During a late October trip to Taipei meeting with several vendors, one topic consistently came up: tariffs. Discussions on the impact of 10% and potentially 25% tariffs on computer assemblies made in China and imported to the US are everywhere. A unique perspective arose regarding how tariffs impact the Intel Xeon D, Intel Atom, and AMD EPYC 3000 series platforms. Tariffs hurt these platforms to a much greater extent than socketed counterparts. Arm is equally if not more impacted since many of those designs are now BGA instead of socketed. Since that trip, the 25% looks like it will be avoided, but let us take a second to understand the concern.

Why the US Tariffs Impact Embedded Systems

The value used to determine the tariff rate is based upon the value of the imported good made in China. If you are talking about a simple good, such as a power supply itself, it is relatively easy to see the impact of the tariff. When looking at assemblies comprising a larger number of components, the calculus can change.

The HTS Subheading 8471 deals broadly with automatic data processing machines which include computers.

One of the key items listed that we heard cited frequently was under HTS Subheading 8473.30.11, Printed circuit assemblies, not incorporating a cathode ray tube, of the machines of 8471

Although vendors were trying to find ways to interpret the tariffs as not including their parts, it was virtually impossible to do so reading the tariff list, especially in the 8470 to 8473 range.

Some companies have moved assembly of components to places such as Taiwan, Mexico, and elsewhere. Changing production from China to another nation is enough to get around the tariffs, but places like Taiwan do not have enough manufacturing capacity to move all production from the mainland. For assembly, goods can be imported, tariff paid on the China-made parts such as the motherboard and chassis. High-value components such as RAM, drives, and CPUs can then be installed post-importation. Decoupling the components means that tariffs are only paid on portions of the server or embedded device.

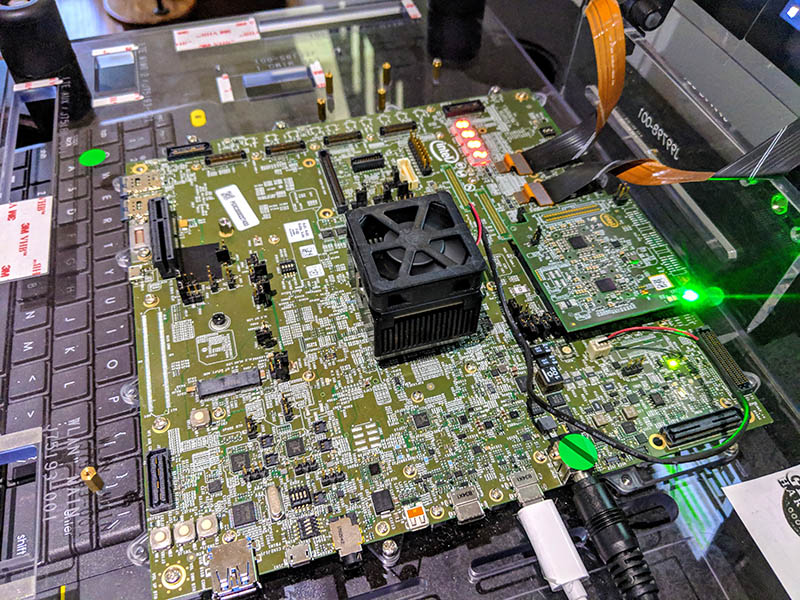

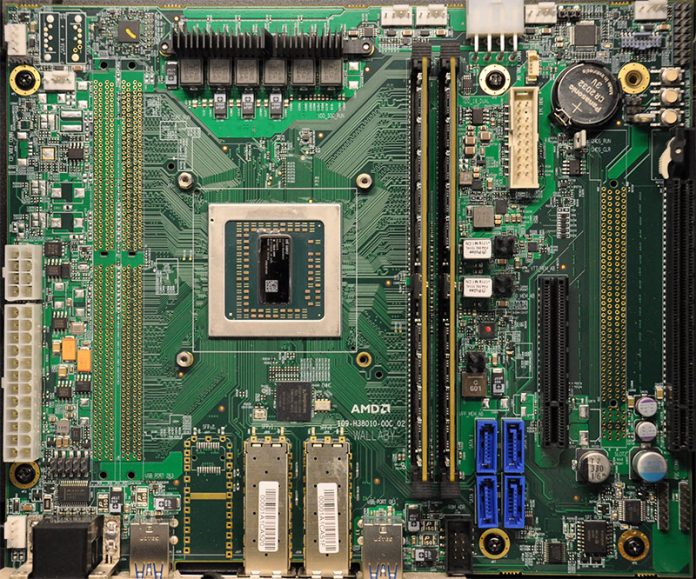

For embedded parts, this presents a problem. The Intel Xeon D-2183IT we reviewed is a ~$1750 part. Adding a 10% tariff is $175 to the direct price and a proposed 25% tariff would add almost $440 to the cost of a motherboard assembled in China with an Intel Xeon D-2183IT affixed. In many cases, that will change the calculus of whether to use an embedded part versus a socketed part that can be assembled in the US.

That 10% tariff has a bigger impact down the supply chain. If a vendor imports the good, it may look for say 15% gross margin. A distributor/ reseller may want 5% gross margin. The final system seller may want 20% gross margin as well. Importing a $100 good to a US office, then selling it through distribution can yield a $100*1.15*1.05*1.2 = ~$145 final price if the supply chain looks for its normal margins. Gross margins. and downstream financial metrics are commonly used as covenants in debt obligations. Therefore, some in the supply chain cannot even absorb the price increases and have no choice but to raise prices.

Final Words

Tariffs are a big deal. Large OEMs/ ODMs can shift production to mitigate a portion of the impact. At the same time, many smaller players who make embedded systems will not be able to shift production easily. Costs for tariffs are being directly passed onto customers. A common practice is to tell customers that a quote is subject to the 10% tariff and blanket raise prices. We have seen this in the channel.

We’re seeing this in our business. One part you’re missing is that often embedded systems have lower selling prices and the markets are more price sensitive.

In other words, the tarrifs are doing what Trump expected them to do.

I know it comes with short term pain, but we were way past time putting some pressure on China to change its terms.

While pressure should be applied at the international level to change China’s economic and human rights policies, there’s little evidence that recent American trade moves are part of a long-term coherent plan.

Costs for tariffs are being directly passed onto customers… marcelo B… your iq is 0

frump just make another trillions hole to debt .. and will lose in nuclear war with RU and co.

Tariffs should be the last ditch solution. As jk said, they are being passed directly to the end consumers, and often at a premium higher than the original tariff itself.

With the economy being more and more globalized and manufacturing and assembly becoming ever more distributed and involve numerous site worldwide, the tariff impact becomes a shotgun that starts to hurt everyone and in a lot more ways than can sometimes be predicted initially.

I am all against a lot of China’s practice of stealing innovations and other tactics, but there are definitely better way punish China that is more limiting in collateral damage than tariffs.

As for reversing the import deficit, it’s pretty much an uphill battle. You really can’t put the genie back in the bottle anymore…. Tariffs won’t be the answer either….

awesome article as usual patrick! thanks for finally showing how the china tarrifs we keep hearing about actually impact the items and prices relevant to us! 1st time ive seen a clean / clear explanation and analysis. tks

Can someone show me some AMD EPYC 3000 systems actually for sale anywhere? I get there are probably some embedded appliances out there, but even searching today I can’t find a platform that could be bought for a NAS for example

To all the anti-Trumpers decrying tariffs: they’re hurting China much more than they are hurting the US, and that is the point. I am so sick and tired of people trotting out their naive econ 101 arguments against tariffs. News flash: those arguments only apply to a system in equilibrium. China-US trade is far from equilibrium and vastly in China’s favor. We (the US) have put up with this for decades in the interest of seeing China modernize its economy. But now it is time to level the playing field. In that regard Trump is doing an excellent job.

To clarify: the intention is not to impose permanent tariffs, but to reciprocate with short-term punishment that will result in lower tariffs and liberalized trade longer-term. In that sense the situation is dynamic, and is why it falls outside naive econ 101 arguments (something even Paul Krugman fails to appreciate).

The computer assemblies always show up first in

US even produced in China. And one in

China want to buy these,also need imported from US. So As a Chinese,whom I

Will blame?

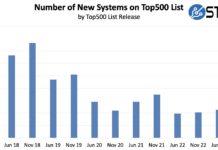

When your almost 6 month old article ages really well. #STHowningIT