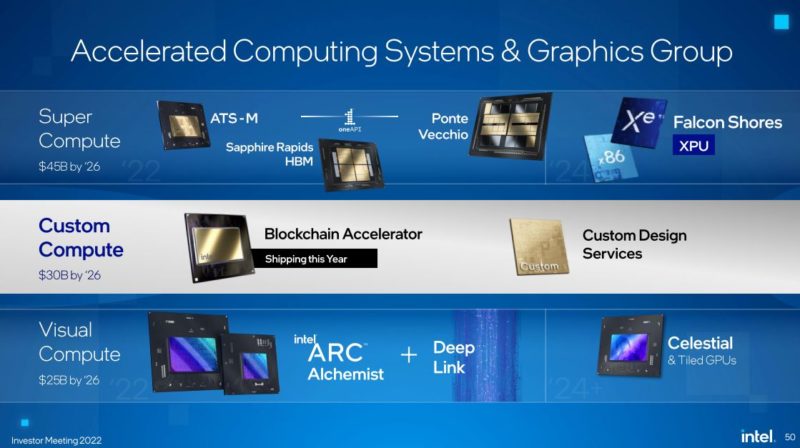

Intel has a big business brewing, specifically the Intel AXG business for its Accelerated Computing Systems and Graphics. This is a small business today, but one that Intel aims to grow rapidly in the next four years to become a ~$10B revenue stream. As part of the event, Intel also discussed Falcon Shores, a part that touched on briefly in November 2021. Let us get to some of the announcements.

Intel AXG Growing Opportunity

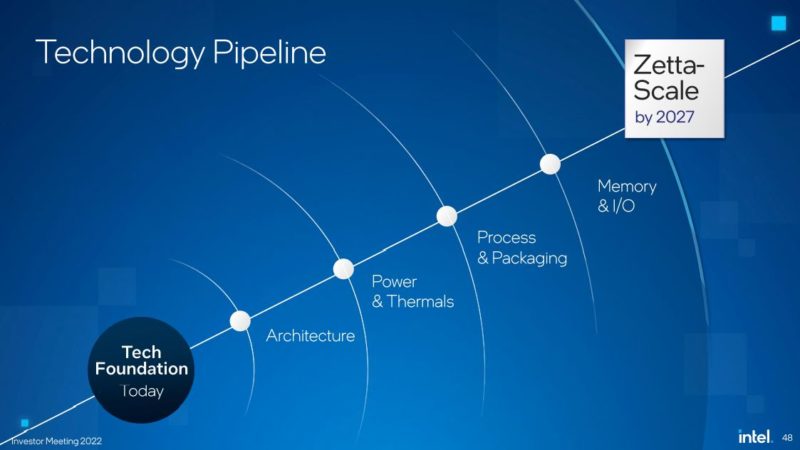

Intel is focused on having PFLOPS, the measure of today’s supercomputers, available in endpoints by 2026 or so. That means that the entire stack will need a rapidly evolved compute architecture to get there.

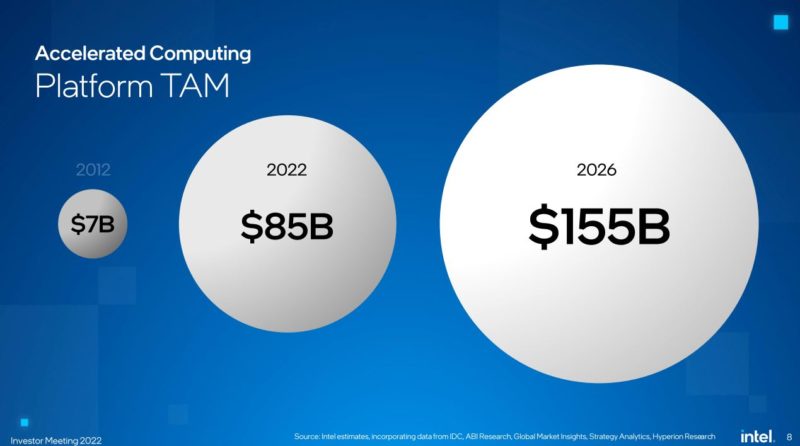

Intel sees a $155B TAM from $7B in 2012 and $85B today. This growth rate is also what is powering earnings at NVIDIA and is the case of a rising tide lifting all ships in the industry. Intel is getting serious about this market, with products, in 2022. Of course, it has taken years to get to this point, but it is easier to sell packages of Silicon than ideas (NFT’s notwithstanding.)

What is interesting here is that Intel is placing media in its Super Compute segment, and showing a 23% CAGR. Of that $155B TAM in 2026, $100B is for the hardware components side. Perhaps the more interesting part is really that Visual Compute which includes gaming and content creation has a relatively small CAGR and TAM. While Intel is going into the gaming market, that is not where it believes the big dollars are.

An implication of the above, and that Intel is only aiming for $10B of revenue of this $155B is that the overall acceleration market will grow from $85B today to $155B. If Intel takes $10B of that, that means that there is $65B for others.

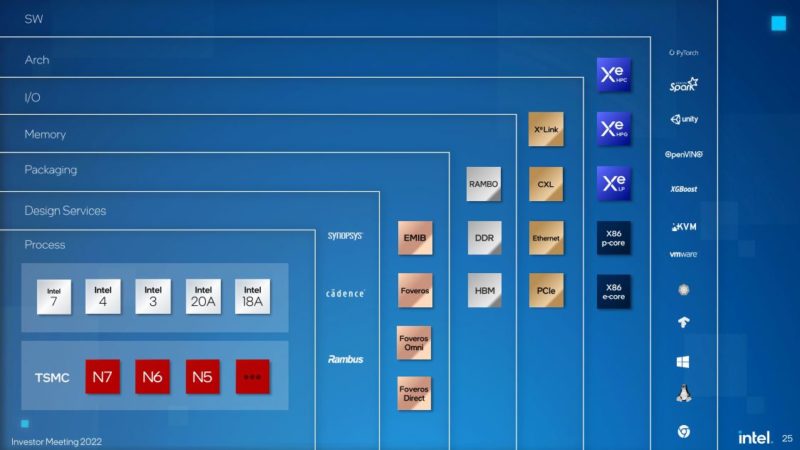

A big part of that journey is Intel’s IDM 2.0. Intel is moving to tiles and the ability to leverage external foundries and IP to build the tiles it needs to integrate into next-generation solutions.

Overall, Intel is building Tiles with defined interfaces so that way it can mitigate manufacturing risks and supply new technology to the market. A big part of this is being able to customize the tiles that go into customers and segments so that there is an alignment between IP needs and what is packaged and delivered.

For a food example, Intel previously built chips like to-go lunch boxes that had fairly set configurations. In the future, Intel will be able to offer more of an American Chinese food experience where a customer picks what they want.

Intel AXG Product Roadmap

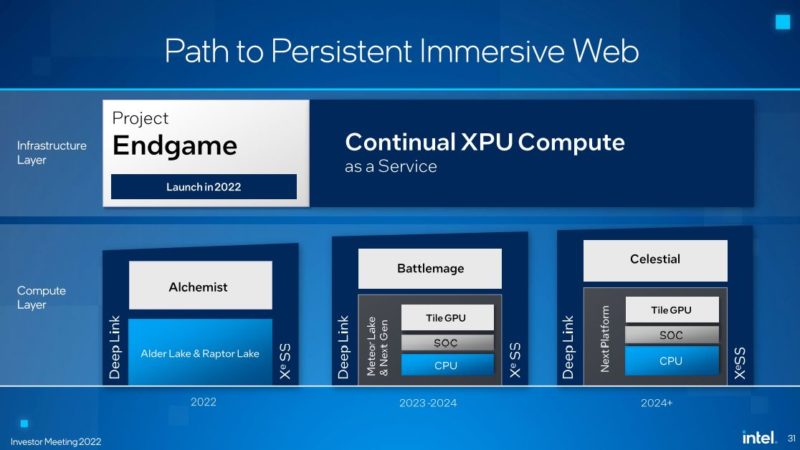

Part of the announcement today is that Intel believes that it will ship 4 million Intel Arc Alchemist GPUs in 2022.

We will cover more on this as it rolls out into the desktop and workstation segments later this year. Meteor Lake will allow tiled GPUs to be integrated into packages which should allow higher-performance integrated graphics. Project Endgame will enable users and developers to use GPUs as a service and we will get more on this later in 2022.

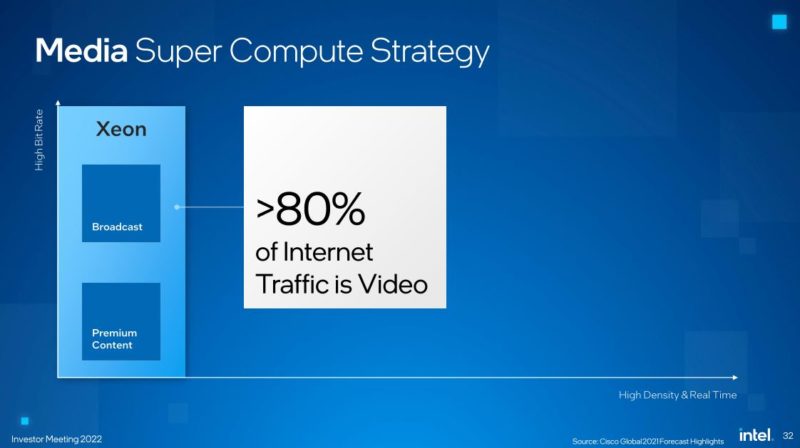

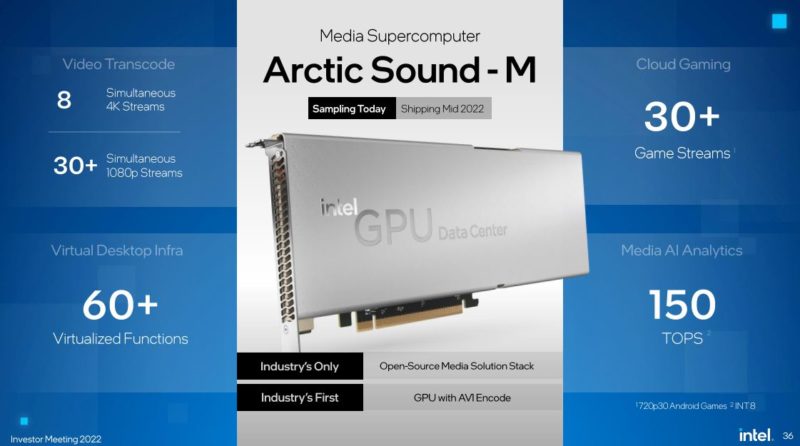

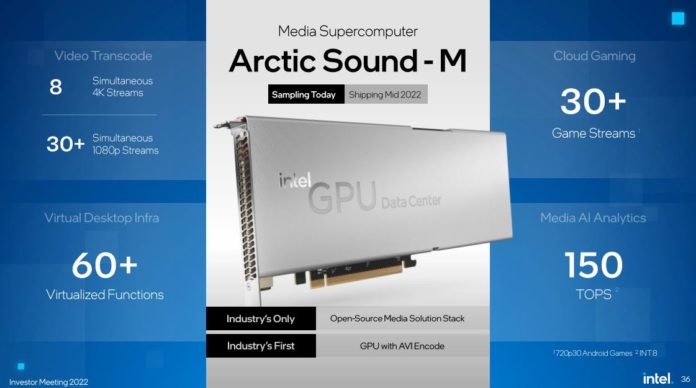

Getting bigger, over 80% of global traffic is video. This is creating a huge demand in the data center. The breadth of this means that companies like Google have a VCU Video Coding Unit just to do transcoding, and this is a huge field.

Intel is building a software solution around this. For those hoping to see a NVIDIA competitor for video transcoding, and virtual desktops in the data center (especially as GRID pricing increased recently), this may be the industry’s best hope.

Intel Arctic Sound-M is designed for video transcoding and virtual desktops. Intel says it works for cloud gaming as well. Arctic Sound-M has a hardware AV1 encode engine that is more efficient to stream.

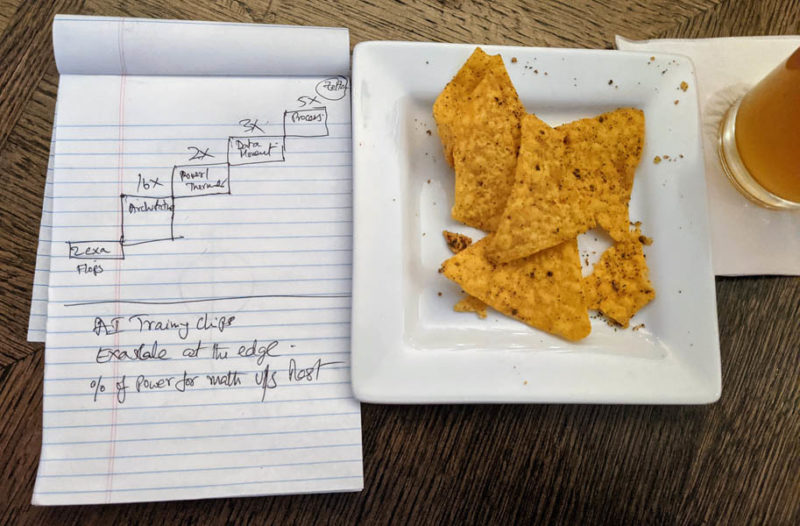

The next part of Intel’s talk is very aligned to our November 2021 piece: Raja’s Chip Notes Lay Out Intel’s Path to Zettascale. Here is the video for that:

As an interesting aside, this was a very popular web article for STH, but the video hit a technical snag that caused a re-upload and so it was not a popular video. I now use this when discussing how different STH’s web and video audiences can be.

Intel is pushing to get to Zettascale compute by 2027 and has a number of vectors to do this with.

Here is the note from my discussion on Raja. The new slide is a more refined version of Raja’s notes over Doritos and beers. You will see that Data Movement is now Memory and I/O.

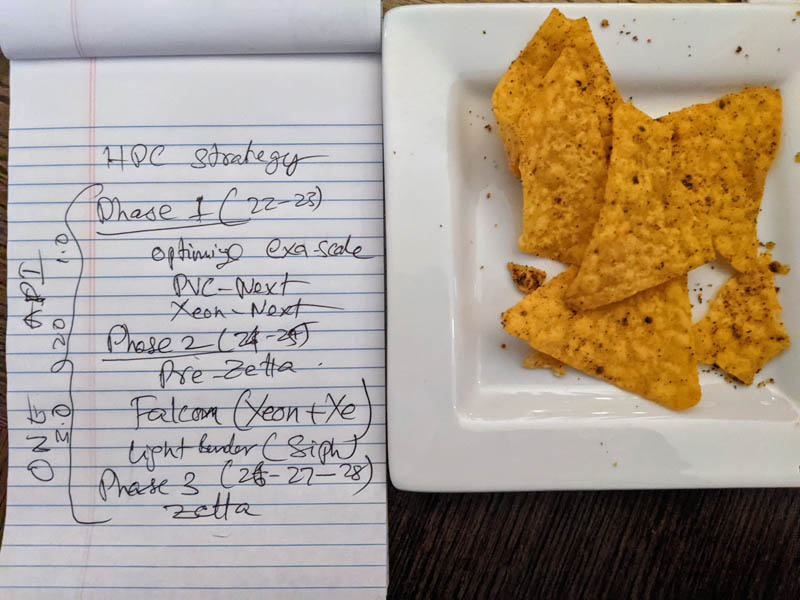

As part of that discussion, Raja laid out phases of getting to Zettascale. These Phases are now “waves”.

Wave 1 is using current 2022-2023 technology. This year we get Intel Xeon Sapphire Rapids and Ponte Vecchio GPUs.

Later in the investor meeting, we are going to discuss the next-generation Xeon, but this piece is going to be up before we can share the updated roadmap. Still, think of 2023 products as a refinement of 2022’s Sapphire Rapids and Ponte Vecchio.

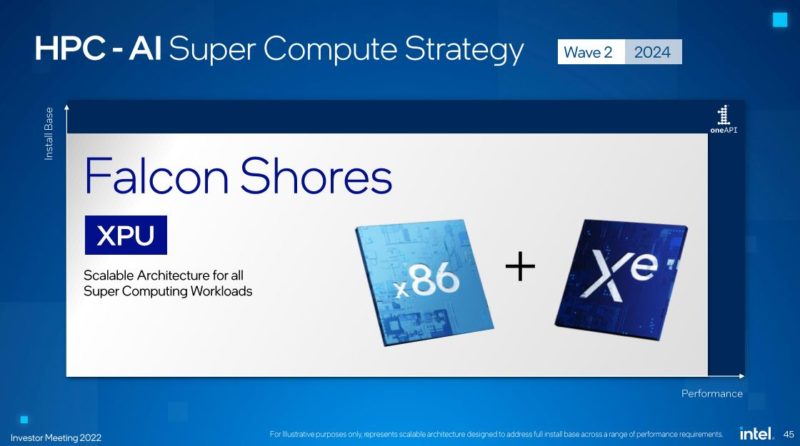

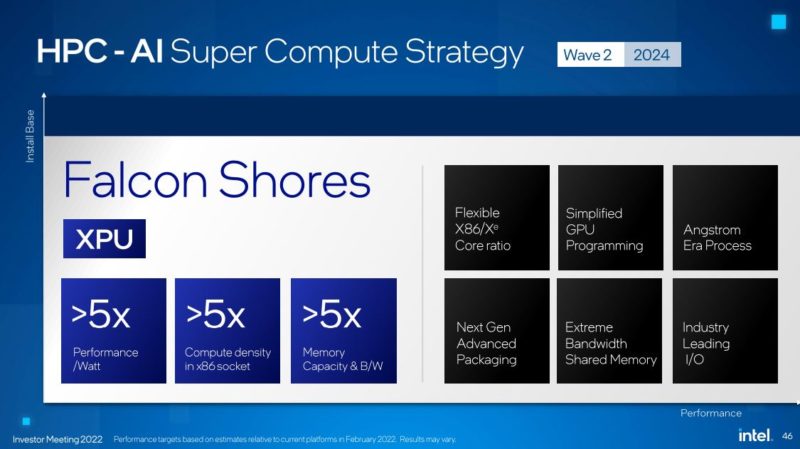

2024 is where things get really interesting. Falcon Shores brings x86 compute and GPU compute into a more unified design. This is Intel’s answer to NVIDIA Grace.

Intel says that there are big gains across a number of segments. Here Intel says “Industry Leading I/O”. During my chat with Raja, you will notice Lightbender for Silicon Photonics is in this Phase 2 / Wave 2 era. The way that Raja explained this to me during beers, this is going to be an awesome architecture.

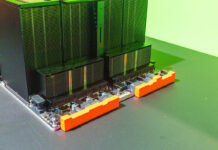

Update: Intel just shared a Falcon Shores image:

I am not supposed to talk about the other bridges coming beyond Ponte Vecchio, but Intel has a GPU plan as well.

With all of this, Intel also has a Custom Comptue group. Intel is taking its IP and is able to also add additional custom logic and create custom chips for customers.

Final Words

Overall, Intel has a lot of new technology, but we are at a bit of a strange phase. This is basically a startup business within Intel and we have been hearing about it for some time, but are just about to start seeing products. There is a lot of ground to cover, but Intel has a plan and is specifically eschewing old design principles to become more startup-like in its agility in the AXG. Now our eager countdown until hardware begins.

Arctic Sound (no -M) used to be the codename of Xe-HP, which was publicly canned, no? Strange that they would reuse the name for something else.