I just wanted to drop a quick note since after Intel’s latest Q3 2021 earnings call I have been getting a lot of questions about the Ice Lake Intel Xeon ramp. Several folks were surprised that Ice Lake was not dominant now, especially given the fact that it is a vastly better platform than the Cascade Lake Xeon platform. Or more precisely, folks were looking to see the scale of this ramp. I think this makes sense based on the market indicators, and just wanted to address the ramp in this piece.

Some Anecdotal Thoughts on the Intel Ice Lake Xeon Ramp

I had some sense that the ramp was still in progress despite the parts being launched six months ago. To be clear, with server CPUs there is always a ramp because of purchasing cycles. Intel at its earnings call said that it has shipped 1M+ Intel Xeon Scalable CPUs.

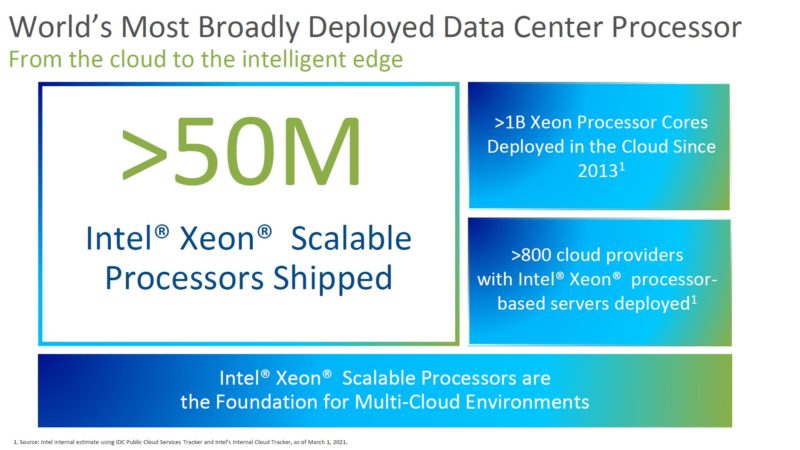

In April 2021, at the Ice Lake 3rd Generation Intel Xeon Scalable launch, Intel had disclosed it sold over 50 million Intel Xeon Scalable CPUs. Intel Xeon Skylake first generation was launched in July 2017. That gives us around 4 years of shipping (CPUs ship before formal launches) and so 50 million units/ 48 months and I generally use ~1 million Xeon Scalable CPUs/ month as a rough order of magnitude for mainstream Xeon sales. There are non-Xeon Scalable Xeon sales such as the new Intel Xeon E-2300 series for Entry Servers.

Using 1 million/ month is again not an exact figure, but if Intel shipped 2 million or so per month over around four years they would likely be touting a much greater figure than 50M+.

At its Q3 2021 earnings release, Intel said it has shipped 1M+ Ice Lake Xeons. While 5M is certainly greater than 1M+, our sense is that if Intel was at 2M or greater we would have seen the first digit increment. Even if it was at 1.9M+ it could have likely said ~2M shipped. and had a much larger number.

Assuming the number is closer to 1M-1.3M, at the time of the Intel Xeon Ice Lake launch in April, it had shipped around 200K units. The Q3 earnings call happened around six months after the Ice Lake launch so that roughly puts average production in the ~200K units/ month range. Add to that the 200K shipped before launch and we would then be at 1.4M units which is probably on the higher end of “1M+”.

A quick observation is that an average of <=200K Ice Lake Xeon chips per month is under the ~1M Xeon Scalable per month rate the company has been operating at.

During its prepared remarks, Intel said:

Customers continue to choose Intel for their datacenter needs, and our 3rd gen scalable Xeon processor Ice Lake has shipped over a million units since launching in April, and we expect to ship over 1Mu units again in Q4 alone. All of our OEMs are currently shipping systems, and we expect all our major cloud customers to have announced instances by the end of the year. (Source: Intel Q3 2021 Earnings Prepared Remarks)

To ship over 1M units, Intel would need to be at a 333,334/ month average rate in Q4. While that may seem like a big jump, it does not seem unreasonable assuming the Q1-Q3 average we were seeing was really a ramp over the period instead of sustaining an average volume.

Still, 333K/ month would be roughly a third of the 1M Xeon/ month average from 2017 to April 2021.

Anecdotal OEM Evidence: HPE

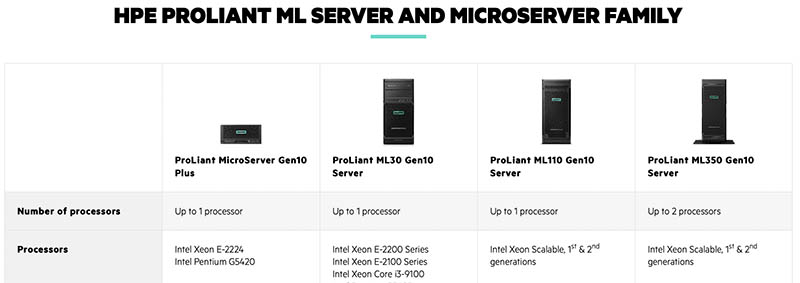

Recently, I was looking for a lower-end HPE ProLiant tower server based on Intel Xeon Scalable Ice Lake CPUs and noticed, there were none available. I then was looking at HPE’s portfolio and saw that many parts of the portfolio were still being advertised with the previous generation.

Aside from the ML110 Gen10 and ML350 Gen10 tower servers, traditional rack servers like the ProLiant DL160 Gen10, DL180 Gen10, DL360 Gen10, and so forth were still being listed as current generation servers.

When I reached out to HPE on this, I was basically told that for a lot of the lower-density segments, the portfolio did not transition to Ice Lake yet just due to what makes financial sense for customers.

One can see this same behavior at a number of large OEMs. We are now around six months after the Ice Lake Xeon launch, and it is common to have systems launch months after, but it feels like this is a lower saturation point in terms of available models from major vendors.

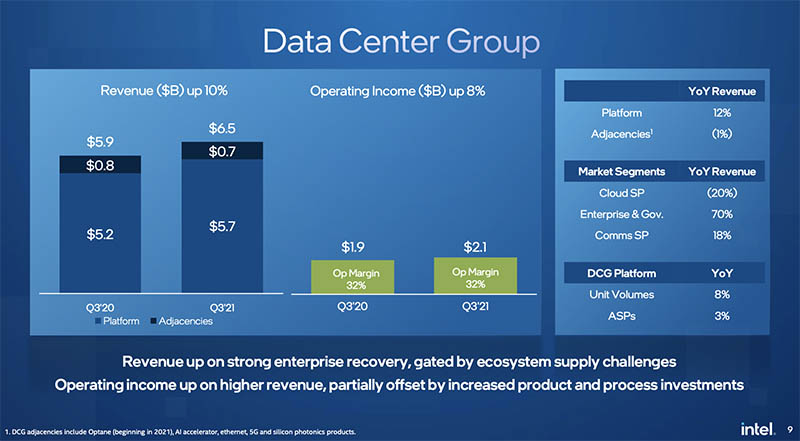

What is very interesting here is that the enterprise segment was up 70% without these new Ice Lake enterprise server models.

Final Words

Having used both the newer Ice Lake Xeon and the previous generations, let us be completely clear that the new chips are a big step forward across a number of fronts, and well beyond just increased core counts.

The bigger question is what happens in 2022. Assuming the 1M shipped per month and 1M Ice Lake Xeons will ship in Q4 2021 figures hold from the earnings deck, that means Intel will have roughly two-thirds of its Xeon sales on 2017-2020 era CPUs, one third on 2021 product by the end of 2021. It will then go in-production of Sapphire Rapids in Q1. Intel reset Sapphire Rapids Xeon Q2 2022. Going from ~200K units to 333K units/ month and increasing at the same rate in Q1 would put us somewhere in 460-500K units/ month exiting Q1 2022.

As we noted in The 2021 Intel Ice Pickle How 2021 Will be Crunch Time, the challenge for Intel is that Sapphire Rapids is going to be what the higher-end customers want in 2022 starting. Assuming volumes and ratios hold, and a continued Q1/Q2 Ice Lake ramp, Intel will have its new generation out roughly when half of the market is for its previous generation (Ice Lake) parts, and half of the market is still on 2-3 generation old product (Cooper Lake, Cascade Lake, and Skylake.) Cooper Lake is more closely related from an underlying technology perspective to Skylake and Cascade Lake even if it is marketed as a third-generation product.

A key challenge for server vendors is now becoming clear: When do transitions need to happen? In Q1/ Q2 of 2022, a period that will start in just over two months, we will get into the Sapphire Rapids cycle. It would be hard for an OEM to launch a new Ice Lake Xeon product line at the end of Q1 2022 as there would be Sapphire headwinds. As a result, we will need to see Ice Lake Xeon updates happen in Q4 to help drive the unit volume but also to give OEMs to ship platforms as current generation before the next generation arrives.

Perhaps the biggest takeaway should be that we are actually seeing a stratification of the customer base happening here. The technology transitions between Cascade Lake to Ice Lake and Ice Lake to Sapphire Rapids will be bigger than others in Intel’s history over the past decade. There seems to be a large segment of Intel’s customer base that is not availing of these transitions whether that is due to supply challenges or a supply/ pricing/ density challenge. We have been advocating for some time that the server market is going to bifurcate and the latest Ice Lake Xeon shipment numbers and next quarter forecasts seem to follow that storyline.

Hopefully, this helps answer some questions based on the market.

I think access to supply is just as large of an issue. Purchasing is FUBAR’ed right now for anyone with a budget under $M. I’d love to buy latest generation chips & PCIe4 NVME drives but VARs simply don’t have the parts for sale, or only for list prices. Dell are only now listing a few Milan chips on their website … for delivery in February. The market is bifurcating into those with purchasing power to cut a deal, everyone else gets the leftovers.

Patrick

I think you missed here few important things:

1. In April Intel released Ice Lakes, but it did not meant that they were freely available for ordering from all the vendors.

2. Vendors started to offer these servers with slight delay – these were new platforms, they needed validation. I think only release partner (Supermicro) has something since start. For other vendor AFAIR ordering was possible like on the end of May, beginning of the June.

3. At the beginning you could only order servers with XCC CPUs – so with at least 28 cores

4. HCC was available around July ?

5. Actually on lower core counts I don’t think that Ice Lake is that attractive. You need to invest more in memory sticks, you are getting lower clocks, IPC gains per core are kinda dubious.

I think right now the most important market factor is inability of AMD to provide enough supply for the demand.

What stock photo site has Intel on a rainy day?

BUT – AMD are selling large numbers of the lesser bins of the same chiplet in retail desktops – 6 core & 12 core 5000 series cpuS. These are the rejects that server buyers dont want.

They are so busy providing premium bin 8 core chiplets to data center, they dont have supply for lesser products like TR & enterprise.

I have Xeon Skylake and Cascade Lakes at 400 M units.

Entering Copper lake Xeon production volumes fall way off on channel data on financial reconciliation in q3 2021 I record 10,216,112 units. For q4 2021 I record 8 M to 10 M and q1 2022 I record 8,596,001 of which 2 M are Ice and where Rivera said Ice reached 4 M units through q1 2022.

Intel and AMD have both grown out their hyperscale niche strongholds to the extent they can without innovative adaptations to address compliment expansion of application use cases.

AMD’s current plan for 2022 sends VARS after Xeon Skylake and Cascade Lake replacement on Milan extended production through year end.

Mike Bruzzone, Camp Marketing