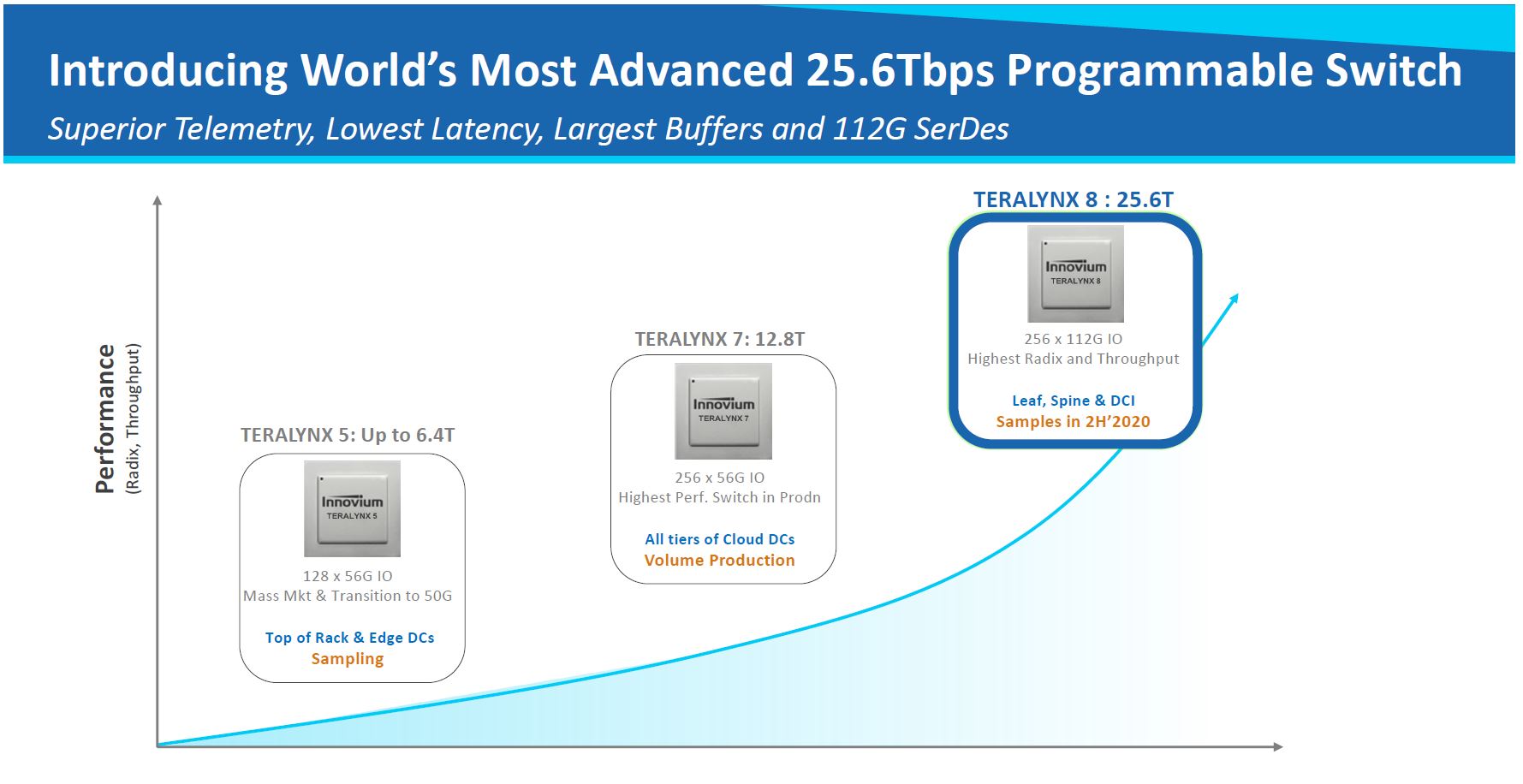

Today we have the release of the Innovium TERALYNX 8 which is a new switch product that will sample in the second half of 2020 designed for the 25.6Tbps switch generation with 112G SerDes. As networks are pushing more media and storage data we are seeing increased demands on the switch infrastructure. TERALYNX 8 is designed to be a solution that will see products and deployment in 2021 as an alternative to Broadcom solutions.

Innovium Background

Innovium is a 5-year old company with engineers from Trident and Tomahawk lines as well as many other switch vendors. Networking takes time to get into markets as well as get solutions out so the fact that it has some history, customers, and is well-funded by VCs makes a difference in the current economic environment. Indeed, TERALYNX 8 is the company’s third major product.

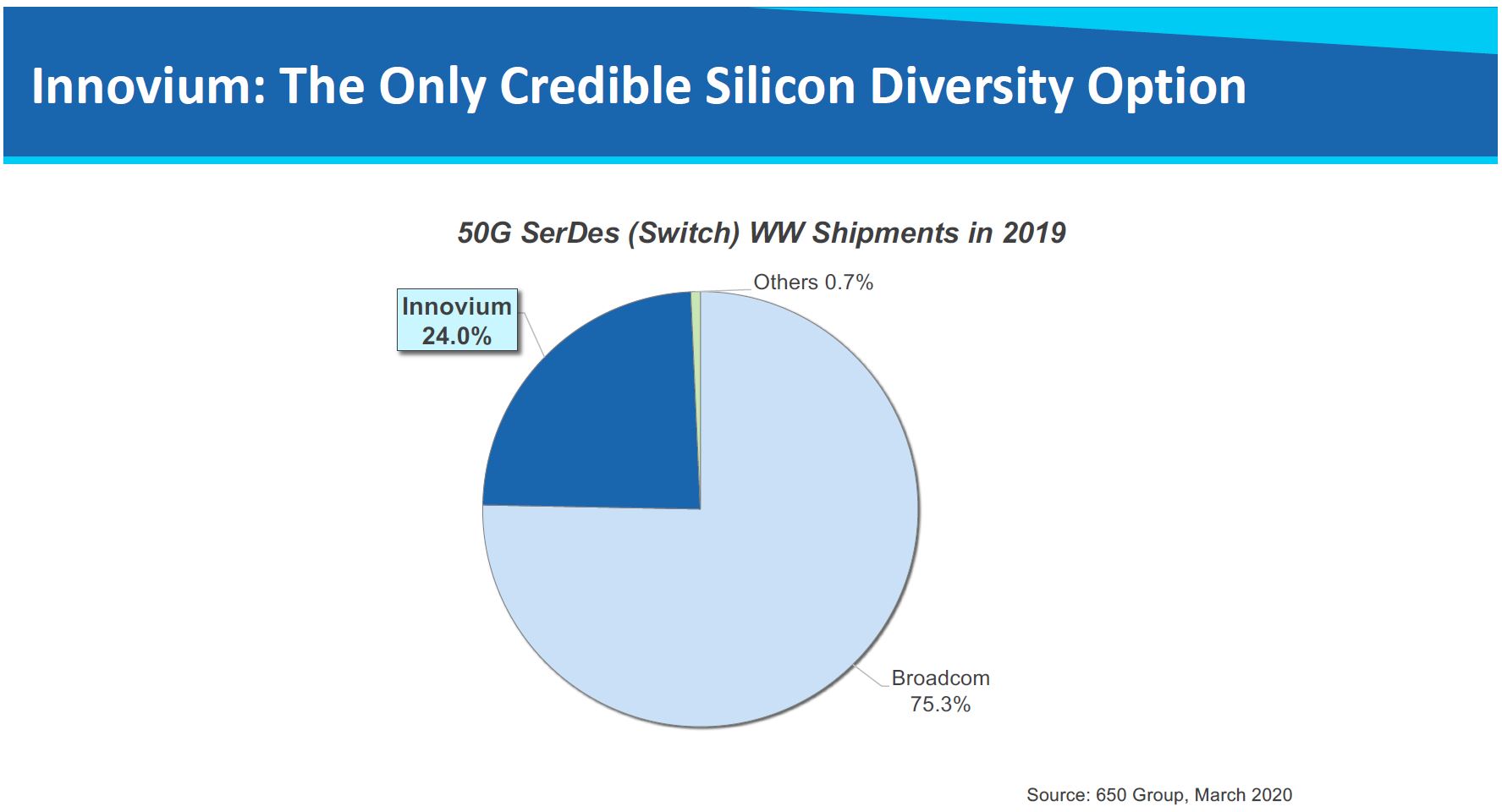

TERALYNX 7 is a 12.8Tbps switch generation product that is being used by hyper-scalers today as well as companies like Cisco in its Nexus 3400-S line. Innovium is claiming 24% market share in the 50G SerDes market in 2019 making it the primary alternative to Broadcom.

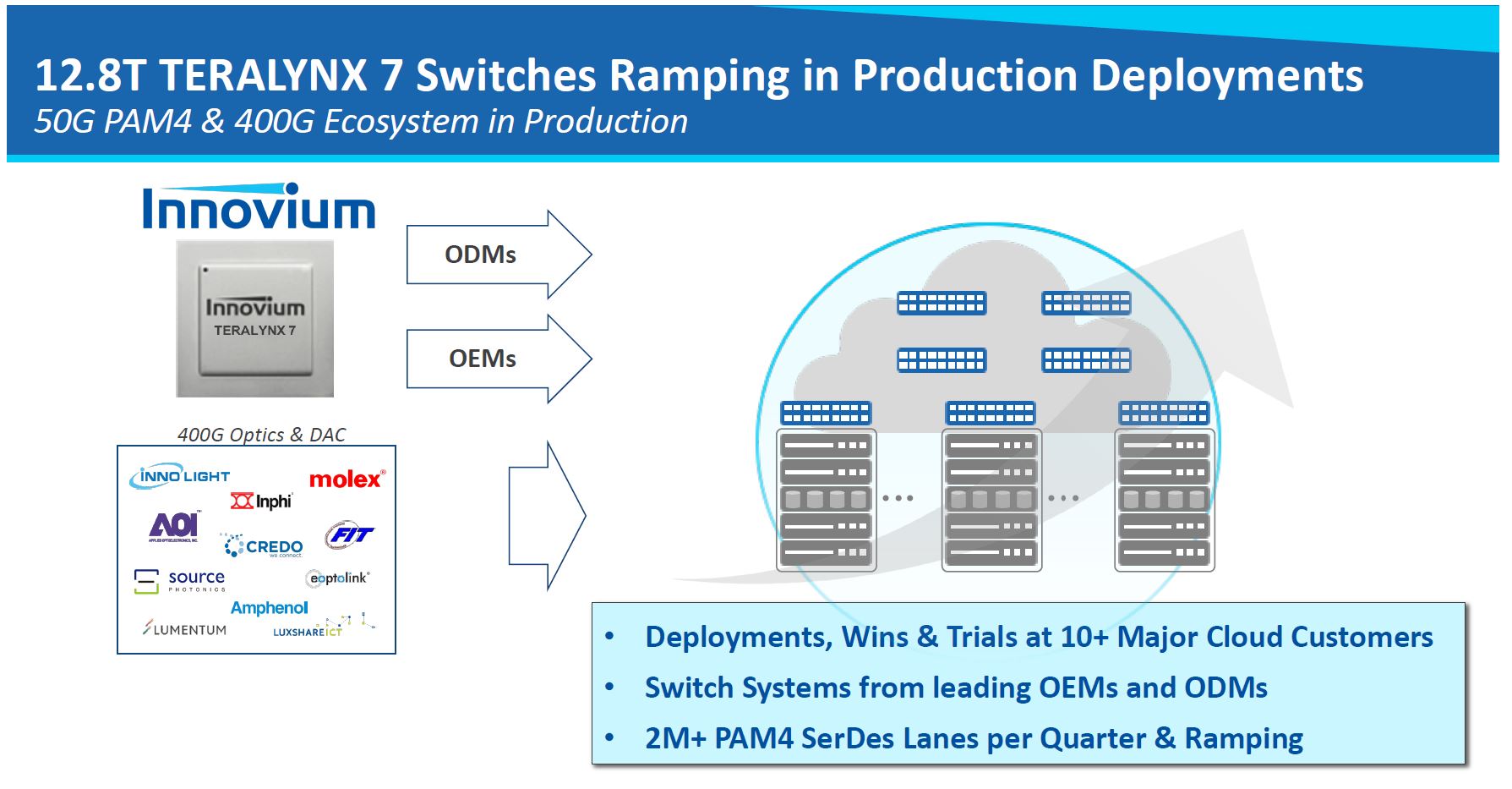

Innovium is shipping its 12.8T generation TERALYNX 7 series to cloud providers and OEMs/ ODMs already. One will note that it says 10+ cloud providers but is including trials. Trials may lead to deployments, but they may not as well and Innovium is not breaking out the numbers here. Still, Innovium is getting some traction which is important for a newcomer taking on Broadcom.

A few months ago, we covered the Innovium TERALYNX 5 6.4Tbps Switch Chip Launched. This is a lower cost switch chip option using Innovium IP. That is getting in designs today making the TERALYNX 8 the next chip in the company’s pipeline.

Innovium TERALYNX 8 Overview

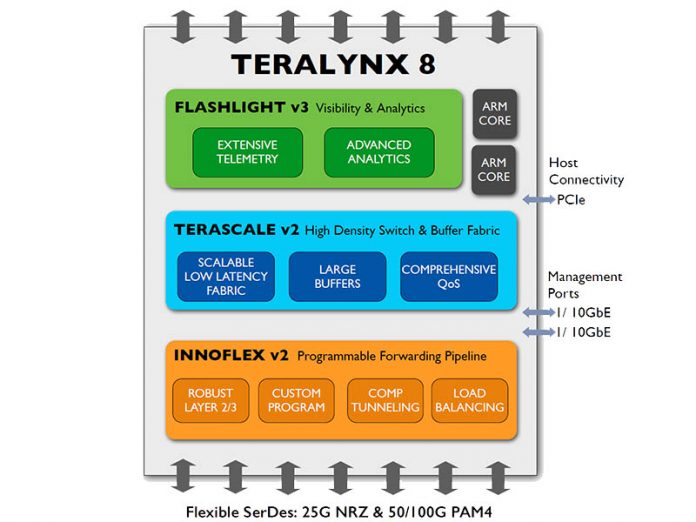

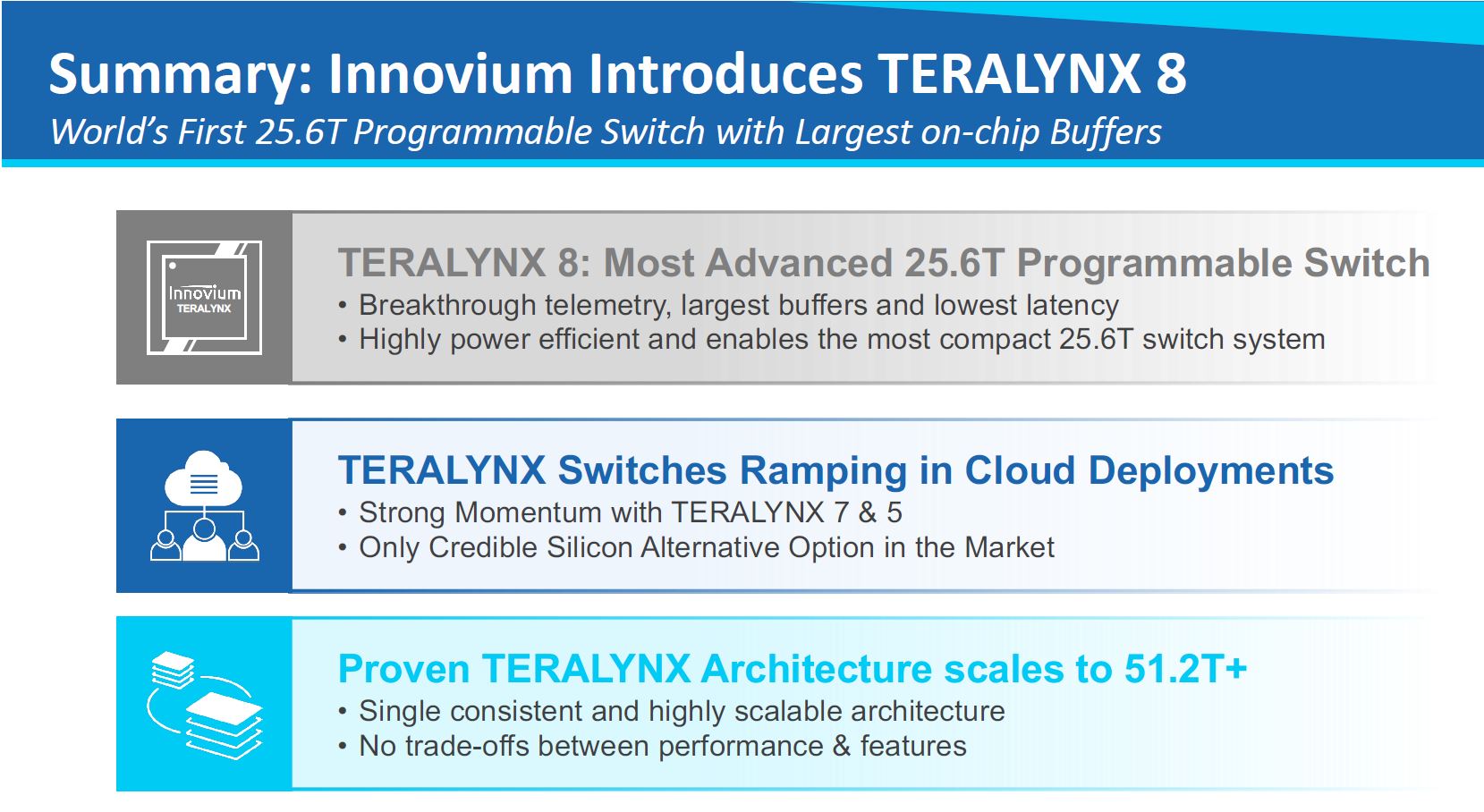

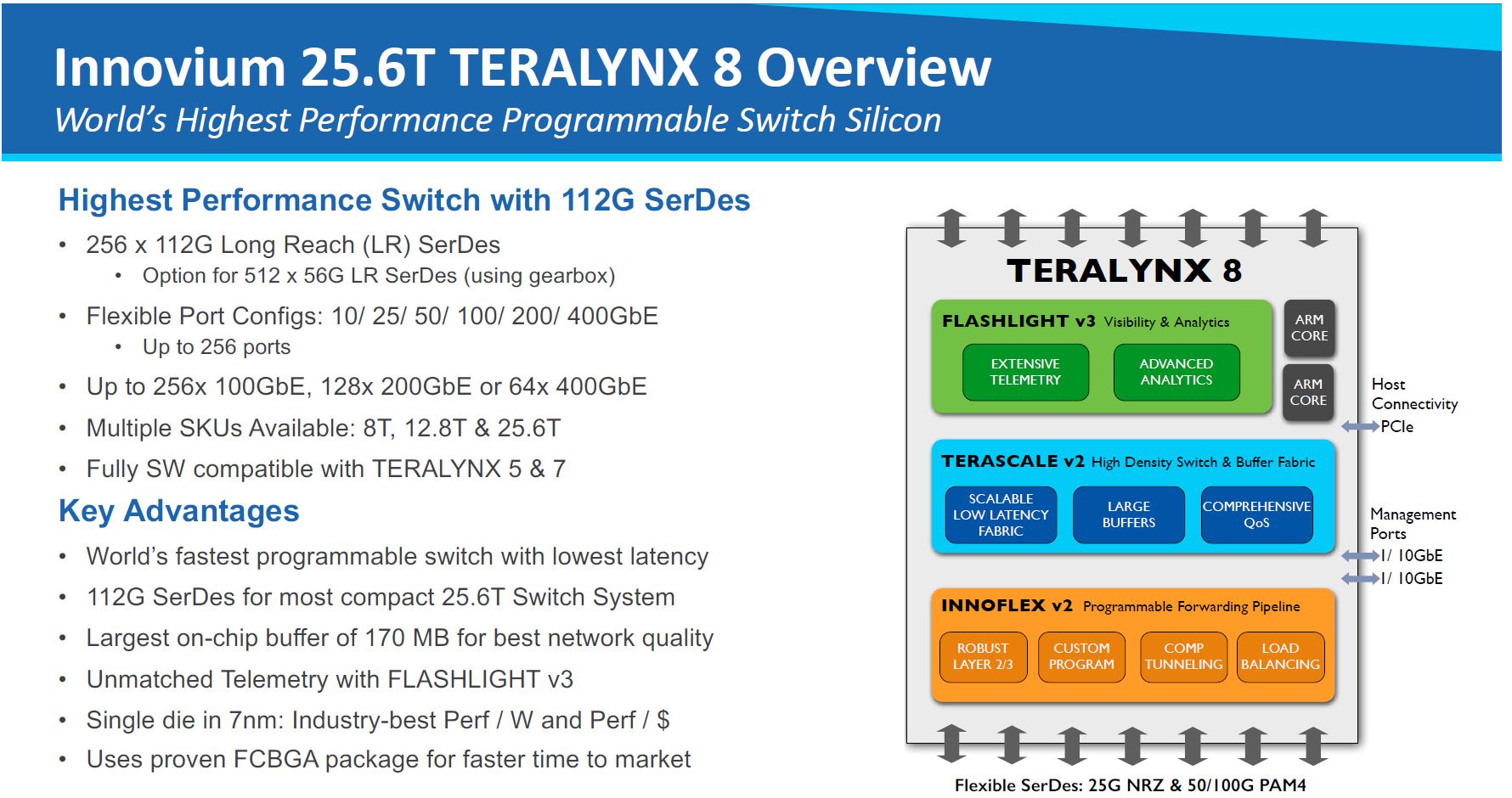

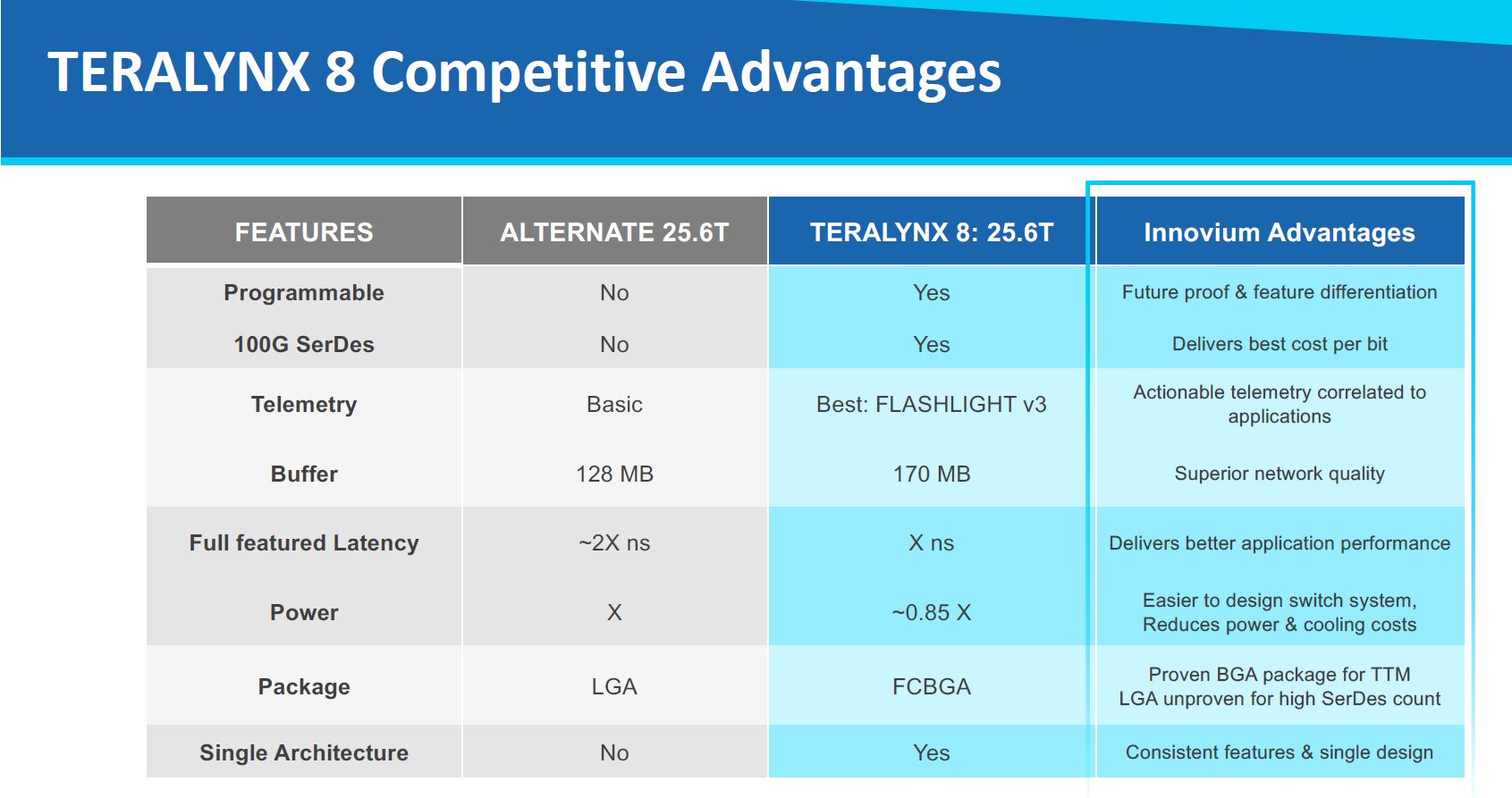

Instead of looking at the TERALYNX 8 summary slide at the end, we wanted to focus on the first line now. This is a 25.6T programmable switch chip that offers large buffers, the company’s Flashlight V3 telemetry solution, and low latency. Effectively Innovium is claiming to combine some of the best features of both the Trident and Tomahawk lines without the tradeoffs of either.

The TERALYNX 8 chip can handle up to 256 ports with 112G LR SerDes. The LR SerDes also enable using high-speed DACs in-racks. This new generation will support up to 64x 400GbE configurations. It also has 170MB of on-chip cache. We asked and TERALYNX 8 is a 7nm single die solution which means it can take advantage of the higher transistor density.

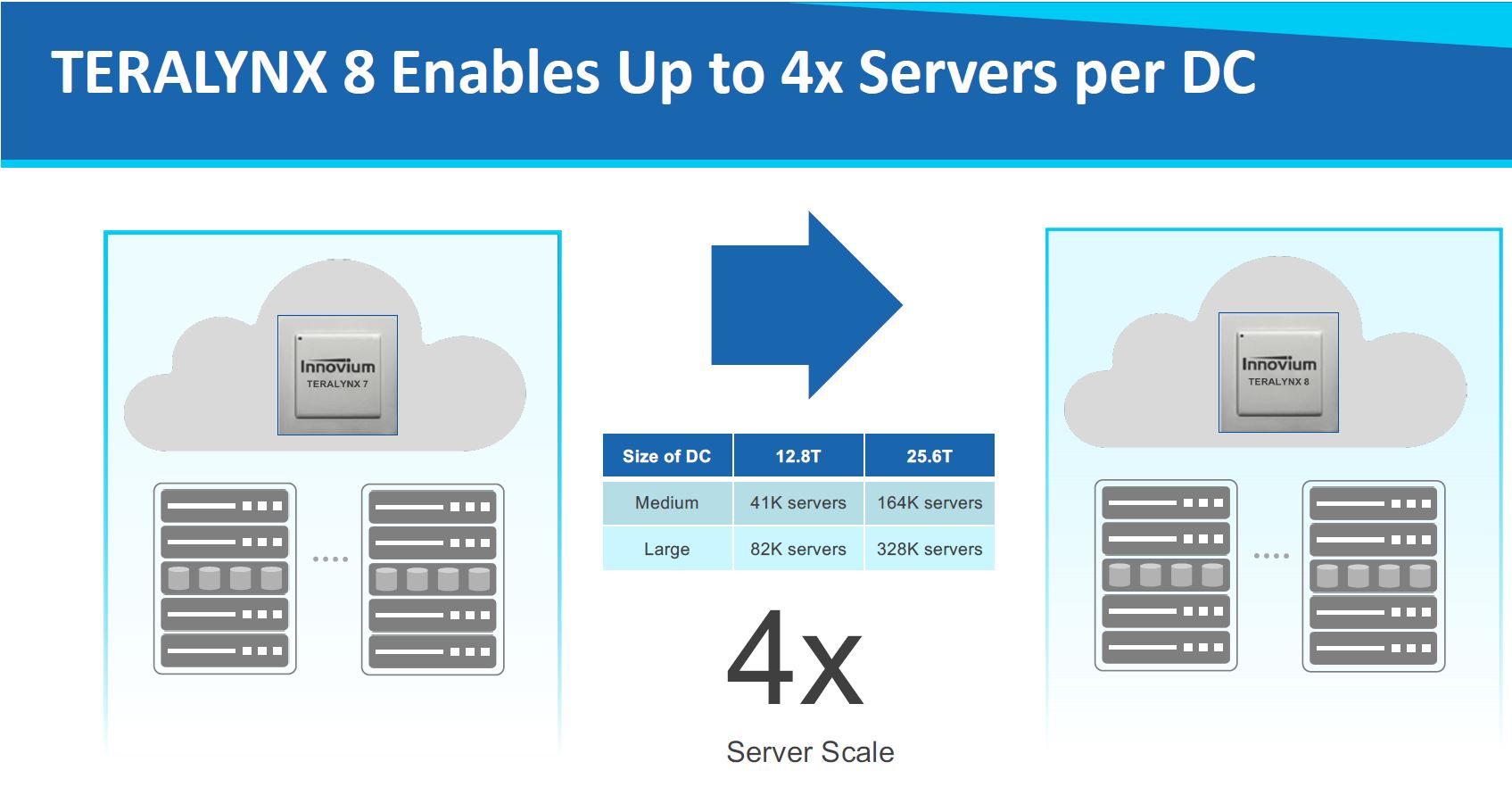

Having higher density means one can increase the number of servers in a data center. Some of Innovium’s clients are looking at 328K server data center configurations which is 4x the previous generation enabled, in part, by denser networking using less space and power.

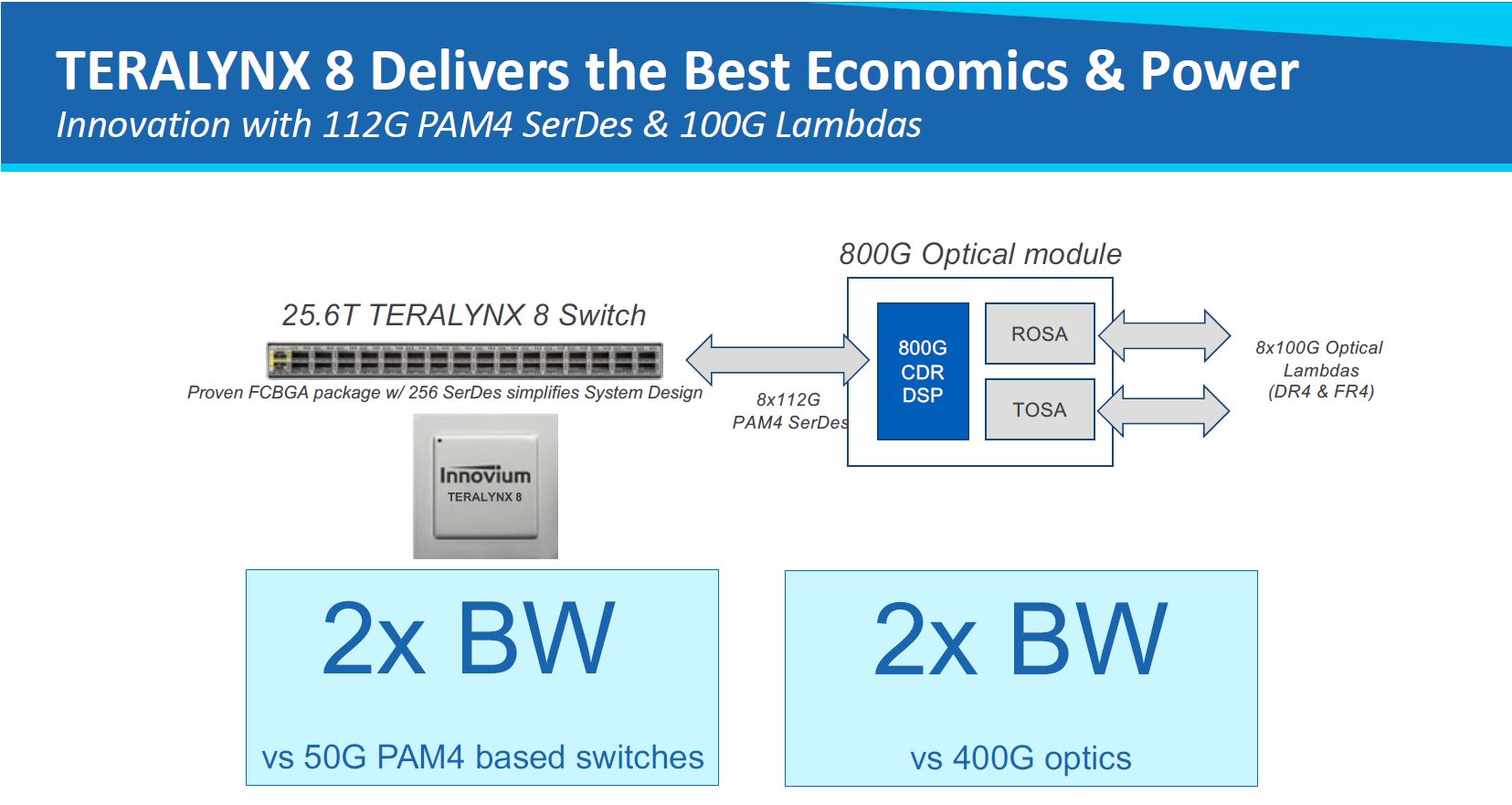

Part of what is driving this innovation is the industry developing 800G optical modules. These are still pluggable modules that Innovium expects will still be dominant in the 25.6T generation.

As an aside here, we asked about using co-packaged optics here since we recently did a Hands-on with the Intel Co-Packaged Optics and Silicon Photonics Switch piece. Innovium said the need for that would be less pressing with the 25.6T generation. The company also said that looking ahead to 51.2T and co-packaged optics may become a requirement. We go into why that will have big impacts on operations and the industry in our video on the subject with the Intel and Barefoot teams.

As one would expect, Innovium believes TERALYNX 8 has key advantages over “Alternate 25.6T” solutions. We would tell our readers that if you remember the 50G SerDes market share slide, that alternate is Broadcom.

We asked about NOS support. Innovium says its products are running hyper-scale network OSes, Nexus, as well as SONiC.

Final Words

While we have plenty of Broadcom switches in the lab, and we have featured many solutions over the years, we have not seen any Innovium pass through the STH lab yet. That makes sense since STH is still focused on mainstream 100GbE networking in the lab. Innovium is perhaps the best-known startup looking to compete with Broadcom. It faces stiff competition as the big data center silicon players such as Intel-Barefoot and NVIDIA-Mellanox are lining up in the space and Marvell with Cavium has solutions as well. We even recently saw a Ubiquiti UniFi USW-Leaf switch at the lower-end with a Nephos switch chip (MediaTek subsidiary.) Perhaps Innovium’s biggest challenge is that its chief competitors have larger silicon portfolios. At the same time, the fact that we have a vibrant ecosystem with lots of innovation also means that the industry is looking to break-up the Broadcom dominance of the network switch space.

Time will tell how well TERALYNX 8 competes, but it will sure be an interesting market going forward. We still have several quarters until these switches will be deployed.