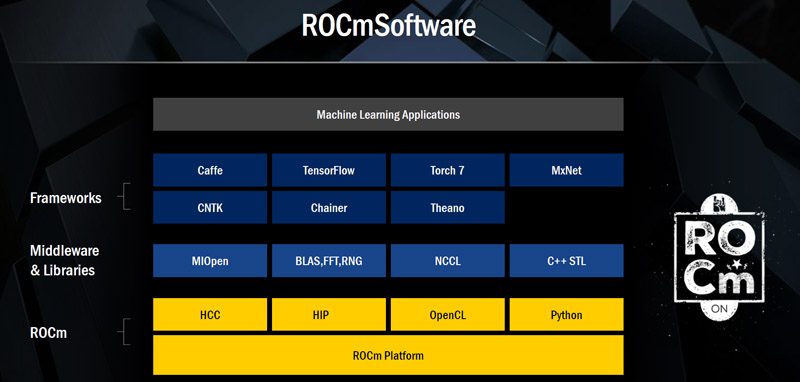

AMD has a really interesting product line as it also has GPU technology. AMD has been trying to get its GPUs utilized in machine learning but NVIDIA is years ahead of AMD in terms of support. AMD is trying to solve this through software but it still ends up being another step for the AMD users. ROCm if successful could signal a major change for AMD and open up its GPUs to more machine learning usage. Right now, AMD’s struggle is that the vast majority of the machine learning/ AI community is using NVIDIA GPUs. This community is also publishing documentation and new tools.

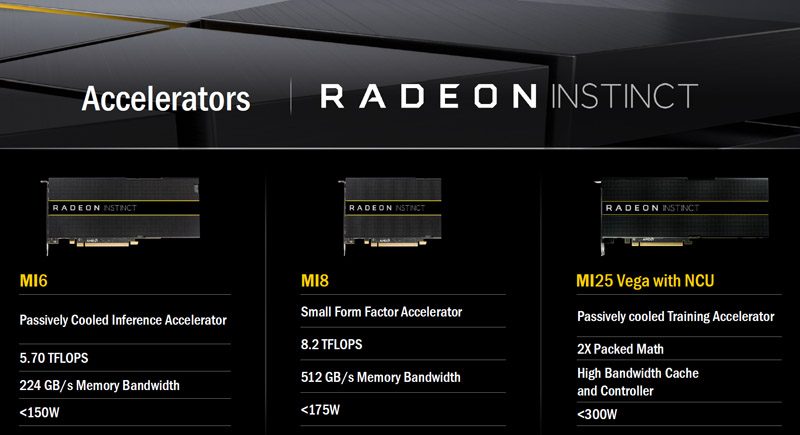

In 2017 like we expect Volta from NVIDIA, we expect to see Vega from AMD. AMD already hinted at this as we saw with the Radeon Instinct launch as well as the AMD Ryzen launch.

Depending on the pricing and feature set, combined with the constrained supply of Pascal P100 chips (and perhaps the next-gen Volta parts) AMD could make a major move into the space.

Our big question on the Radeon machine learning side is whether the market is already too crowded. Is NVIDIA/ CUDA, x86 and the FPGA ecosystem too far ahead to adopt ROCm? That is an answer we hope to see in 2017. Between the traditional compute and AI / machine learning space AMD will have the tools in 2017 to wage a price/ performance war against Intel and NVIDIA if it chooses to see if either company will let their ASPs and margins dip or if they will blink.