In the latest Top500 list released earlier this week for ISC 2022, we had some enormous shifts in the balance of power. That included a lot of churn in the top 10. Outside of the top 10, it was a relatively meager new list. Let us get to the details and dig into some of the trends.

For those wanting to take a trip down into the archives, you can find our previous pieces here: November 2021, June 2021, November 2020, June 2020, November 2019, June 2019.

Top500 New System Trends

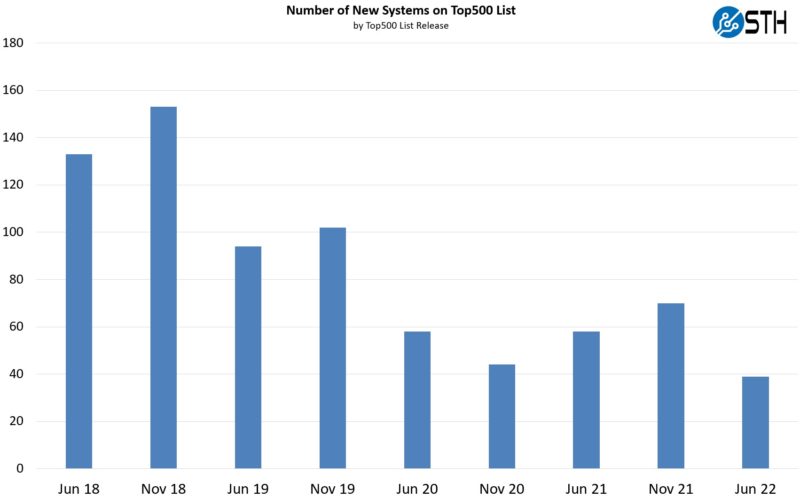

First, we should highlight the sheer quantity of turnover in the Top500. When we started doing this analysis in 2018, we more than a quarter of the list turnover with each new publication. The pandemic in 2020 certainly had an impact, but the new June 2022 list did not even get back to pandemic-era levels:

There were only 39 new systems on this list making it even fewer than the peak pandemic era November 2020 list. After a 2021 bounce back, 39 is downright meager in comparison. At least with this list, we got a new #1 with Frontier. The impact of having so few systems is that we are going to streamline the number of charts we have since there are fewer points of differentiation in this list.

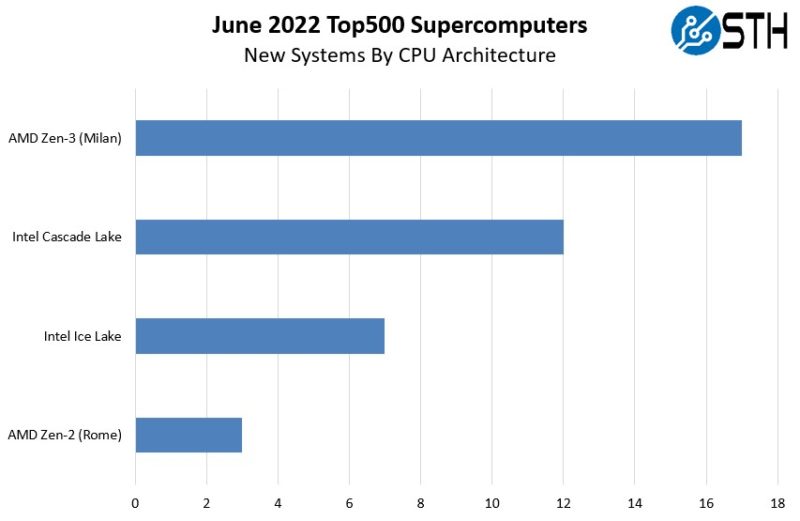

Top500 New System CPU Architecture Trends

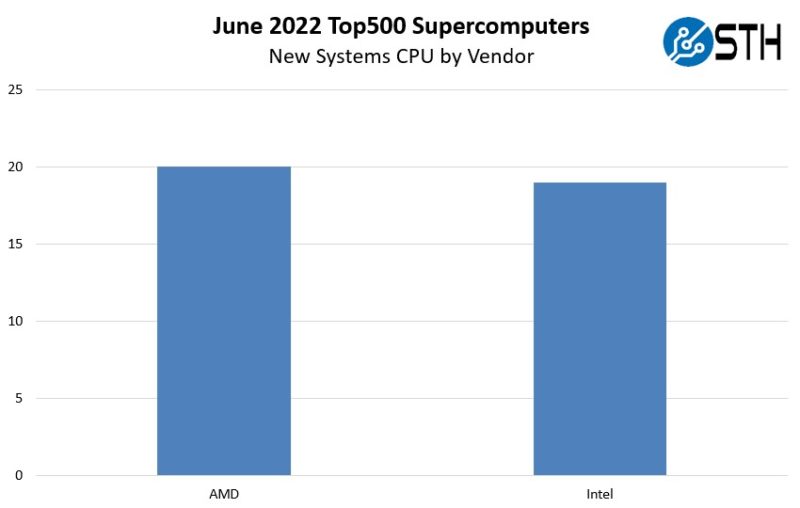

In this section, we simply look at CPU architecture trends by looking at what new systems enter the Top500 and the CPUs that they use. Let us start by looking at the vendor breakdown.

AMD edged out Intel for the most new systems on the list. Intel’s figures were significantly bolstered in this list from a Chinese HPC vendor’s list stuffing practices.

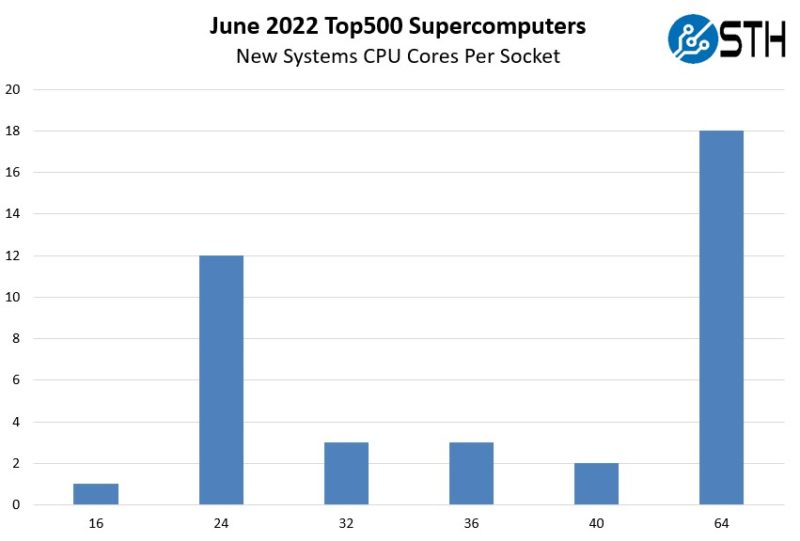

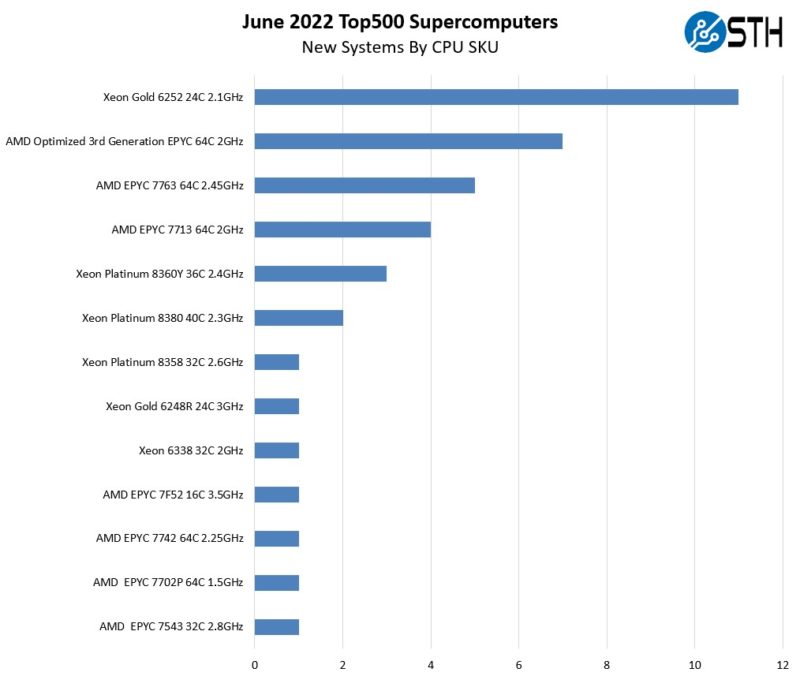

When we go to CPU cores per socket, we see a few interesting tidbits. Notably, the 64-core level has become the most popular. The other big one is that we have a 16-core system using a frequency-optimized EPYC 7F52 CPU. That was quite interesting since many of these systems use lower frequencies but more core chips for better power efficiency. We also did not have a 16-core or below chip in the November 2021 systems.

The most popular architecture was AMD’s Zen3 or 3rd generation AMD EPYC. Here you can see that the Intel side is using more of its 2019 era chips rather than 2021, again due to the list stuffing that we will see later.

Here are the actual SKUs that are being used:

Overall, a much smaller set of processors in this list, but that is due to having fewer systems.

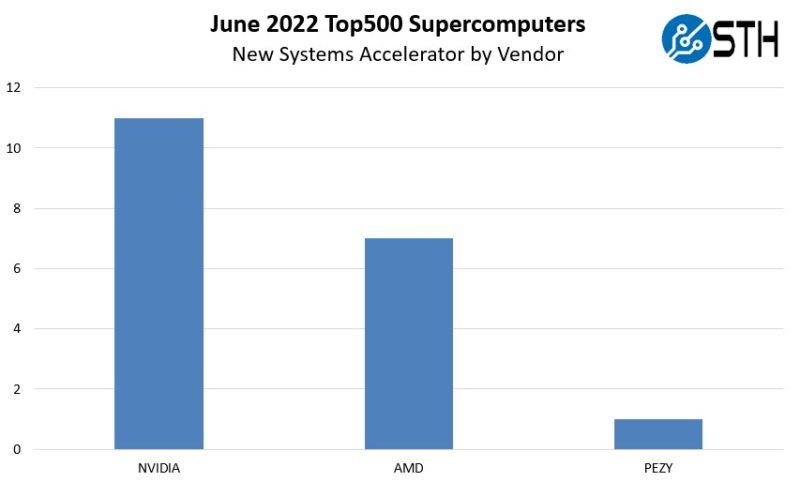

Accelerators or Just NVIDIA?

NVIDIA has been so dominant in the accelerator for HPC market that we have a section specifically addressing that in its title. In this list, it was nowhere near as dominant:

The AMD MI250X-based systems really made headway on this list making up 7 of the 19 accelerated systems. Still, that means that just under half of the systems are using accelerators. We expect Intel to make an entry in the June 2023 list with Aurora and Ponte Vecchio unless another system sneaks in between now and then.

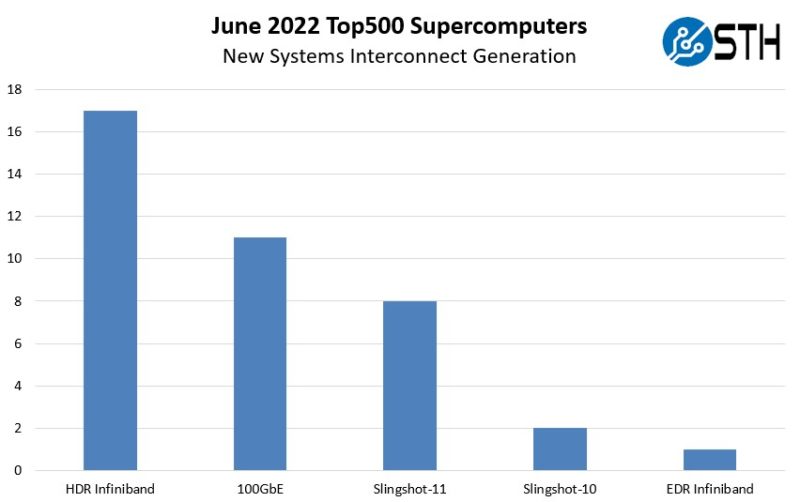

Fabric and Networking Trends

Here is one that many regulars to this piece will identify with. On the Interconnect side, Ethernet has been by far the most common solution.

With this generation, Infiniband did well. Slingshot also made a major move on the list making up just over a quarter of the new systems. Since that is a HPE technology, that is a big move.

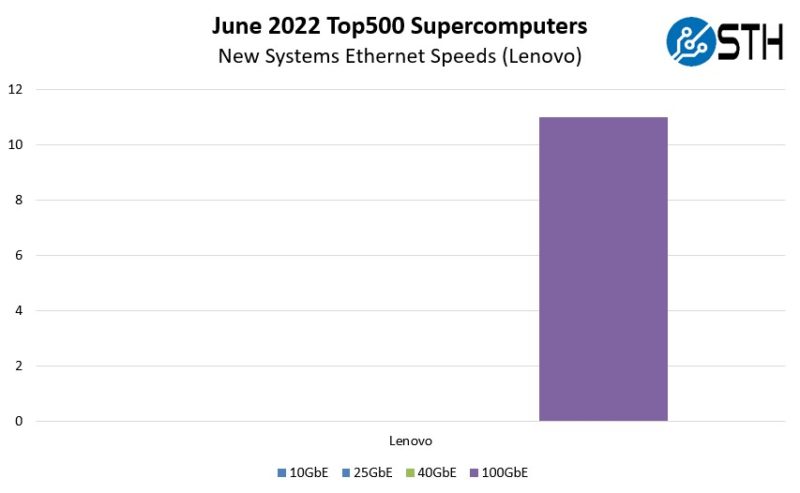

On the 11x 100GbE systems, those are all from Lenovo as we have come to expect:

If that “11” systems seems familiar, that is the same number of systems as the Xeon Gold 6252. These are usually Chinese hyper-scale clusters that Lenovo runs HPL on portions of the clusters just to get additional systems on the list. At least Lenovo is using 100GbE in this year’s systems as for many lists the systems would simply have 10GbE.

Final Words

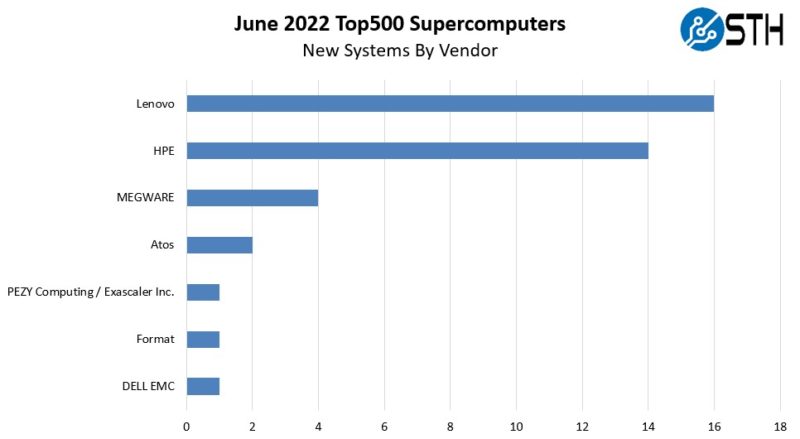

When we look at the vendor picture, we can get a sense of what is happening in the market:

That is, of course, in terms of quantity. Lenovo barely edged out HPE this time, even though HPE had #1 and three new top 10 systems. Lenovo was focused more on the bottom 300 systems with the list stuffing. Megware has an interesting system based on the Inspur NF5488A5 8x NVIDIA A100 HGX platform we reviewed but that is showing up as Megware, not Inspur. IBM has effectively abandoned the HPC space and Dell EMC has a single new system on the list. Dell’s GPU servers are behind the competition, as we saw in our Dell EMC PowerEdge R750xa Review so this makes sense that it is not focused on the top-end HPC systems anymore.

Alas, perhaps the answer as to why so little has changed is more simple. There were no Top500 systems added from China for this list.