During Intel’s Q4 2024 earnings call, the company said that it would not bring Falcon Shores to market after all. We have been watching Intel’s GPU market for some time, and Falcon Shores was supposed to be the one to get Intel back into the game. It looks like Intel is not planning to meaningfully participate in the high-end AI accelerator market in 2025.

Intel Falcon Shores GPU Not Coming to Market in an AI Hit

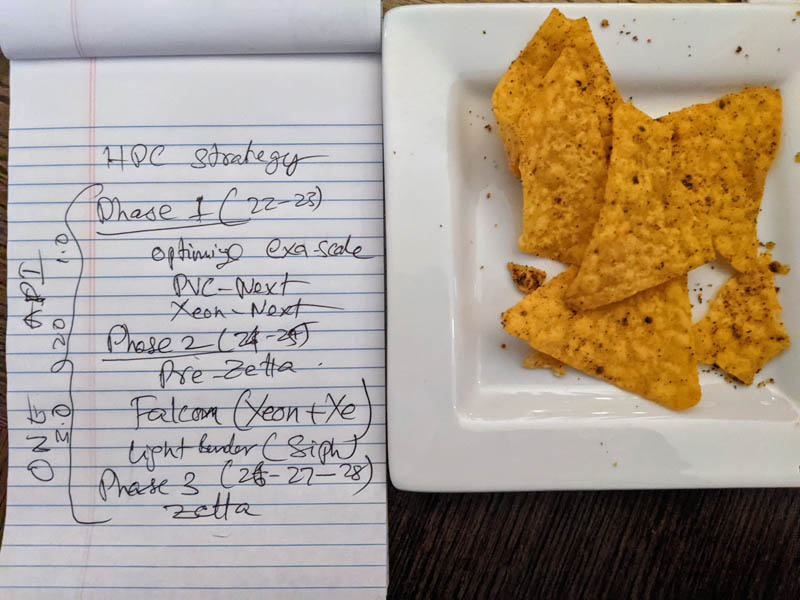

As a bit of history, STH first showed details about Falcon Shores in 2021, Raja’s Chip Notes Lay Out Intel’s Path to Zettascale. Here is then Intel’s accelerated computing lead, Raja Koduri’s hand-written notes showing Falcon Shores in 2024-2025.

Falcon had some ambitious plans. It would be a Xeon plus GPU product with Lightbender. Lightbender was Silicon Photonics in a package roughly the size and power of a HBM stack that could be used for a high-speed interconnect. From what I understand, Lightbender was cancelled some time ago.

In 2022, Falcon Shores was still being discussed as x86 and GPU IP, but with options for all GPU or all CPU with HBM.

Taking a pause here, this is very similar to AMD’s MI300X (all GPU), MI300C (all CPU), and MI300A (x86 plus GPU) IP. Intel even had plans for $10B of accelerator sales in 2026 which seemed like a lot in early 2022, but now it all feels like if we showed the 2022 vision for Intel accelerators, it would sound a lot more like how AMD has been executing.

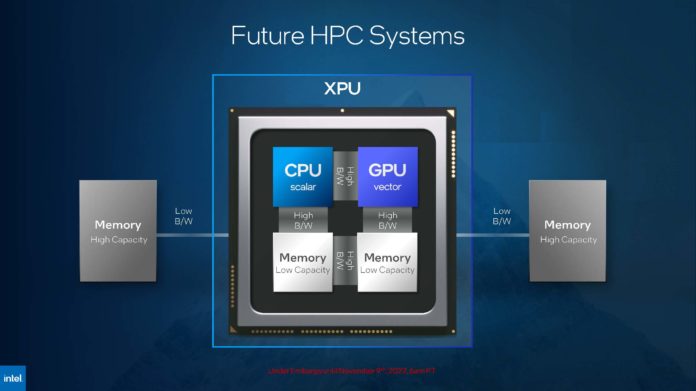

In early 2023, we broke the news that Intel Announces it is 3 Years Behind AMD and NVIDIA in XPU HPC. The reason is that both AMD (Instinct APU) and NVIDIA (Grace plus GPU) both were focusing on CPU and GPU coupling, but Intel announced it would only drive Falcon Shores as a GPU. It is worth mentioning that coupling was a key enabler in Raja’s chip notes in 2021. Without Falcon Shores in 2025, it feels like that statement that Intel is 3 years behind on XPUs is going to be accurate, if not falling short.

On that note, during today’s earnings call, here is the statement on Falcon Shores:

“… on the other hand, we are not yet participating in the cloud-based AI data center market in a meaningful way. We have learned a lot as we have ramped Gaudi, and we are applying those learnings going forward. One of the immediate actions I have taken is to simplify our roadmap and concentrate our resources. Many of you heard me temper expectations on Falcon Shores last month.

Based on industry feedback, we plan to leverage Falcon Shores as an internal test chip only without bringing it to market. This will support our efforts to develop a system-level solution at rack scale with Jaguar Shores to address the AI data center.

More broadly as I think about our AI data center opportunity, my focus is on the problems our customers are trying to solve. Most notably, the need to lower the cost and increase the efficiency of compute. AI is not a market in the traditional sense. It is an enabling that needs to span across the compute continuum from data center to the edge. As such, a one-sized fits all approach will not work and I can see clear opportunities to leverage our core assets in new ways to drive the most compelling total cost of ownership across the continuum.” (Source: Michelle Johnston Holthaus Intel co-CEO on Intel Q4 2024 earnings call)

There is a lot there, but the narrative seems to fit. If Falcon Shores in 2021 was planned as a product that would be in the market today with AMD-like variations and silicon photonics, it would be really neat. Later in the call during Q&A MJ said that it was not enough to deliver silicon, instead it needed a rack-scale solution. I had the sense that the 2021 vision for Falcon Shores was closer to the rack-scale solution. If Intel Falcon Shores is not hitting its timeline, and companies like NVIDIA are accelerating their cycles, then passing may make sense.

At the same time, AMD is in-market with alternative GPUs in the market today, so that means that software development will naturally push to utilize AMD over Intel architectures until Intel re-enters the market. Intel had Ponte Vecchio which Stopped Hunting New Clusters three quarters ago. Intel Gaudi 3 just hit GA a few months ago, but we know that Falcon was designed to be a major architectural shift. As a result, it feels like Intel is at least pausing meaningful participation in the AI accelerator market.

Final Words

Let us face it, the AI GPU market has a lot of money behind it, and Intel has thus far missed the bulk of the market. For AMD this feels like a big win since it is now the public GPU alternative to NVIDIA, and has some novel architectures. One just has to hope that the Jaguar Shores products can be pulled in by moving Falcon Shores to be an internal test chip.

What seems a little puzzling is the juxtaposition of killing this for not being system-level/rack scale enough while also saying that

“AI is not a market in the traditional sense. It is an enabling that needs to span across the compute continuum from data center to the edge.”

Unless there’s something about Falcon Shores that is specifically bad for smaller than rack scale purposes the position that AI compute will exist at a variety of scales seems like a good reason(along with, unless their upcoming offering will be too architecturally different for this to be helpful, at least letting interested parties get hardware to target software against; since we know that takes time to mature) to offer the part in smaller scale systems.

SPR-HBM is looking quite good for local LLM deployment. Used SPR/EMR parts are getting increasingly competitive in AI training with GPU price hikes.

This is so stupid. What is intel thinking? They cannot still expect to compete for AI clusters when they missed the bus for the last 3 years in a row, can they? How can they still pretend to only compete at the top when they are not even a competitor anymore at all?

Intel is shit at being the underdog. They definitely need some humility in management. Not only execution is shit at intel, but this strategy of big or bust has been a disaster too.

They shot themselves in the foot already by canceling Habanas roadmap. The Startup they bought for billions which actually delivered competitive products on time.

Habana Labs had a great inference solution called greco, which intel canceled shortly after launch.

Intel also cancelled the sucessor to the Gaudi3 training chip because it would have competed with their own internal falcon shores. How can one be so stupid?

Dreaming of competing in the highly competitive AI cluster is chasing the stars. Nobody in the industry is gonna spend good money on unproven Architectures and software ecosystem. Just look at AMD how hard it is for them and how they are nowhere near the margin of nvidia. Intel would just compete in price.

Meanwhile they are completely neglecting the huge opening that nvidia and AMD have in the edge AI market. Now nvidia has finally woken up with their project Digits.

There are many reasons why people want to run and train local LLMs: Like latency for robotics, security/compliance, cencosrship/limitation of services, EU data privacy laws (especially in the healthcare), or just Tinkerers trying to do their own models and inferencing.

Habana Goya was a great solution for running local models and very affordable at that. Gaudi2 was available as PCIe Cards, but intel dropped that withg gaudi3 and adoption was shit.

The best thing about this market is that it has very low entry barriers. Also the margins are higher because you are not making big deals with big rebates. You can get traction and market adoption much easier than in the AI cluster market.

As an underdog they should really deliver something on this market to attract Developers and serve customers that are currently underserved by nvidia and AMD.

What can you get from nvidia? An old A100 80GB with a PCIe Adapter for 20K? A 5090 which is severely VRAM limited with just 32GB?

Anything in this market would just be an easy win for intel if they did it.

Intel (Products) future will all depend on new CEO. If it stays with Michelle then good luck beyond the path Pat set out on. Like she stated on the call, she will aggresively chase socket wins to re-gain market share with GNR. Ok for interim seat-warmer, not for a fixed choice.

Intel Foundry will likely get their own CEO in ~24months, once spun off. At least that’s how I read all the signs. Assuming it continues to be viable. Not giving any sign on optimized 18A, anything on 14A at the earnings call is a bad signal. Lets see on the April foundry event.

Jaguar Shores – the whole story smells like stretching the goal to ‘tomorrow’ because ‘today’ we aren’t there yet. There is so much potential in the less-than-best category in interim. Intel NEX group falling to DCAI is potentially good, if the interconnect will play a big(ger) part in the rack-scale solution.

IDK, without foundry performing and advancing past 18A this makes no sense. Pat had his blunders but his direction made sense, looking from the outside. Intel Products on its own wont survive.

Intel needs to fire all their project managers and hire new ones based on merit. Of course it’s hard to attract the best talent now with the way stock-based compensation works in the industry. Maybe they should ask DeepSeek to build them a time machine so they can go back and never appoint destruction to their board and never make Krzanich or Swan CEOs. Live in a fantasy world, die in the real one.