In Q1 2022 we covered that Intel was planning to acquire Tower Semiconductor. Eighteen months later, those plans are being scuttled due to not gaining regulatory approval. We know that regulators would be scrutinizing this deal, and now have an answer. Intel will be paying a $353M break-up termination fee to Tower per the release.

Intel Terminates the Tower Acquisition

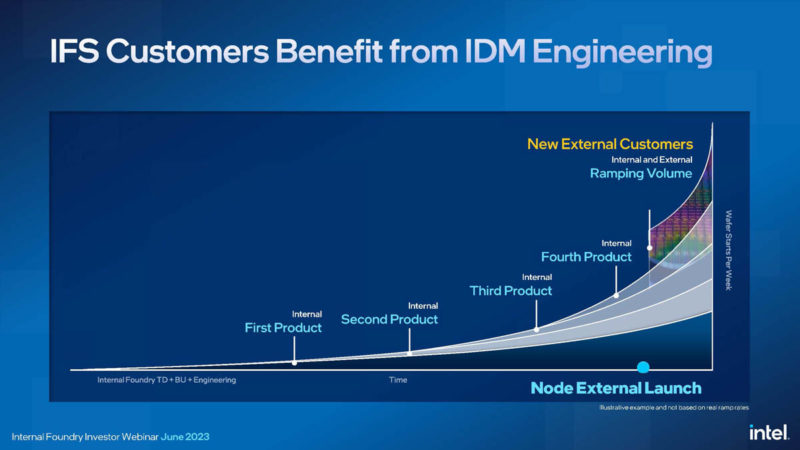

The original thesis behind Intel’s acquisition of Tower Semiconductor was that Tower provides a foundry model, albeit not on the same process technology as Intel. Intel has been building Intel Foundry Services (IFS) over the past few years with the vision of making it the #2 foundry to TSMC by 2025. The Tower acquisition would have given Intel a team that was driving a larger revenue stream and that had a number of customers already. Acquiring not just the customer lists and revenue streams, but also a foundry business would have been a major push for Intel. In the meantime, Intel has been focusing its IFS efforts on future processes like Intel 18A, but Intel 18A is not in high-volume manufacturing today and Tower has multiple fabs making chips for customers today.

At the time of the planned acquisition’s announcement, we said:

With that said, there are challenges. Although the companies do not compete directly in manufacturing, regulatory agencies have been stepping up scrutiny of deals lately. Also, semiconductor manufacturing is a hot topic on the international stage so we will have to see how this goes through the regulatory progress. (STH: 2022-02-15)

The reason for this statement is that I was doing a corporate strategy project at Applied Materials during its ultimately failed 2013-2015 bid for Tokyo Electron. Having seen a highly scrutinized semiconductor equipment deal fail and watching our clients get back to Silicon Valley only to be summoned again to certain regulatory agencies in Asia later the same day or the next day, makes the possibility a deal like Intel-Tower would fall through very close to a real-life experience.

For Intel, this is a big blow to IDM 2.0. The company says that IDM 2.0 is still alive and well pushing towards 18A. At the same time, Tower would have immediately given Intel a foundry business and a team accustomed to operating that business.

If Intel were to spin off IFS in the future, Tower would have been an awesome asset to have. To spin IFS, Intel likely will need a solid customer list across a range of process nodes. Tower would have given Intel a major jumpstart in that area.

Final Words

Intel can still execute IDM 2.0. It has announced deals like the Intel IFS and Arm SoC Manufacturing Deal lined up for 18A. At the same time, calling off the Tower acquisition means that the road has gotten much more treacherous.

Also, Intel has been shedding businesses like its Exiting the Server Business Selling to MiTAC, discontinuing NUCs moving the business to ASUS, and exiting the switching business. That is happening while Intel now has to pay a break-up fee for Tower. Intel is a big ship to turn, but at some point, there will be a question if the ship is turning fast enough.

Patrick, do you know or can you dig up, was it Intel’s plan to use Uncle Sam’s fab handout to buy the people who know how to run a fab business?

Pretty sure Intel used the Uncle Sam handout money already on stock buybacks