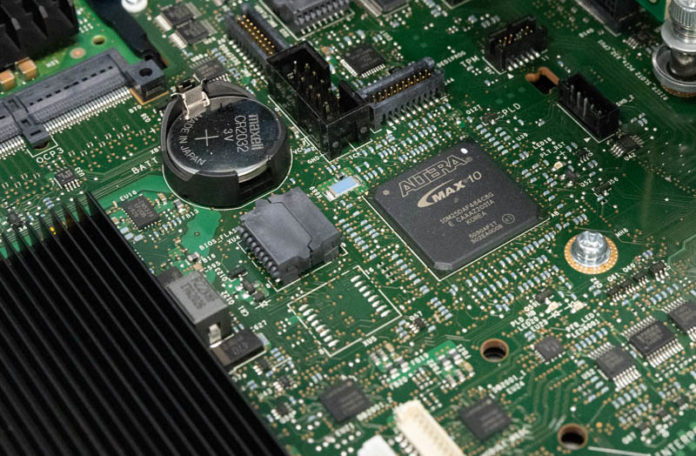

A few quarters ago we heard that Intel was looking to raise cash by selling a stake in Altera, and also looking towards Altera’s eventual IPO. Now, the company has sold a 51% stake in Altera valued at $8.75B to Silver Lake. That is about half the valuation that Intel purchased Altera for in 2015.

Silver Lake Buys Majority Stake in Altera from Intel

In today’s announcement, Intel said that Silver Lake would own 51% of the company. Intel will still own the 49% minority stake. As part of the acquisition, Raghib Hussain, previously at Cavium and Marvell, will take over from Sandra Rivera as Altera CEO, effective May 5, 2025. The deal is expected to close in the second half of 2025. Intel said its 49% stake would allow it to continue to participate in growth at the company.

I have known Raghib since his Cavium days. He is a very smart man that I think will do well at Altera. On a more personal note, congratulations to Raghib on his new CEO role.

Still, the path ahead is not going to be easy. AMD has done well with its Xilinx FPGA business. At the same time, Intel has roughly halved the value of its Altera FPGA business, and that number looks even worse if you inflation-adjust the 2015 acquisition price. In the Substack, we discussed how, even with that, Altera might be one of, if not the most successful, Intel data center-focused acquisitions over the past decade or so.

This is certainly setting Altera on a new path.

Final Words

Overall, this is probably a good outcome for Intel. In the Substack above, we noted that the company would have been better off investing in NVIDIA or AMD instead of buying Altera. The pattern over the past decade or so has been that Intel has been in the right markets, but picking the solution Intel did not own has been the winning bet in the market. By yielding control of Altera to Silver Lake, Altera will be seen as more independent. Intel for its part gets money to invest elsewhere while retaining a big investment in an asset with new management that has proven it is able to create shareholder value. Silver Lake, among many of its accomplishments, took Dell private not long before the Intel-Altera acquisition and created a massive windfall for investors.

It certainly feels like this is a major shake-up in the industry which is always exciting.

I’m of the impression that the reason for Intel for purchasing Altera was the ever increasing penalties they’d have to pay out for their failure with IDF 1.0. Altera was one of the initial supporters of Intel’s first attempt at being a foundry and in the contract were various penalties Intel would pay given delays in their fab road map. We all know how well Intel’s 10 nm process went and that is that Altera signed up for. It was easier for Intel to purchase Altera than what Intel would have paid in penalties. The acquisition was a means of saving face.

Now that Altera is spun off again, they have a mix of products across IDF 2.0 and TSMC. It’ll be interesting to see where things go.