Most of STH’s readers can rattle off a big portion of the top 5 server vendors by either revenue or units shipped without much effort. Titans of the industry such as Dell EMC, HPE, and IBM/ Lenovo have a rich history in the space. Companies like Cisco and Supermicro are well known as well, although in very different parts of the market. One of the companies that has been making the list recently is Inspur from China who we will be focusing on in the near future. What if you were told that there was a company that did over $2.8B of revenue, and has done over $2.8B in revenue the first half of 2018? We were at the Wiwynn Tech Day in Palo Alto, California this week and heard that exact story.

[Ed. The company contacted us after going live and said that we should use $2.8B instead of $2.6B as 2017 and 1H 2018 numbers. This piece has been updated accordingly.]

Wiwynn’s Path to a $5B+ Per Year Run Rate

Wiwynn started its path to $5 billion a year in revenue in April 2012 when it was first founded. The company is backed by, and a subsidiary of, the Wistron Group, one of the largest ODM/ OEMs around.

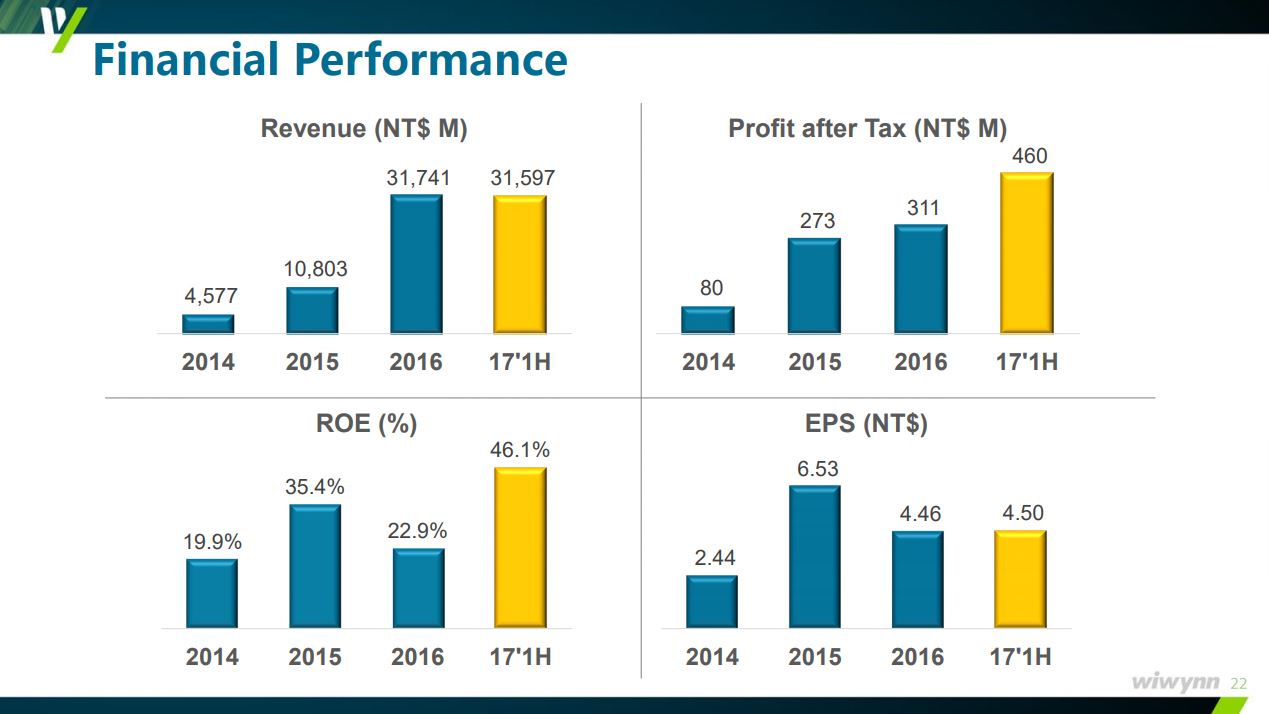

At the tech day in Palo Alto these figures were presented:

- 2016 Revenue: $1B

- 2017 Revenue: $2.8B

- 1H 2018 Revenue: ~$2.8B

Wiwynn is now on an annual run rate of over $5 billion a year. After the event, we wanted to double-check that our notes were correct and found a slide presented in November 2017 that shows about $1B in 2016 revenue, and in 1H 2017 so the numbers seem to line up:

The company did not release exact figures but said that it is preparing for an IPO in 2019.

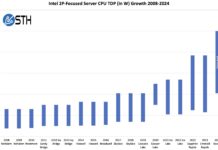

This is a big deal. A $5B per year player puts it ahead of Supermicro in terms of revenue, with a significantly higher CAGR. It is equally astonishing given that they were lumped into “ODM Direct” in IDC’s server market tracker released earlier this month. That is likely due to counting methodology, but with this growth rate (and this article) we expect that that may change in the near future.

As another check to see how the company is growing under the radar, we searched for “Wall Street Journal Wiwynn” and here is what we found:

That is somewhat stunning that the WSJ does not have much coverage of such a fast-growing company, even if it is a subsidiary. We checked STH coverage of Wiwynn and here is what we have on the company this year:

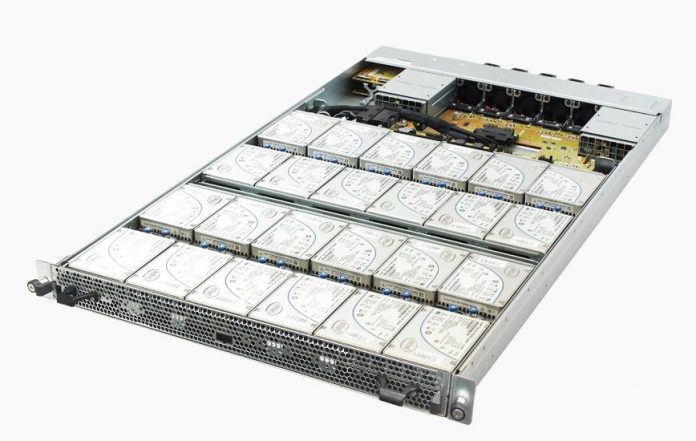

- Wiwynn XC200G2 PCIe Gen4 16x Compute Accelerator Machine

- Wiwynn ST300 1U 24 bay U.2 NVMe JBOF

- NVIDIA HGX-2 Design Launched for AI Cloud Providers

- Twin Lakes Intel Xeon D-2100 Platform Powering Facebook

The company has made its name selling into a relatively small number of large accounts. One of the key accounts we know is Facebook, as we have covered how Wiwynn produces innovative OCP servers for the company.

Overall, we are excited to see companies servicing the hyper-scale community flourish. The OCP project has attracted not just hyper-scale players like Microsoft and Facebook, but also many telecom operators building out next-generation software defined 5G infrastructure. Wiwynn is poised to continue growing as a leading provider in the OCP ecosystem.

Final Words

If you read standard analyst reports, you probably missed the rise of Wiwynn and thought data center spending was stagnant with players like HPE and Dell EMC slugging it out for a few percentage points at the top. Instead, behind the scenes, we see a business that is on pace for over $5 billion in revenue this year, up from $1 billion just two years ago and is doing so largely under the radar. While one may suggest that Wiwynn’s strengths stem from the OCP community, they are building 19″ standard rack servers as well. Expect Wiwynn to be a player in the market in the coming years, as they gone from $0 to a $5 billion per year business in just over six years.

That’s crazy. I never believe the IDC numbers anyway, and I think most people know they’re a lot of guess work. It’s still embarrassing that STH sussed out a company that is big enough they should’ve been a top 3-5 vendor. I think Wiwynn doesn’t even have social media accounts.

STH is doing a great job.

It does have social media accounts:

Facebook: https://m.facebook.com/WiwynnCorporation/

Can STH review their gear? I’d like to see what makes their 19in better. You can’t buy these servers as smaller players.

Ok I didn’t know these guys existed. I learned something today.

Looks like most interest comes out of Taiwan based on Google Trends. https://trends.google.com/trends/explore?q=Wiwynn,%2Fm%2F03p3m28

Supermicro dwarfs it in regards to popularity. I guess that’s to be expected at this stage though in the company’s lifecycle.

We buy over 60m Euros of servers a year and I’ve never heard of them except on STH

Wiwynn is a Taiwanese company. It is currently listed in Taiwan’s emerging stock as code 6669, it’s Chinese name is “緯穎”, expected to go IPO at the end of this year or next January.

There’s a page about it in Bloomberg https://www.bloomberg.com/quote/6669:TT

But more infomation about it’s revenue and EPS growth are in Taiwan’s stock related websites.

EPS for 2017 is 11.7 TWD, as of 2018 first half, it’s EPS has already soared to 19.7 TWD, the market has expected its EPS for 2018 could go up to 30-35 TWD, which is quite crazy.

This page is in Chinese, but it’s about Wiwynn’s monthly revenues this year (all in TWD, million).

As of August 2018, the annual accumulated revenue growth rate is 135%

http://pchome.megatime.com.tw/stock/sto3/ock2/sid6669.html

I’ve only heard of Wiwynn because of STH articles from this year’s Computex. Patrick and STH I’d like to hear more.

Yea we buy $10’s of millions of dc gear per year and I’ve never heard of Wiwynn. I can’t believe there’s a company this big that I’d never heard of. I thought it was a brand of open compute not its own company.

Suprised that so many comentators didn’t knew the company. And they developed full portfolio/visibility. The problem is availability of hardware and sales team.