Intel reported its Q4 2022 earnings. While I normally reserve posts on earnings releases for Twitter, I wanted to cover this one. It was another rough quarter at Intel. We are going to mainly focus on the data center and network and edge group results since this is STH. Still, we cover most of Intel’s segments, so it seemed reasonable to at least have a quick discussion on the other results.

Intel Q4 2022 Earnings and the Data Center Challenge

Here are the highlights for Intel’s full year 2022 results. As we can see, revenue is down 16% versus 2021, but the EPS and gross margin are down by a fairly huge amount.

On the Q4 side, both gross margins and EPS seem below the trend by a significant amount. Intel on the earnings call said that it is investing in getting to leading-edge manufacturing by 2024, which is in 12-24 months from now. In the meantime, Intel is not the earnings powerhouse it once was.

Something on the call was really interesting. Intel said that it planned an aggressive Sapphire Rapids ramp, but then to launch Emerald Rapids in 2023. It then expects to launch Granite Rapids and Sierra Forest in 2024. That is really interesting since it puts Intel into a pickle again. Update to Sapphire today, or wait a few months for Emerald or Granite/ Sierra? The big difference is that the platforms are out today, so this will have a refresh chip in the same servers, whereas Ice Lake was a one-and-done generation.

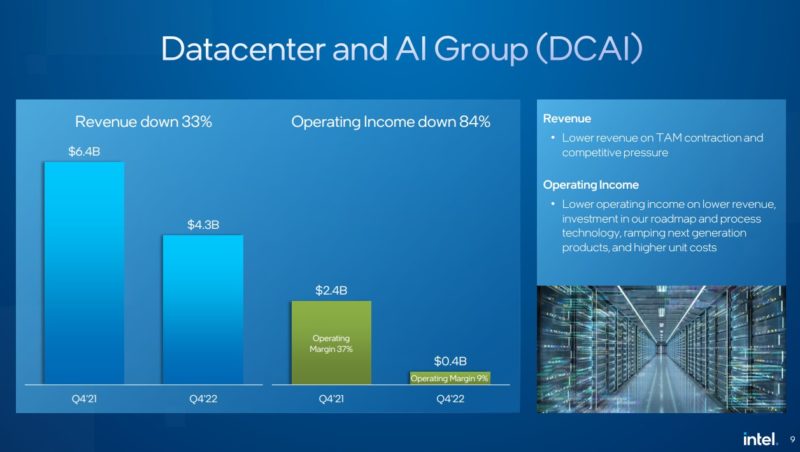

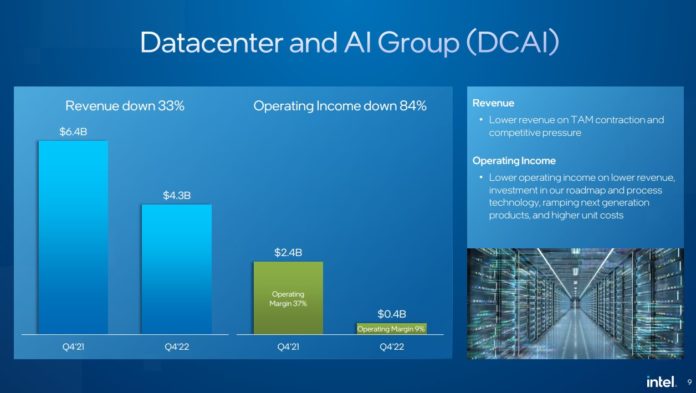

Here are the results for the DCAI group. Intel said its programmable solutions group (PSG or ex-Altera) did very well this quarter.

Intel seems to be getting squeezed by competition (AMD EPYC and Arm CPUs) as well as higher costs. That is a very difficult place to be as a business. I will say, as excited as I am for any new server CPU, and I think Emerald Rapids will be interesting, Sierra Forest is the part I am most interested in as that might just be the big game-changer.

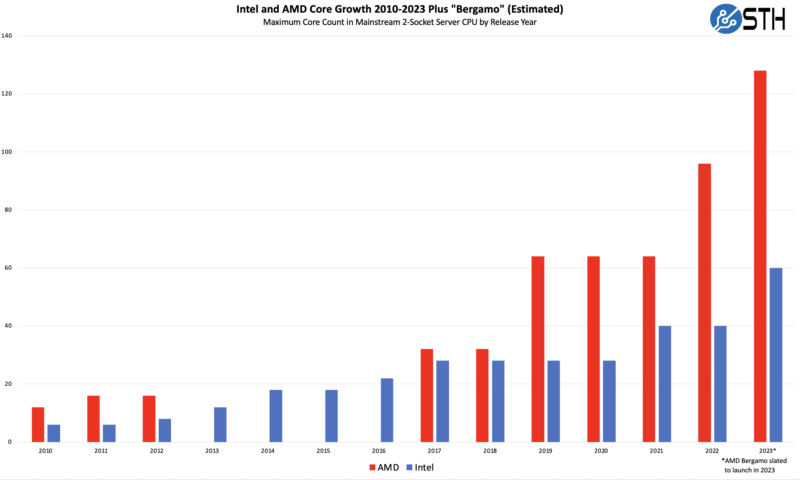

Another aspect of this is that Intel is rapidly increasing its core count growth. It needs to get on a more aggressive slope to increasing core counts and Intel knows this is the case. It just takes some time to get new products developed and in the meantime, it has significant competition.

Intel also said on the call that it feels that its roadmap and execution on the data center side are going to get customers more comfortable with the pace of innovation in 2023. That will mark about 4 years since the AMD EPYC Rome generation launched (2019.)

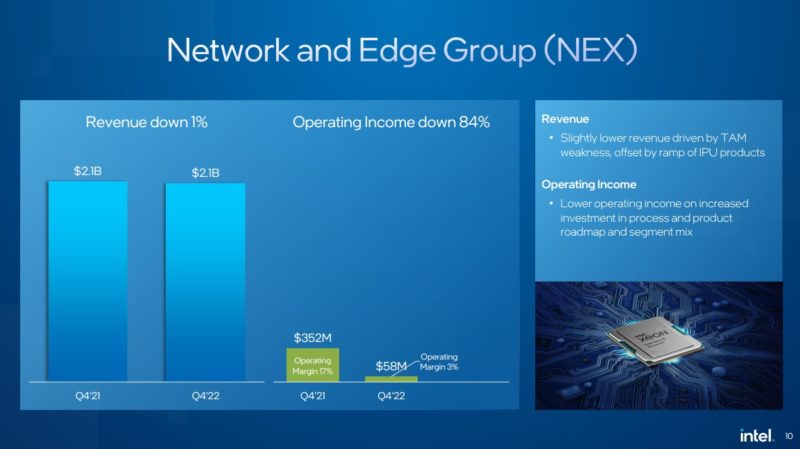

Intel said that declining economic conditions are what is pushing NEX down. Something also seemed strange here as the Mount Evans IPU, or the Intel E2000 was being called out as an offset for lower revenue and income due to macro conditions. That is Intel’s product for Google Cloud to take on an AWS Nitro card. We have still not seen a lot of movement on the Intel E2000 in the more general server market.

Better put, we have NVIDIA BlueFields, we have Marvell Octeon 10, and AMD-Pensando cards, but we do not yet have the Intel E2000. Our sense is that IPU ramp is for a net-new market and one that will include Google’s Cloud and then later in 2023 hopefully the broader market.

One of the big announcements is that Intel is discontinuing investment in the switching business. That means Intel Tofino, purchased as part of the Barefoot acquisition, seems to be meeting the same fate as Optane. This is interesting because network switches tend to be decently high-margin businesses. Next-gen switches seem to need advanced packaging and silicon photonics, so there would have seemed to be a lot of IP Intel would have leveraged for its switch business.

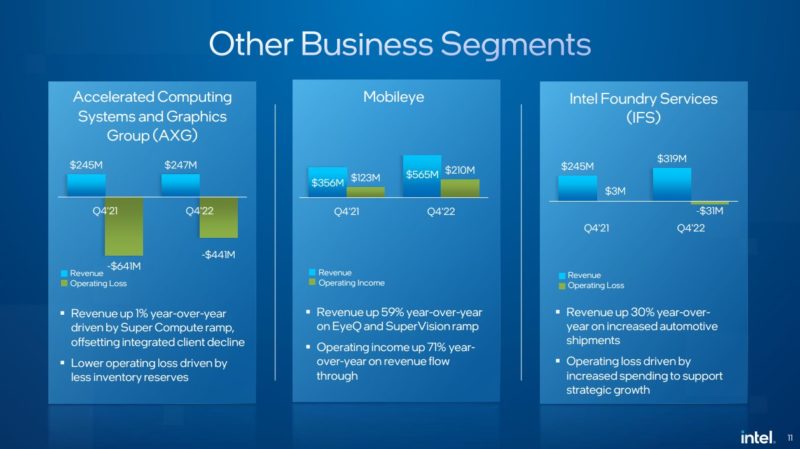

On the other business segments, AXG is being split to consumer GPUs and data center GPUs. Both are in the new market entry mode still. Mobileye is Intel’s third-highest operating income business. IFS is interesting. It is a key growth driver for Intel, but it is also not helping gross margins.

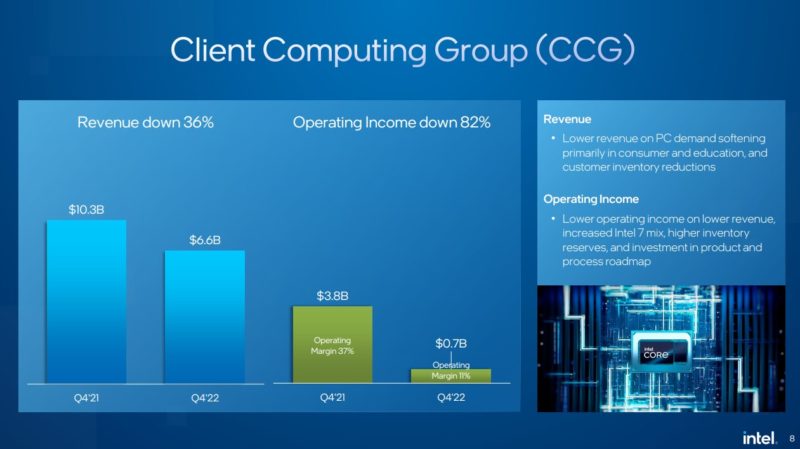

On the CCG side, we are waiting for Meteor Lake on the product side. Intel said on the call that its customers are going to go through a dramatic inventory reduction. Hopefully, that means deals on client systems. This was a rough quarter for a large Intel business.

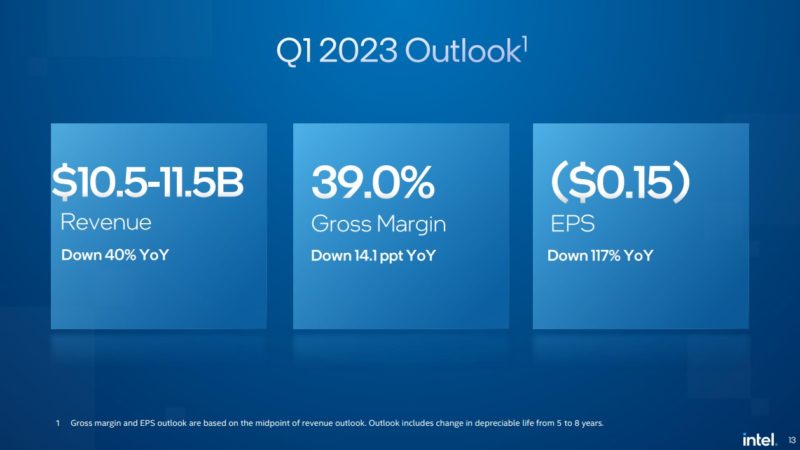

Here is the big slide. Intel’s business is guiding to negative EPS in Q1 2023 and a gross margin in the 39% range. This is for a business that had been a 50-60% margin company for a long time.

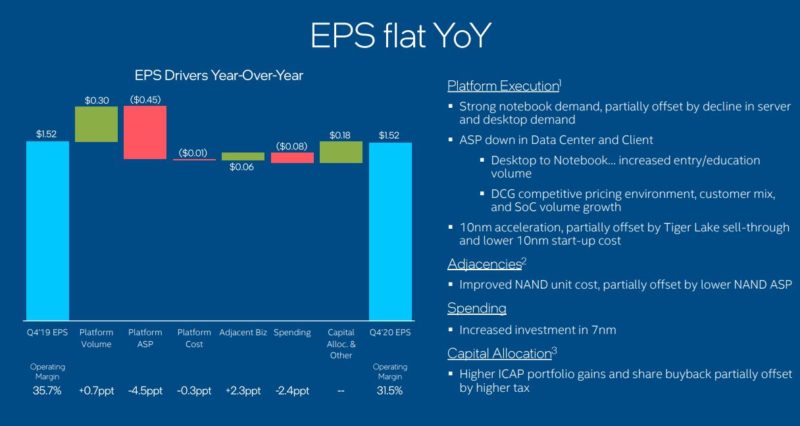

Just looking back two years ago, Intel was showing Operating Margin in the 30% range with Gross Margin closer to 60%.

That is quite a big difference.

Final Words

This was not a great earnings day for Intel. That was also the tone of the call, with the next quarter or two sounding difficult. Intel is hoping later in 2023 its business will start to turn the corner, but it thinks the data center market is going to see a down year. It will be interesting to see what AMD thinks about that market when it reports earnings next week.

The other side to the server market is that supply on the AMD EPYC 9004 has been tight, and the Sapphire Rapids supply is ramping. As a result, many of the higher-end deals may have been stuck waiting for the new generation. That is something we have seen in many generations previously.

One thing is for sure, if you have been getting excited about the server market in 2022, get ready for the next five years as things in the server market will drastically change.

With the baffling non-discount pricing of Sapphire Rapids and with a SKU list as long as the number of weeks in a year, I wouldn’t be surprised if Intel loses out on the entirety of 2023.

I get that Intel is enamored with accelerators. Fine. But not everyone is HPC, and I guarantee not many people want to pay a premium for what are largely first-gen accelerators with uncertain adoption and absolutely zero roadmap. I mean, at least AMD didn’t charge a premium for 3DNow.

Is Intel Inside manufacturing doldrums of their own creation? Yes, and that’s something Intel can’t control at this point – what’s done is done. But why on earth would Intel then take Sapphire Rapids and chop it up into 52 SKUs, then slap a premium on them when they are substantially weaker than AMD in mostly all but Intel’s own benchmarks? It’s just baffling.

Intel said PSG revenues grew 42% YOY.

No real mention of the plans for SPR Workstation in the call, which is an exciting product for some.

PG says that Lunar Lake has taped out. That part is described as ultra-low power. Says it is on schedule for product release qualification in 2024.

PG says Emerald Rapids is already sampling, and aiming for 2023 launch.

Intel did not mention Arrow Lake in the earnings call. I believe it had appeared on slides as a 20A part, while Lunar Lake appeared as 18A. PowerVIA and RibbonFET are mentioned as related to 18A. I wonder if Intel is pulling in its schedule for 18A and doing away with 20A Arrow Lake.

The margin for that outlook is actually worse than it looks. Intel changed the useful life of their fab tools from 5 to 8 years. Depreciation cost is much lower.

That will only work if their foundry model will play out and get high utilization for many many years. They are betting everything on a future that looks very implausible. Now that every foundry is increasing capacity I see huge write-offs coming in a few years.

————–

“The other side to the server market is that supply on the AMD EPYC 9004 has been tight, and the Sapphire Rapids supply is ramping. ”

You keep writing that but the Genoa CPUs have much better availabiity at distributors. Contact your parts distributor (not your HPE /DELL salesman). It seems obvious that Genoa has a higher priority on cloud than enterprise for the ramp.

—–

@ssnseawolf

“I get that Intel is enamored with accelerators”

That’s the only marketing angle they have left. Put yourself in their shoes. They know that most won’t use them and that there are better alternatives.

the CCG Revenue charts are massively doctored. the bars depict -18%, but it’s actually -36%. are there legal implications for this?

The discontinuation of network switching is huge given Intel’s lead in the requisite packing technologies to scale beyond 1 Tbit. Even then, their chiplet strategy would have provided unique opportunities to put unique IP directly into switches like CPU cores with will access to backplane bandwidth or FPGAs for custom acceleration directly on the network.

You see this, then you go back and read STHs sapphire rapids article, and it makes a ton of sense why Patrick and team rat-holed into accelerators and skus. I’d say Intel needs to fire its Xeon product mgmt team.

If I were an Intel investor, I would take offense at your frequent performance characterization of “not great”. I get it, you don’t want to bite the hand that feeds you.