In baseball, a pickle, or rundown is when a base runner is stuck between two bases that ofter safety with defenders on either side and the ball being tossed between them. Also called a rundown, the play can be entertaining to watch as the ball travels faster than the runner. In many ways, based on Intel’s latest product guidance, that is where Ice Lake Xeon generation finds itself today. On Intel’s Q2 2020 earnings call, the company made new disclosures about 7nm processors, being delayed. They also quietly set expectations for the 10nm launches. In this article, we are going to discuss what we are calling the “2021 Ice Pickle” as a result of those disclosures.

Video Version

Since this is a piece I have been thinking about since the summer of 2019, and mostly wrote in October 2019, I had some time to put thoughts into a video form:

Of course, we have more detail below, but there are those who prefer to listen rather than read.

How We Got to a 2021 Ice Pickle

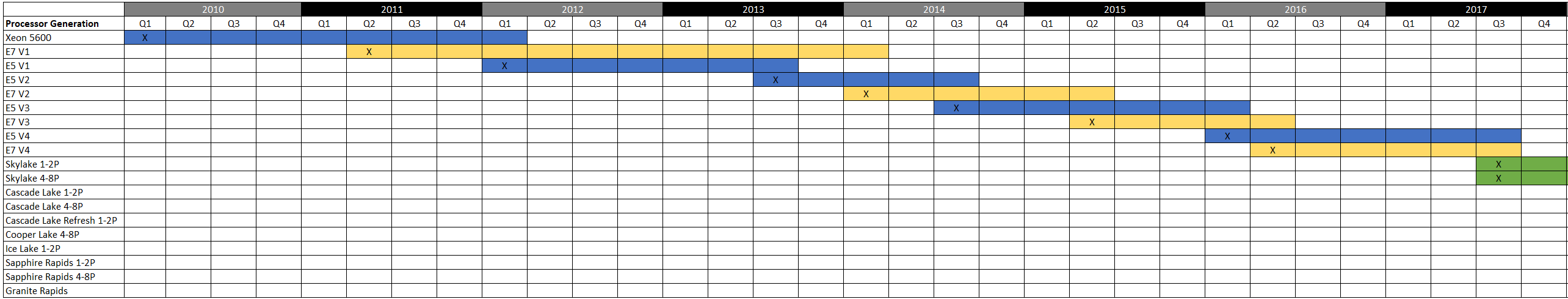

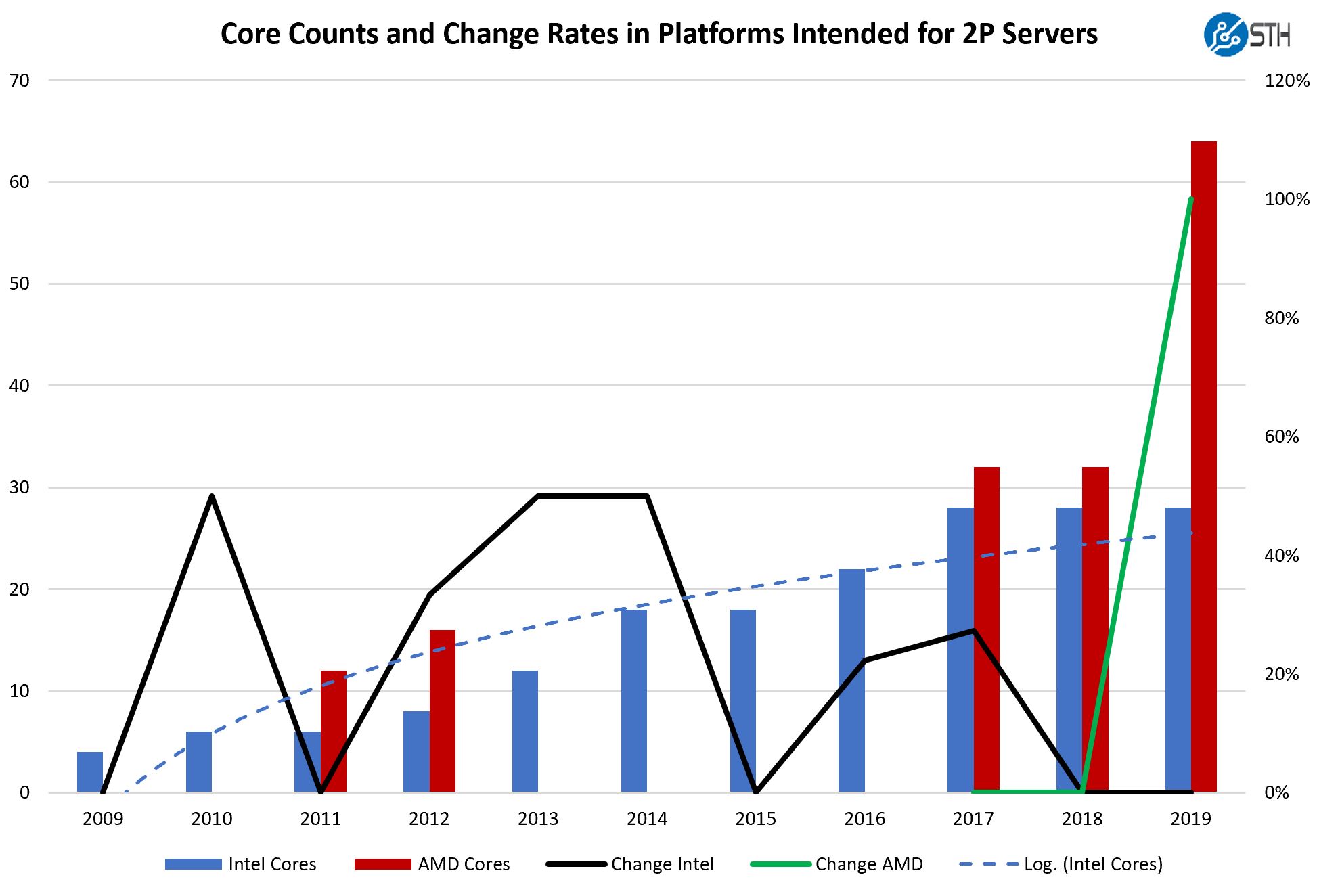

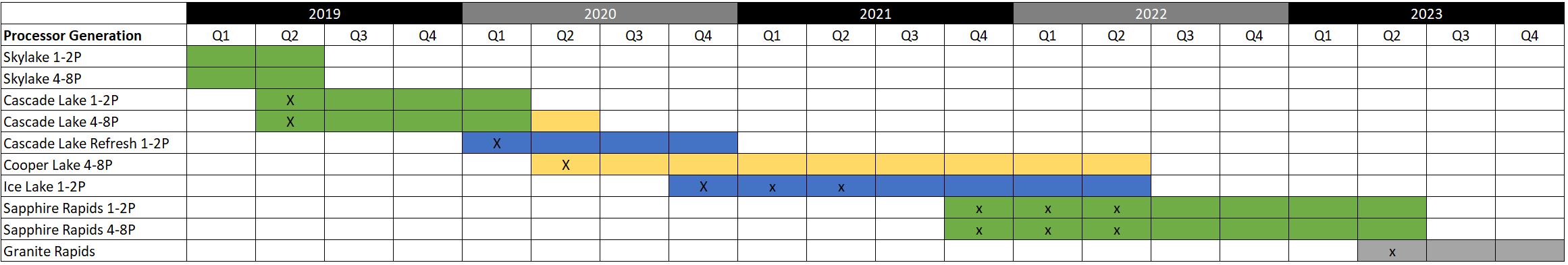

To explain how we got here, we are going to use a timeline. We have a timeline with processors from Westmere-EP (Xeon 5600) the company’s first 32nm mainstream server part to Granite Rapids a future 7nm server part. The future based on Intel’s statements and augmented by what we have heard the company messaging.) We are also splitting out the mainstream (mostly for 2-socket) and more scalable (4+ socket) solutions since that is part of the story as well. Blue will be mainstream only. Yellow will be 4+ socket focused. Green will be a unified stack.

You are going to see “X” marked in a number of these. Those are basically the product introduction quarters. Since there are overlap quarters.

As you can see, for almost seven years we saw regular updates to platforms. The 4P+ platforms lagged generally by a few quarters. Starting with the 32nm Westmere generation (2010) we then had the 32nm E5 V1 Sandy Bridge (2012 quad-channel memory and PCIe Gen3 introduction.) 22nm Ivy Bridge (2013) E5 V2 was followed by E5 V3 22nm Haswell (2014 and DDR4 introduction.) The current 14nm generation started with the E5 V4 Broadwell in 2016. We will note here that the 2015 Intel Xeon D-1500 / Broadwell-DE launched on 14nm a few quarters earlier, but we are focusing on mainstream socketed parts.

According to the normal cadence, we saw the 14nm Skylake generation with the first increase in DRAM channels since the 2012 Sandy Bridge generation. We also saw PCIe Gen3 lanes creep up slightly to 48. These chips did not offer huge core count increases, but they did offer new instructions, new features, and a nice bump in platform connectivity. The other important facet of what they accomplished was to unify the stack. Instead of blue and yellow bars, we have a unified stack where CPUs could be used from 1-socket to 8-socket configurations. That was the idea behind “Xeon Scalable”. Many lump Xeon Platinum in as a mainstream processor, but given the pricing, it was more of a successor to the higher-end multi-socket CPU families.

After July of 2017 with Skylake, progress effectively stalled at Intel, yet those years of building a brand with little to no competition, and building a portfolio kept financial performance and market share numbers high.

In 2019, while AMD was moving along a different core count, process, and feature vector, we got the 2nd Generation Intel Xeon Scalable series, codenamed Cascade Lake. Realistically, the Cascade Lake cores are very similar to the Skylake cores. Some of the big changes are speculative execution security fixes, VNNI/ DL Boost, and support for Intel Optane DCPMM (now PMem 100.)

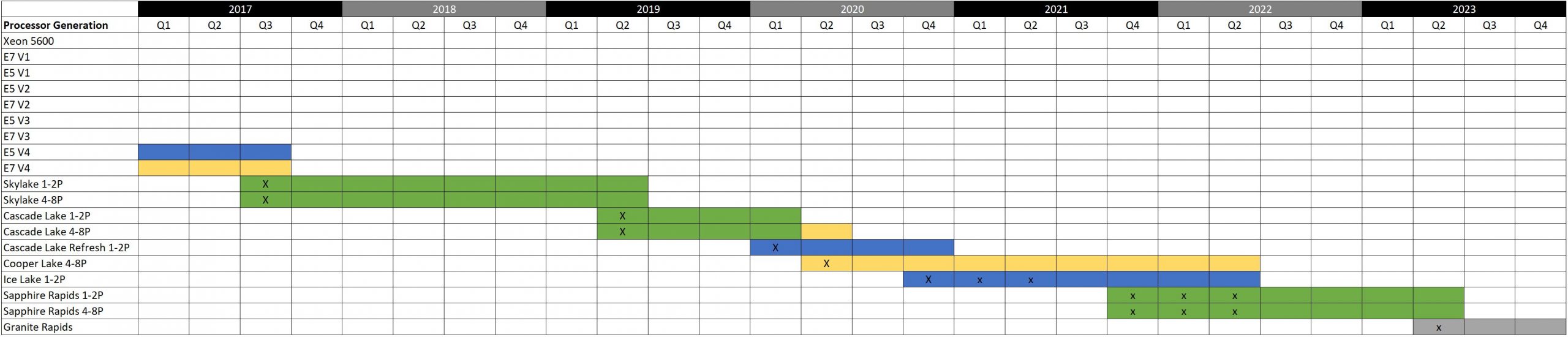

Meanwhile, in 2017, AMD EPYC 7001 “Naples” arrived. AMD forged ahead and while Intel was staying fairly static in Xeons, we AMD EPYC 7002 Series Rome Delivers a Knockout. In Q3 2019 AMD had a 7nm (TSMC) part with eight-channel memory, more PCIe lanes, PCIe Gen4 support, and up to 64 cores. AMD EPYC 7002 “Rome” was designed to be competitive, and still offer advantages over the Intel Xeon Ice Lake generation. There was one issue: Ice Lake did not arrive in 2019 due to Intel’s 10nm execution woes.

A lot had slipped in the schedule. In August 2018 (8/8/08 since “8” is a lucky number in Chinese culture) Intel held the Intel Data-Centric Innovation Summit. There the roadmap was shown as:

While Cascade Lake was shipping in late 2018 to large customers, most of the early access and then the General Availability was shipping in Q1 then Q2 2020. Intel has been focused on hyper-scale markets for years, so there is now a large gap between when cloud providers get chips and when you can purchase a Dell EMC or HPE machine with them.

Here we see where things started to go awry. Cooper Lake, originally was supposed to bring the next-gen Whitley platform shared with Ice Lake was supposed to launch in 2019. It did not. The Cooper Lake in Whitley, shared with Ice lake was axed in 2020, and STH was the first to get an official confirmation from Intel on that one. Again, take a moment to realize the gravitas of that situation. Ice Lake has slipped schedule in 2020, and even with that and the feedback from customers, partners, and Intel’s own teams, the decision was made to not release an entire line of mainstream Xeon processors. That was likely the correct decision, but it is also a big deal.

Instead, we got Cooper Lake launching in the Cedar Island platform which is mostly for 4P and 8P markets, although Facebook is using them in 1P and 2P designs. Cooper Lake is very similar to Cascade but with Bfloat16 and a few other tweaks such as to the UPI fabric. The cores are basically the Cascade Lake cores otherwise, which are basically the tweaked 2017 Skylake cores. This combined with the Big 2nd Gen Intel Xeon Scalable Refresh which was a pricing adjustment to the Cascade Lake line, means that we now have blue and yellow bars in our chart again. This is important since Cooper Lake in Cedar Island will still be the 4-socket capable option until Sapphire Rapids displaces it.

That basically leaves late 2020 and into 2021 as the Ice Lake generation. Sapphire Rapids, the future generation is going to upend the computing paradigm in many ways and that is slated to start shipping in 2021. I actually think of Ice Lake as the last of the traditional servers as we know them before the new Sapphire Rapids generation starts to change paradigms.

The 2020 Ice Pickle

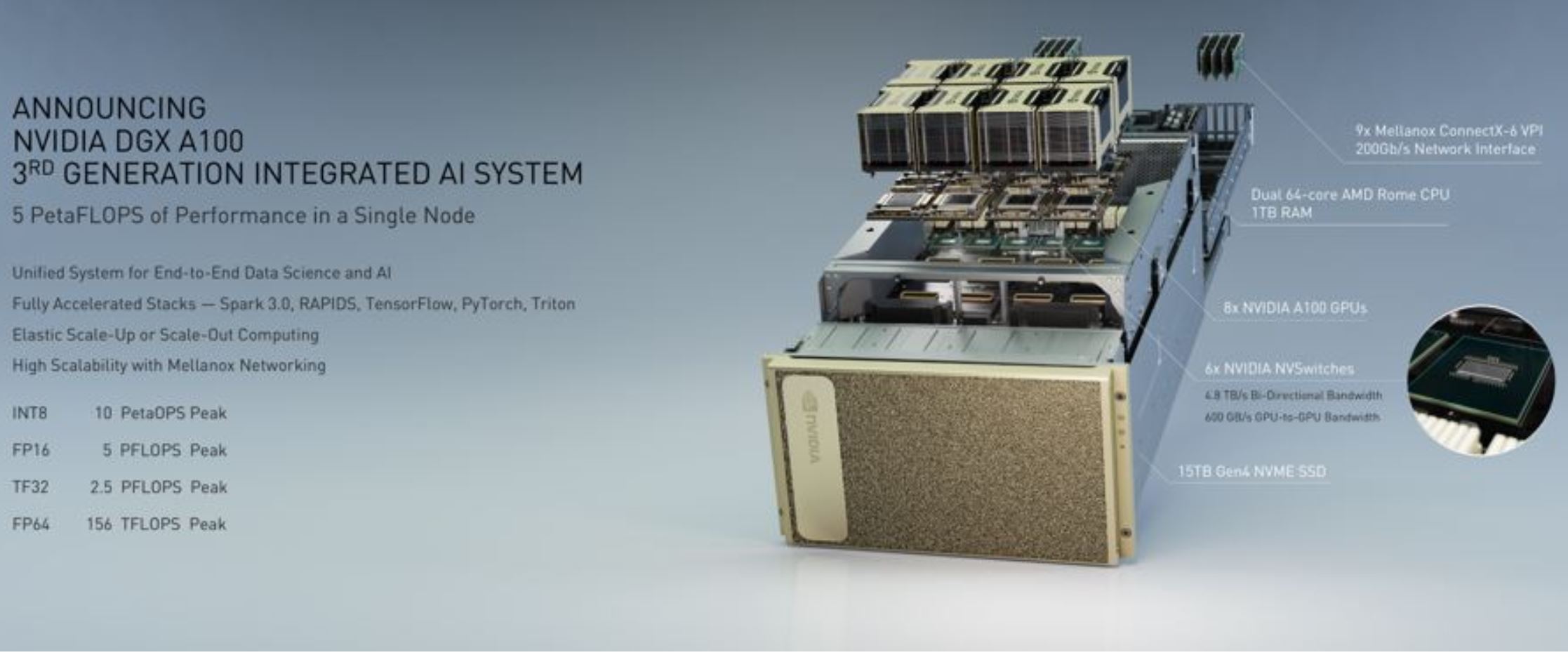

So why am I calling this the Ice Pickle? This is a concept I actually outlined last summer, I wrote a 90% complete draft of in Taipei in October of 2019 where I had things like NVIDIA will be forced to use AMD for next-gen DGX because of the 2020 Ice Pickle. After this week it is time.

On its Q2 2020 earnings call, and in prepared statements, Intel reiterated that Ice Lake Xeons would ship this year. The term was not, volume production. Instead, it was “initial production shipments” in 2020. Likewise, the Sapphire Rapids we were expecting in 2021, Intel now says this is only “Initial production shipments” as well. Remember, Intel could produce eight 8 core chips, call me up and say “want to buy these production parts for $100 each?” and I would buy them which would qualify as “initial production shipments.” By the way, Intel, if you want to do that, I am in. The cash is waiting.

Granite Rapids, the 7nm product is impacted perhaps the most. Intel announced a 12 month 7nm delay which will push products 6 months. Intel effectively is saying it has great design, but its underlying process is not working well enough. When pressed on how a 12-month 7nm delay means a 6-month product delay, Intel said it was due to buffers already in the schedule. 10nm has been delayed for years and has Intel in the 2021 Ice Pickle situation. 7nm is two years out and has burned through its buffer already. With first half of 2023 guidance for Granite Rapids, we are going to just put that as a Q2 2023 entry in our timeline. This is how the 2019-2023 timeline now looks for Intel, based on that earnings call.

Why does this matter to the server buyer? Most in the industry are expecting a mid-to-late Q1 2021 volume shipment for Ice Lake (XCC.) It has been that way for many months already in Intel’s partner messaging. Some of the smaller core count (HCC) parts people are expecting late Q1 early Q2. So what that means is that for an enterprise looking to refresh servers, Ice Lake is really a 2021 product, and potentially not even a Q1 2021 product unless something changes.

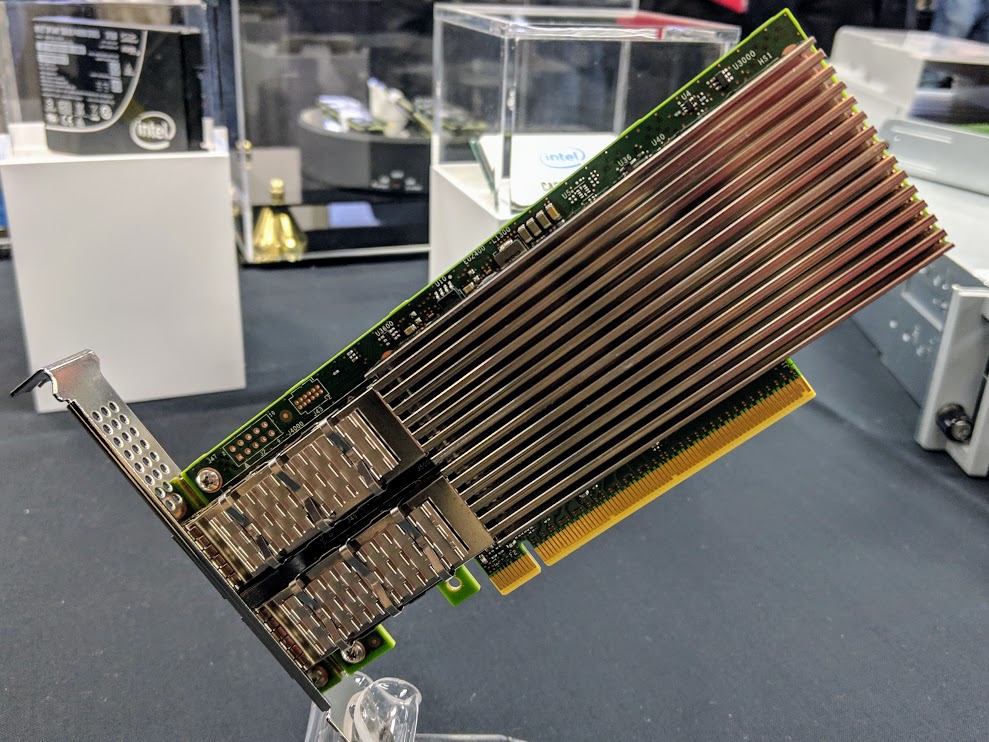

That puts the industry and companies looking to refresh in a bind. Ice Lake is Intel’s PCIe Gen4 part with 64 lanes per CPU. Just think about that. If you want PCIe Gen4 from an Intel sever part, you are waiting until some time hopefully in Q1/Q2 2021. All of the accelerators and technology that Intel has for Ice Lake generations such as Columbiaville 100GbE NICs, FPGAs, and even Optane PMem 200 in memory mode (not supported on Cooper Lake) one will have to wait until some time in 2021.

For server vendors, this is very difficult as well. In 2018, vendors were preparing for a Whitley based Cooper Lake Xeon 14nm generation in 2019 followed by Ice Lake in 2020. Designs were underway and we have seen a number of the platforms at this point. Now, instead of having Whitley be a Cooper Lake then Ice Lake platform, OEMs underwent all of the design and validation work now for only Ice Lake, a part that is bringing PCIe Gen4 about a year and a half after AMD.

For accelerator and storage vendors, even Intel’s own teams, what is the option now? Realistically, you are doing all of your product validation on AMD EPYC Rome especially since Milan seems relatively on track for 2020. That is a big deal. One of the reasons most in the industry, including STH, has at some point noted how Intel has better PCIe Gen 3 support on Xeon. The fact is, the industry has validated its PCIe Gen3 designs on Xeon since 2012. When AMD EPYC 7001 came out, there was another re-validation effort. With PCIe Gen4, validation is happening on AMD EPYC Rome, not Intel Xeon Ice Lake.

A great example of this is with the NVIDIA A100 GPU and specifically the NVIDIA DGX A100 platform. NVIDIA has historically used Intel Xeon CPUs in its high-end systems even through the V100 generation ecosystem followed. Now, if you want to run the top-end GPU you use AMD EPYC 7002 Rome, not Intel Xeon. As another benefit, you get faster networking and storage as well. The ecosystem is validating and releasing reference platforms for PCIe Gen4 on AMD not Intel at this point which is monumental, yet underappreciated. When Ice Lake does launch, it will now be the Xeon chips that are subject to re-validation efforts. That means while AMD platforms will have had many quarters of bug fixes and deployments, Intel systems will get the resourcing to bring them online, but that will be compressed if Ice Lake Xeons have too short of a time on the market before Sapphire Rapids in 2021 (realistically 2022.)

How STH Readers Can Navigate the 2021 Ice Pickle

For customers, and if you are in the market for servers, there is an important aspect of this schedule. Intel will have PCIe Gen4 in say 2021. Sapphire Rapids with PCIe Gen5 and the new paradigm of CXL, which will eventually upend computer paradigms, is slated for 2021 “initial production” but realistically 2022 sales. So if you want PCIe Gen4, your options are basically this:

- Wait for Intel and likely deploy PCIe Gen4 late Q1/Q2 2021 assuming no schedule slips, then see that obsolete in Q4 2021 to Q2 2022 when PCIe Gen5 and CXL arrive (barring schedule slips)

- Stay Intel and continue to use PCIe Gen3 and low core count server CPUs and wait for Sapphire Rapids and PCIe Gen5. If your validation cycles are significant, there may not be a huge wait given the current roadmap, but you are taking on risk by assuming that will not slip further.

- Deploy AMD EPYC Rome now, Milan later in 2021/ 2022, then make a decision on PCIe Gen5. Outside of Intel, the rest of the industry is validating on AMD EPYC Rome now. If they were waiting for Ice Lake in Q1 2020, by now they have swapped to Rome. Even NVIDIA, a sworn enemy of AMD, could not take the risk of sticking with Intel for its Ampere GPUs.

- Go Arm and just roll the dice. There are some PCIe Gen4 designs out now like the Ampere Altra and Huawei Kunpeng 920. There will be more coming such as ThunderX3. As part of Intel losing its manufacturing advantage, Arm is becoming more competitive.

At this point, most industry observers have figured out the above. That is not to say PCIe generation is everything. We are going to deploy another Cascade Lake Xeon node or two this year simply to get access to Intel Optane DCPMM or now PMem 100. Still, AMD has a bigger platform, it is getting better with Milan and the ecosystem is building around its platforms in the PCIe Gen4 generation. Remember, if you have a PCIe Gen4 connected device that you need to ship for revenue to customers, AMD is now the enabler of your technology.

Final Words

For Intel, here is the pickle. Ice Lake Xeons, heralding in the thoroughly delayed 10nm Xeon era, offer a single-generation CPU platform, that will be short-lived, and just before architectures get very interesting with PCIe Gen5 and CXL. Ice Lake Xeons are going to be ultra exciting to watch as they are caught between the bases of today and tomorrow. Therein lies the pickle.

These delays now have some OEM partners disappointed. Investors are questioning Intel’s execution. The big questions now are how can you navigate uncertain schedules if you are a customer or partner, especially since the concept of a “launch” has become nuanced to where Intel will claim it has launched a processor, but they are not generally available.

Not all is doom and gloom. Intel has a large portfolio, and it now has an opportunity to sell its PCIe Gen4 NVMe SSDs, 100GbE NICs, FPGAs, AI accelerators, and more on other platforms. While the process technology is causing issues, eventually organizations figure that out and swing back and become principled in their execution and communication to re-establish alignment to their vision.

For the next few quarters, we in the industry get to see more innovation as a result of Intel’s missed execution steps which is a net good for customers. Years ago, there were not four possibilities outlined above for courses of action. Today there are which is good for the market even if it is not necessarily positive for Intel.

finally a video thumbnail facial expression that perfectly matches the content! Loved it!

(also loved the stack of Benjamins)

Sounds like Stockholm syndrome.

The video is similar but I like the extra personal to it.

This analysis is what STH is famous for.

That is analysis. Patrick is a top mind in this space.

>When pressed on how a 12-month 7nm delay means a 6-month product delay, Intel said it was due to buffers already in the schedule.

STH is the only site, and publication I know that asked this question. How did an initial 7nm rollout expected late 2021 has now turned to consumer products in late 2022 and early 2023.

Correct me if I am wrong here.

I am reading Intel has a 6 months delay in 7nm product launch, and it will be launching 7nm Server CPU first in mid 2022. By moving all client production capacity to server products and pushed the consumer CPU further out. And because of the yield issues, those extra capacity only get them the volume where they previous expected.

I am that is at least a sensible, logical explanation that no one seems to be writing or asking.

Remember when Intel 10nm was planned for initial sales 2015, mass production 2016, with 7nm starting in 2018?

@Ed Intel said their first 7nm product will be a consumer CPU in late ’22 or early ’23, and the first 7nm server CPU will be “first half” of 2023. And this will probably realistically be more like the paper launches talked about above, barring even further delays.

For PCIe 4.0 there is also POWER9 systems, such as the Talos II 4U Rack Mount Server – TL2SV2, dual CPU support for several thousand dollars.

@Ed

StH isn’t the only site that asked that. No one has gotten a decent answer from Intel.

One explanation that I heard on another site was that Intel normally builds up stock before a release, using the time to tweak the process and get production levels up, and that takes about six months. So they are apparently not planning On building stock, or getting production levels up. That’s a scary concept to me.

The cynic in me thinks that Intel is only announcing Ice Lake SP “very soon” to keep customers from exploring other options – you waited this long so why not wait a bit longer? While we have seen 10nm products in the wild these top out at 4 cores even for Tiger Lake.

Then there is the recent news that Intel has just purchased all the remaining capacity at TSMC. If that doesn’t help to produce new Intel CPUs and GPUs earlier, this move will certainly prevent AMD from scaling up production any more.

Wow, another Top notch analysis!

Tech Journalism at its best!

If Intel stays with a monolithic design for server cpus, the server cpus still delays even longer because of the inferior yield of bigger dies. That means slower time to market and lower bang for bucks.

If Intel goes the way to chiplets, they need a need a new interconnect because mesh or ringbus does not work for chiplets.

@Doomofdevil if you follow SemiAccurate, you’ll see that Intel already uses “yield mitigation” technologies…

@Steffen: Tell me more.

Great piece. I think that the big question isn’t Ice Lake anymore. I have heard rumblings that it might never see true mass availability. Regardless, I don’t see it keeping up with Milan (I’m not sure how well it will keep up with Rome, for that matter). But this is a very short lived platform and as mentioned in this article what’s coming next, the CXL era as enabled by PCIe 5.0, really is going to change things in a way that PCIe 4.0 did not. If Sapphire Rapids is delayed enough for Genoa to become the reference platform, for PCIe 5.0 (and thus CXL), I think you’d see Intel struggling to stay top dog in the data center.

From my perspective as someone in the enterprise ML/AI space, the transition to CXL enabled GPU/accelerator servers with massive pools of unified memory is exciting in a way that the current generation and next generation really aren’t. Milan and Ice Lake are upgrades within the current way of doing things, Sapphire Rapids and Genoa will allow us to do entirely new things. It’s that generation that will drive the future of our data centers, and it’s that generation that I have my eye on the closest as I try to decide whose tech to drive my clients towards (I am a consultant).

“When Ice Lake does launch, it will now be the Xeon chips that are subject to re-validation efforts.”

No worry, Intel has tons of cash of the market competitiveness fund and use it to get the priority for its validations and have them accelerated.

“How STH Readers Can Navigate the 2021 Ice Pickle”

Apply for the market competitiveness fund to speed things up?

“While the process technology is causing issues, eventually organizations figure that out and swing back and become principled in their execution and communication to re-establish alignment to their vision.”

Be reminded, Intel’s process technology is now competing against TSMC’s, not the AMD/GF’s lagging non-mainstream (but exotic) SOI processes or not-as-competitive Samsung 14nm.