Dell Technologies is the new name for Dell and EMC. With over 140,000 people worldwide it is now the titan of enterprise technology with over $74B in revenue. Given Dell still plays in the notebook and desktop PC world, it is essentially filling the void that HP abdicated when it split into HPE and HPI last November. We wanted to focus on why EMC was vulnerable and implications for VMware.

EMC’s Business: Cash Cow in Decline

EMC’s business has fared better than NetApp, but revenue has been relatively flat for three years (up about 6.5% from FY 2013 to FY 2015.) Given cumulative inflation over this period in the US was around 3% revenue growth was modest. Metrics like operating and net income were down between FY 2013 and FY 2015. EMC has a large installed base, but transition of compute and storage to cloud providers have limited growth in some traditional sectors. On the first Dell Technologies Press & Industry Analyst call this morning, David Goulden, President of Dell EMC Infrastructure Solutions Group, clearly outlined a vision for servicing a hybrid cloud with the broad Dell Technologies portfolio.

The rumors we have heard repeatedly suggest that EMC was concerned by slowing growth in a rapidly changing industry (hyper-converged infrastructure and cloud infrastructure) and it was time for an exit.

The interesting proposition by Dell Technologies with EMC is that the company now has a much better portfolio for companies looking for best-of-breed architectures with compute and storage.

Dell Technologies’ “Other” Business: VMware at a Crossroads

STH covered VMworld 2016 and in the press/ analyst lounge and events there was a sense that the show was lacking a revolutionary product launch. Reading financial analyst research notes this week has supported this notion (see UBS and Pacific Crest notes that came out after VMworld as examples.) The company is transitioning towards being a platform agnostic virtualization management company (see here for an example.)

Becoming platform agnostic is dangerous. Cloud providers are using KVM, Xen and similar virtualization technologies that are significantly less costly than VMware’s offerings. As workloads move to public clouds VMware is losing the opportunity to sell additional virtualization host licenses. New organizations are often starting in the cloud then moving to OpenStack or hyper-converged solutions such as Nutanix, both of which do not rely upon VMware virtualization. VMworld 2016 was largely focused on how VMware sees this transition and is going to help its existing customer base manage the transition. That seems to indicate that VMware is doubling down on its existing customer base rather than looking to become the next-generation architecture for new organizations.

VMware is still a giant software business. With HPE looking to sell it’s software business (by itself a top 10 or so software company) Dell Technologies is set to have the hardware/ software infrastructure stack for corporate IT departments. That stack will push the vision of a hybrid cloud in the future as that is how Dell Technologies will continue to sell hardware.

Expectations for the First 180 Days

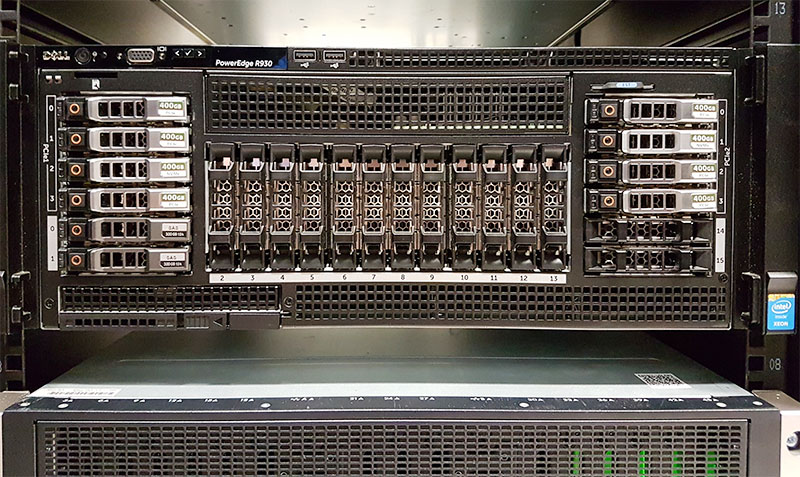

At STH we have a fairly good sense regarding upcoming hardware releases. Given the breadth of Dell and EMC’s respective storage portfolios it is reasonable to assume that rationalization of the portfolios is coming. We are not seeing major hardware releases for re-platforming products into significantly new solutions over the next 6 months. At the same time, Dell and EMC will likely look to streamline back office operations. The ability to achieve cost synergies in that area can produce significant earnings benefits. Pre-split, the HP entity had gotten so large that the company struggled with intra-organizational communication. That is likely a lesson learned the post merger acquisition teams are taking to Dell Technologies.

Overall, as we hear pundits opine that hardware is a commodity and we see stagnating revenue growth from some vendors, we expect to see more consolidation in the industry. It is widely rumored that HPE will be looking to pick up fast-growing hardware companies with cash generated from a HPE Software sale. The new Dell Technologies family of businesses now has significant scale advantages over HPE.

Once are market hits the point of product saturation, growth will be minimal at best regardless of the industry. After a company reaches this state, they need to know how to correctly transition into a relatively flat growth model. Take a look at Blue chip companies, they had their booming years decodes ago but now have relatively stable sales and revenue numbers year over year. It will be interesting to see how some of product segment overlaps in storage between the two are sorted out.