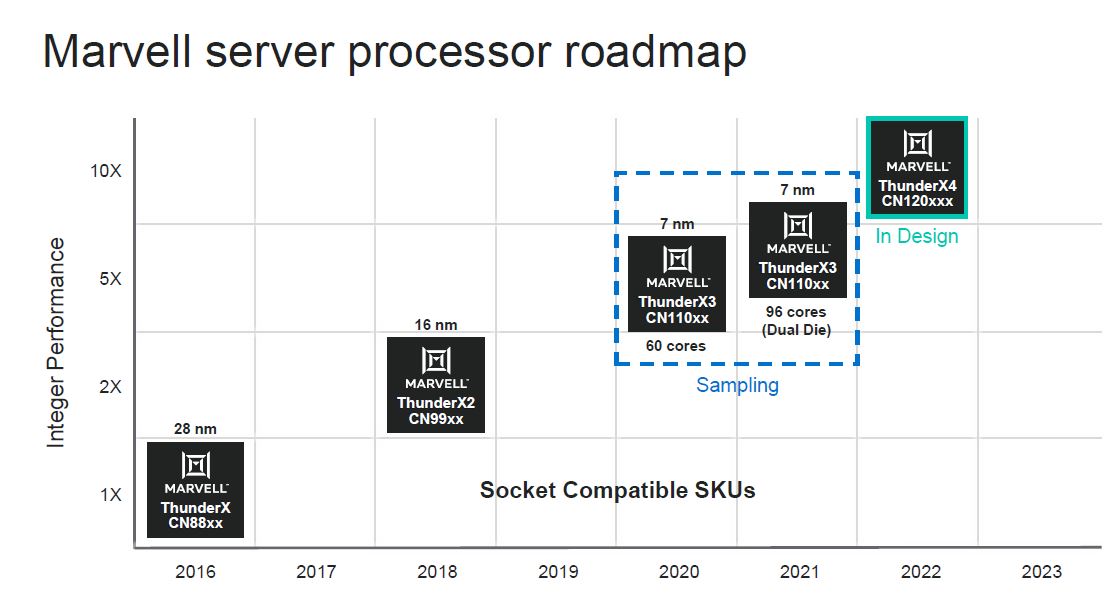

I just had a discussion with the folks at Marvell. The news this week on the company’s earnings call was that the company is pivoting to more of a custom solution focus for its Arm processors. After discussing the change with the company, it makes a lot of sense. Getting clarity on the path forward means that we can move forward, but we wanted to discuss some of the impacts.

Cavium/ Marvell ThunderX Background

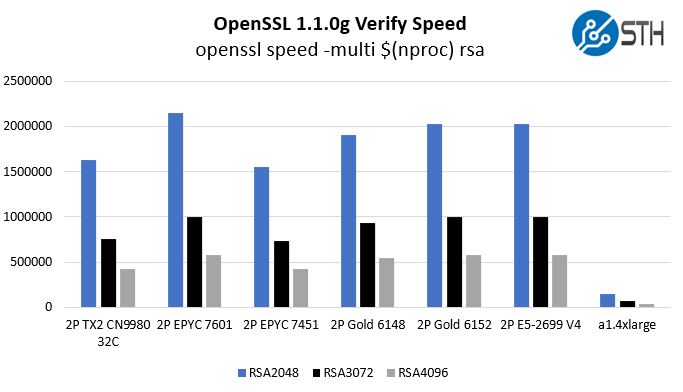

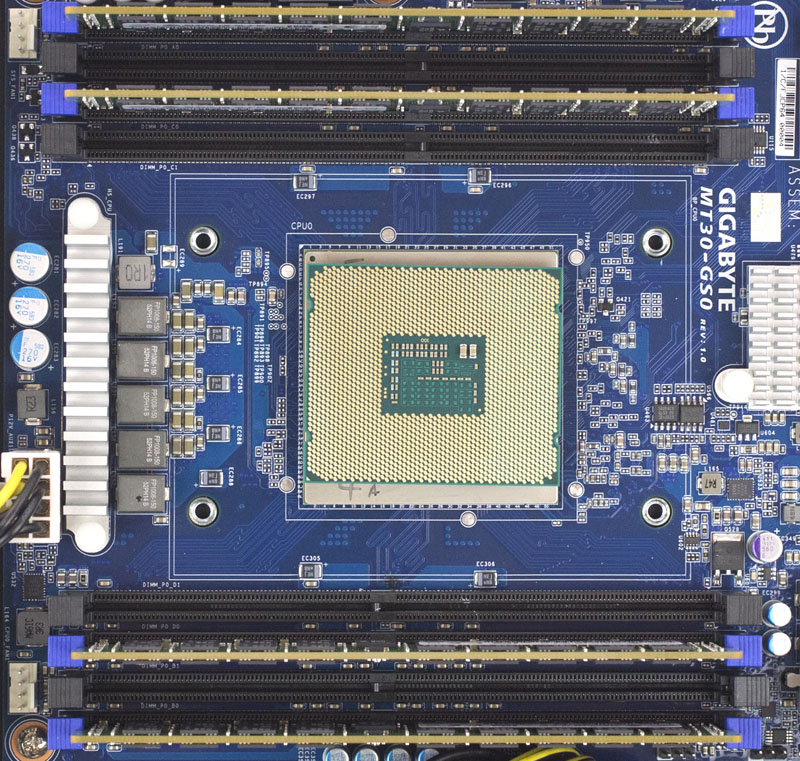

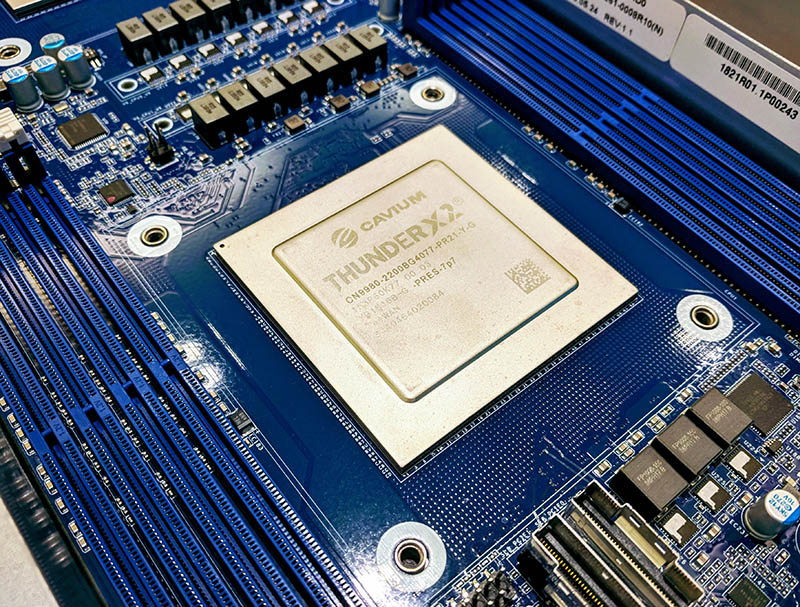

We covered Cavium ThunderX early in 2016 including Cavium ThunderX Benchmarks. We also covered Cavium ThunderX2 General Availability and had a launch Cavium ThunderX2 Review. Through the years, we covered ThunderX2 and developments on ThunderX3 including the acquisition by Marvell and even our recent Marvell ThunderX3 at Hot Chips 32 coverage.

Since 2016, the Cavium then Marvell ThunderX line absorbed the Broadcom Vulcan project which gave us ThunderX2 designed for HPC workloads. Realistically, if anyone wanted to get an Arm server product, Marvell was well ahead of anyone else. It is not just the custom Arm cores that Marvell had, but also all of the infrastructure turning cores into chips. Marvell added the IP for memory controllers, interconnects, PCIe to build a legitimate competitor to Intel and AMD (pre-Rome).

Beyond cores and performance, turning chips into a functional and usable system is not a simple task. Marvell has spent years getting to the point that they had the firmware ready to use. As someone who used ThunderX Arm servers pre-April 2016, then after Ubuntu 16.04 LTS came out with support, then ThunderX2 servers, there was an enormous generational leap in the actual usability of the systems. That is something that we see at STH, but many others who cover chips or do not do a lot of hands-on time miss. Chips are a step, but organizations use systems.

Something shifted earlier this week with Marvell Seeking 5nm Chip Share. There, the idea of helping customers on engagements to create chips with Marvell’s IP blocks and packaging using TSMC 5nm was pushed ahead of creating general-purpose CPUs. That was very telling.

Marvell ThunderX3 Gets Canceled for General Purpose Sockets

The big news of Marvell deciding to cancel ThunderX3 for general-purpose sockets makes a lot of sense. From our Arm Neoverse at TechCon 2019 Focus Getting Clearer last year: “For now, it seems as though Arm sees attacking the edge CPU and accelerator markets as a much easier market to break into versus the traditional data center CPU market.”

Of course, AWS Graviton2 has shown that there is an appetite for Arm CPUs at hyper-scalers. Marvell is not stating they are not making these general-purpose CPUs, what they are saying is that the processors they may make will be customized for these large hyper-scalers. For example, if Hyper-scaler Y wanted to have its own Arm CPU as a Graviton alternative, Marvell would take that as an engagement.

What this means, conversely, is that in the next three years, we are unlikely to see major enterprise players use Arm CPUs. For example, Dell is not going to wholesale replace Intel with Arm CPUs in PowerEdge nor HPE in ProLiant in 2020-2021. Lenovo has partnered with Ampere, but the fact that ThunderX3 was not seen as viable in the enterprise market explains why Ampere is focusing on hyper-scale as well.

From the Marvell Q2 2021 earnings call:

The market that we have always called out for this has always been the hyper-scale customers. And so what we are basically doing is just really acknowledging that and also acknowledging the fact that it turns out they seem to really want their own thing, their own special chip, and this notion of if you go back a few years to where you would have a broad-based Arm server platform that you would drive and you could sell to everybody and put it on like a tick-tock type of cadence and run it like a normal CPU business I think just so much has changed since we acquired Cavium and this market has developed, Arm in the data center and Arm in servers has actually continued to get traction in the market.

Whether that is with us or that is with customers doing their own developments themselves in-house with partners and so we expect that to continue. We are just going to do this in a much more focused and targeted manner and with a business model that looks more like our traditional customer semi-custom model versus funding the whole thing on our own in perpetuity we have said basically we think it is better for us and the better for the customers to do this in a more focused manner.” (Source: Matt Murphy, CEO Of Marvell comments on Q2 2021 earnings call – STH transcript omitting stop words. Please excuse typos.)

We asked Marvell and that effectively means they are still doing development where the customer is helping to fund the chip development. It also, and importantly, does not mean that it is just making custom Arm chips with accelerators. Instead, it can mean customization such as rationalizing the number of cores and memory channels on an existing design to better fit a customer’s needs.

It does, however, mean that we are not going to wait for the Gigabyte Marvell ThunderX3 R282 2U Server we covered almost two months ago.

Although Arm and vendors have discussed cost benefits, it seems as though putting together a general-purpose Arm alternative to Intel Xeon/ AMD EPYC is not viable at this point. Arm vendors are effectively competing on cost with much lower volumes. That is the simple answer. The more interesting answer is that Arm is clearly winning in the data center, just in the less obvious segments.

We asked said Chris Bergey, senior vice president and general manager, Infrastructure Line of Business at Arm about this view. His response was:

“Cloud providers are driving an unprecedented level of innovation in the data center in the face of insatiable workloads, lack of Moore’s Law scaling, and the need to conform to data center footprints and power density. This has been driving optimizations throughout the data center, now extending to the server processor. Arm and our extensive ecosystem of partners are providing a unique platform to enable these future solutions. Marvell’s leveraged direction and the momentum behind AWS are solid proof points of this shared vision, and we are looking forward to what’s still to come.”

As a quick note, this quote was added after going live with the article just due to timing receiving the quote.

Where Arm is Clearly Winning and Marvell Will Play

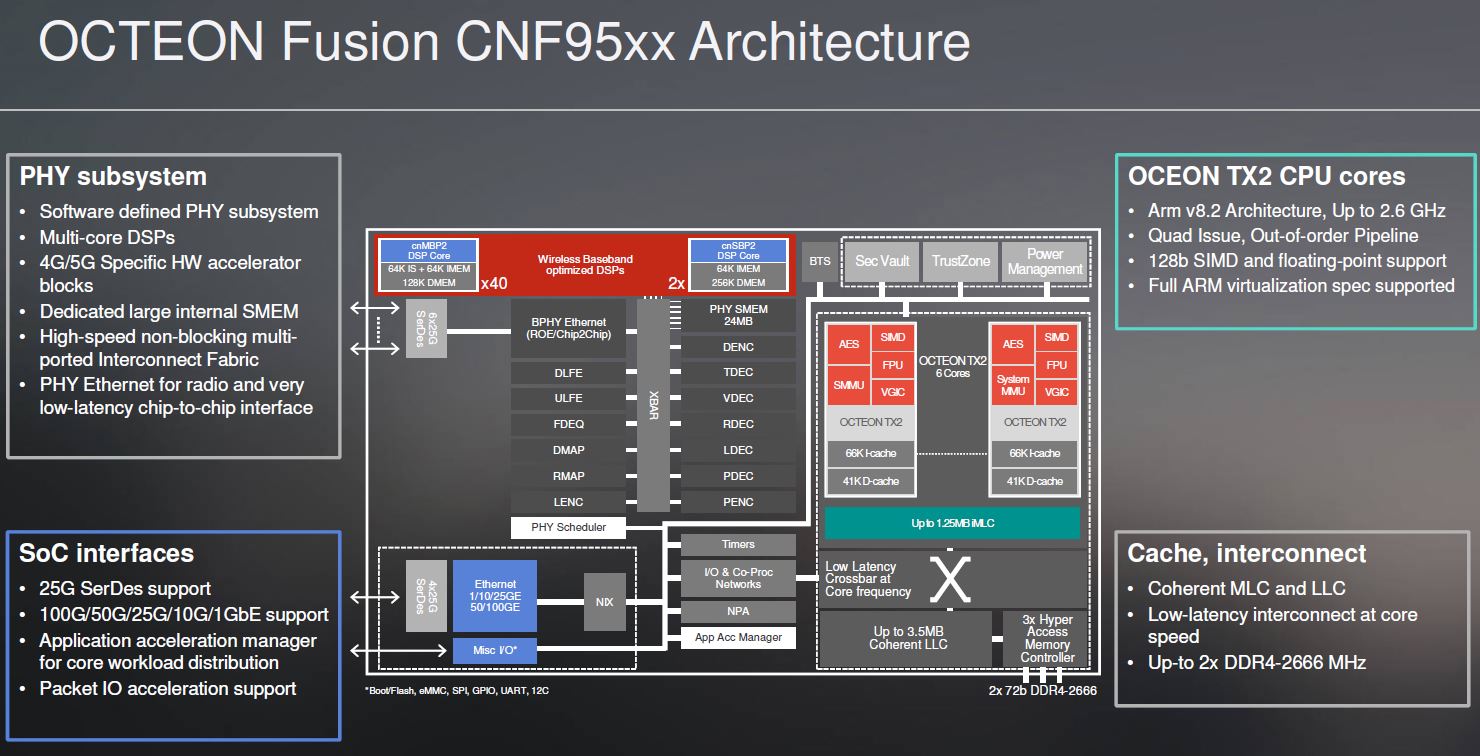

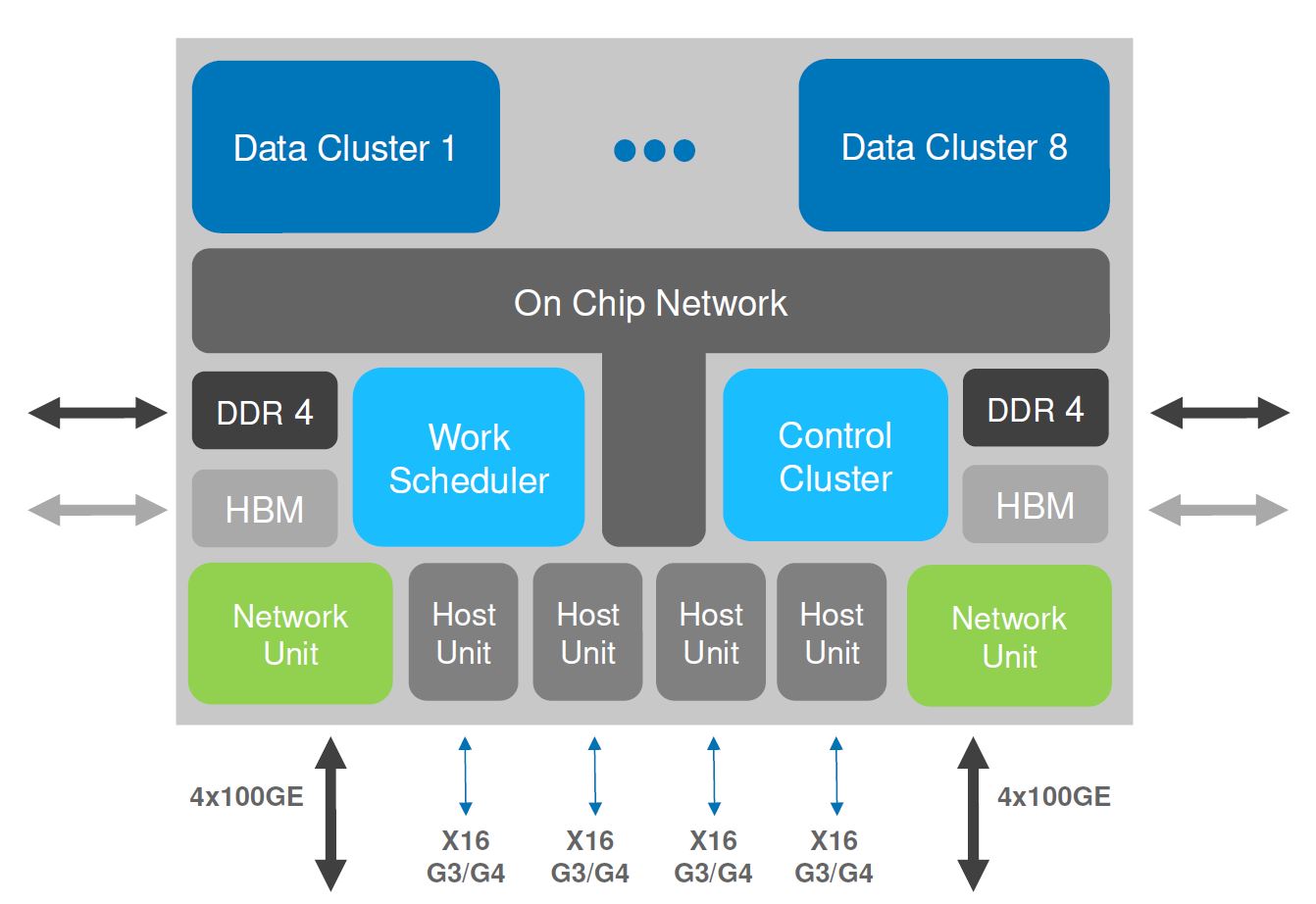

If we look to data centers and infrastructure markets of the future, x86 cores are not winning. Take the Fungible F1 DPU, NVIDIA-Mellanox Bluefield-2 IPU/ NVIDIA EGX A100, Pensando Distributed Services Architecture SmartNIC, and importantly the New Marvell OCTEON TX2 and Fusion CNF95xx 5G SoCs as examples. There is an entire class of co-processors that are not traditional CPUs, nor GPUs. Instead, these are often general-purpose Arm cores, running Linux OSes, that run inside x86 servers.

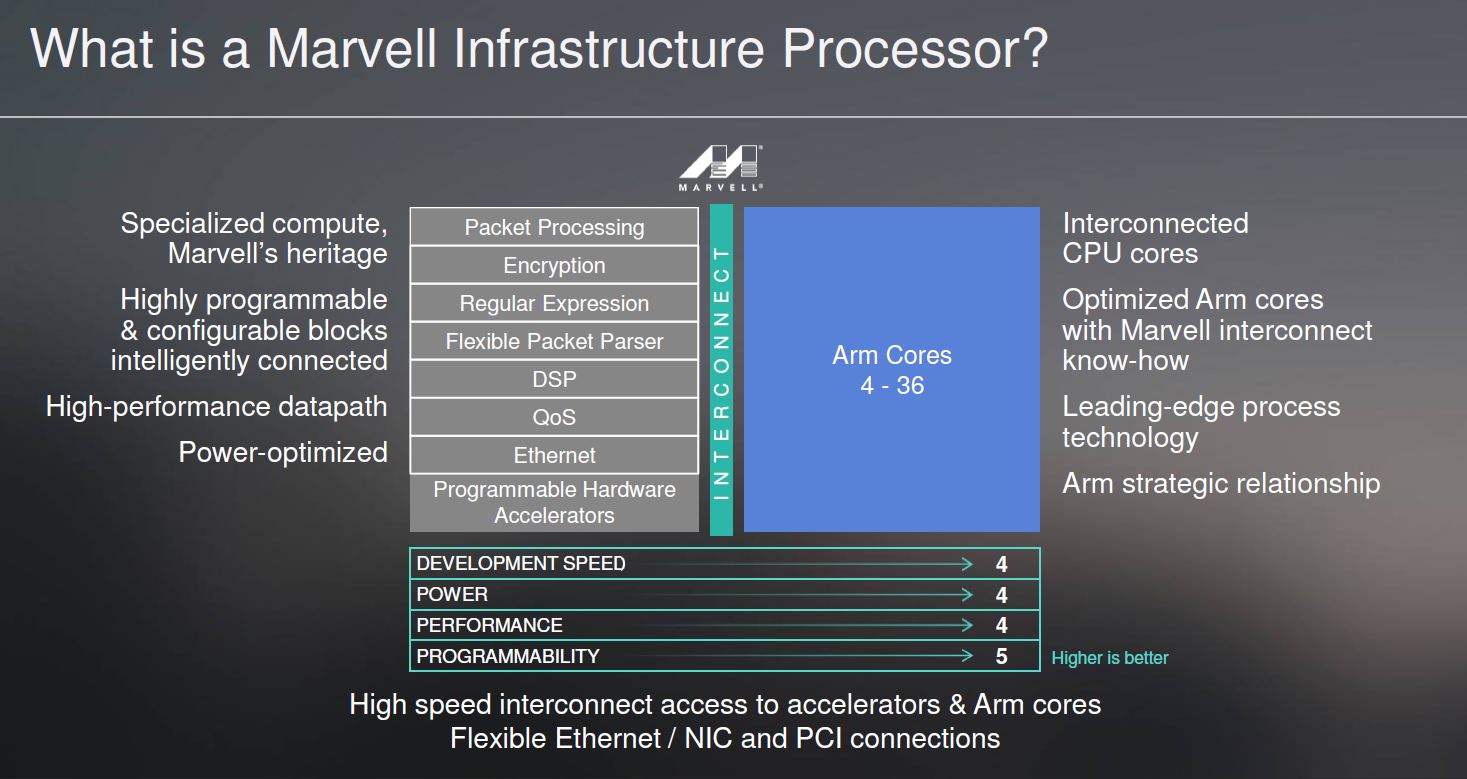

What Marvell is effectively showing is that their infrastructure processors have an array of Arm cores, potentially many of them, along with strong IP for features such as networking and acceleration.

Networking integration into general-purpose x86 CPUs has not been met with the best results. For example, in the AMD EPYC Embedded 3000 Series Launch the “Naples” generation of 10GbE was not overly well-received due to a lack of important features and customers often wanting to use their own NICs. Also, in the Intel Lewisburg PCH family, the LBG-R (Lewisburg Refresh) chips that were launched alongside the 3rd Generation Intel Xeon Scalable Cooper Lake processors, and the PCH that will be used with the upcoming Intel Ice Lake-SP chips omits the 10GbE network connectivity. Perhaps Marvell’s approach makes more sense. Integrated the networking features that customers want.

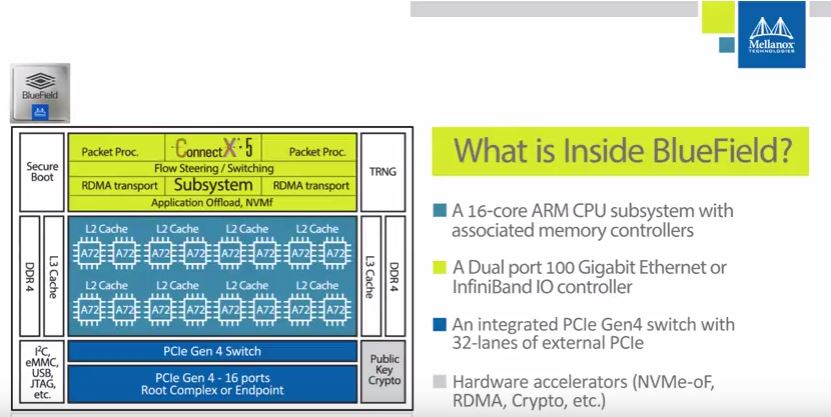

As we think about data centers and infrastructure of the future, it seems like there is a common concept around bypassing x86 processors for critical infrastructure. As an example, Mellanox (now NVIDIA) BlueField has Arm cores along with ConnextX-5 networking (100GbE/ InfiniBand) as well as a PCIe Gen4 switch.

One has to admit, that this model in many ways is similar to the Marvell Octeon above. There are very clear differences, but we have Arm cores, accelerators, networking, a memory controller, and so forth.

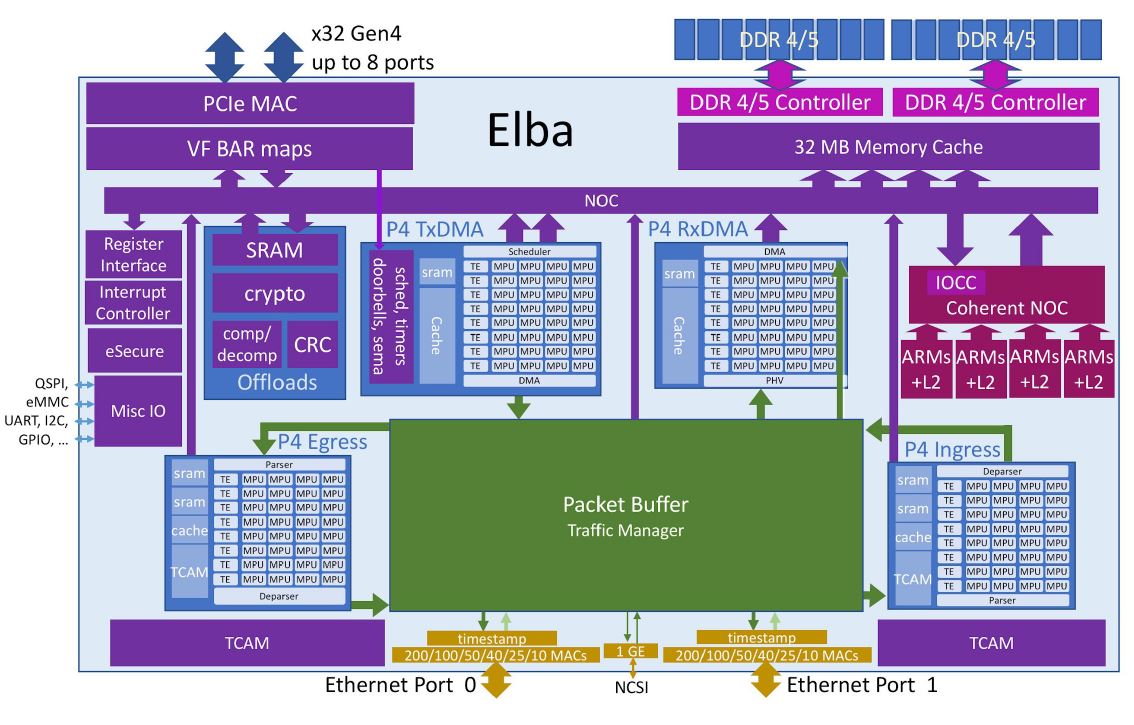

For its part, Pensando is showing networking, Arm cores, memory interfaces, PCIe, and accelerators all running Linux for its new chip.

If we look at the Fungible DPU, we see something very similar as well, albeit scaled up to include HBM and using MIPS today (however this could be Arm in the future.)

Servicing NVMeoF endpoints is a great example of why these types of chips are useful. Using a chip with multiple Arm cores, placement and erasure coding algorithms can be done on the IPU/ DPU instead of the x86 CPU. The processor is accessible to serve data to the network. On the other end, it can have PCIe devices whether they are GPUs, deep learning accelerators, or NVMe storage devices and offload an entire application without requiring a host x86 system.

This is exactly the architecture we discussed in NVIDIA to Acquire Mellanox a Potential Prelude to Servers. In the future, x86 compute will be one type of server, but there are various different functions. Arm compute will be another type of server. Beyond those, there is an enormous opportunity to produce these DPU/ IPU processors. That is the market that Marvell is targeting.

Final Words

Intel does very little marketing in this segment for Xeon D and Atom lines. Indeed, we made “Denverton Day” when Intel launched their new line of processors in this segment and did not hold press briefings. That trend continued as we saw earlier this year when the Intel Atom C3000 Line was Quietly Refreshed. At some point, Intel will need to do this type of modular IP design, as we dubbed its new SoC Containerization Methodology. Otherwise, the opportunity in this segment is wide open for Marvell and other Arm-based solutions to turn x86 into a type of server, rather than the hub of almost all servers.

With the Marvell ThunderX pivot, it has become clear that the Arm competition is lined up to eat away at this new breed of servers and with custom solutions rather than go head-to-head with Intel and AMD. For its part, AMD has been making more inroads into traditional sockets than Arm vendors even with a mature AMD EPYC 7002 series that is well ahead of current Xeon offerings while being x86 compatible. Even given the advantage, AMD enjoys, the road is slow and it shows the difficulty multiple Arm players have had in this market.

Even a casual observer must note at this point that there are more players in this high-end SmartNIC/ IPU/ DPU space that Marvell is focusing on than there were traditional general-purpose Arm server CPU companies. That at least provides some guidance on where the market is heading.

Editor’s note: We have a few requests for comments out. We will add those if/ when they come in.

Since Amazon is now on the second generation Graviton, the ARM server market and software seems ready.

Could it be TSMC doesn’t have the capacity to make all of the world’s processors? Maybe Marvel is focusing only on the highest-profit market niches due to limited production capabilities.

So apple is launching arm instead of x86 and marvel is canceling their general cpu – just in time when shift from x86 can really happen.

I think “canceled” is dramatic, but it’s right. Even if they sold the Thunder X 3 tomorrow, nobody’s gonna want them. With the earnings announcement they’ve said customers are out to dry. I think we’ll still see T X 3 being sold, but you can’t seriously deploy them at any small scale if the company making the chips is saying they only want to deal with hyperscalers and 3rd pty cos.

As I read this technically a big customer could get ThunderX3 with different core and DIMM counts and that’s still ThunderX3 but it’s now “custom”

I get your point though. I’m not plunking down $50k to bring a few TX3 systems into our environment now which was our plan for our k8s env. I’d be dumb to buy into a system that isn’t the focus for Marvell.

Who’s gonna buy a TX3 now other than a big cloud guy like Microsoft?

I’m not buying a Gigabyte server when I know TX3 and that whole model isn’t Marvell’s focus.

This is old news. MRVL talked about this on their earnings call 2 days ago now.

Okay I looked at the date this was published yesterday but it’s still over a day behind the announcement

@Yanni I, an entire day to write up and proofread (well, ok, we know STH didn’t do that) an article. You must buy a lot of ThunderX* systems that a delay of one day to know of its demise is such a concern.

They’d backed themselves into a corner. I don’t agree with Yanni’s too late on the article comment. I’d agree that their enterprise sales will be 0 if they’ve already announced their transition away from that business model. HPE Cray not going bigtime on ThunderX3 was telling if they’re not supporting even at that scale.

I feel bad for STH in this a little. I know it’s been a pet project doing Arm server coverage for years.

There is still Huawei Taishan to test