As we have seen from most major IT players, the industry is transitioning to offering an as-a-Service or consumption model. Most IT organizations understand CapEx v. OpEx pressures since that has been a major topic for years. Pure Storage has updated its Pure-as-a-Service solution to drive home a model of a consumption model for service instead of a thinly veiled lease arrangement. On one of the more exciting fronts, Pure Storage is also publishing MSRP for the consumption model which is different from what we see with other vendors.

Pure-as-a-Service Overview

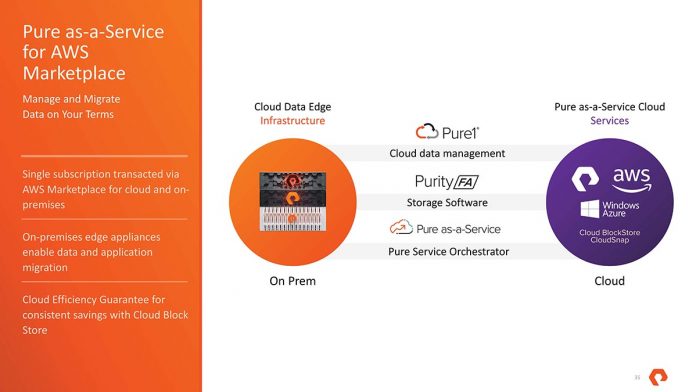

First off, Pure Storage was traditionally an on-prem storage array provider. With Pure-as-a-Service, the company is looking to deliver storage on-prem, in the cloud, or via a hybrid model.

Through its monitoring tools and delivery method, it aims to excel in the customer experience. The flip side is that the old (Dell) EMC storage administrator probably needs a different skillset to remain relevant with Pure-as-a-Service.

Dell EMC, HPE, and others aiming to deliver an experience closer to what AWS offers, but Pure is likely there, albeit focusing on storage.

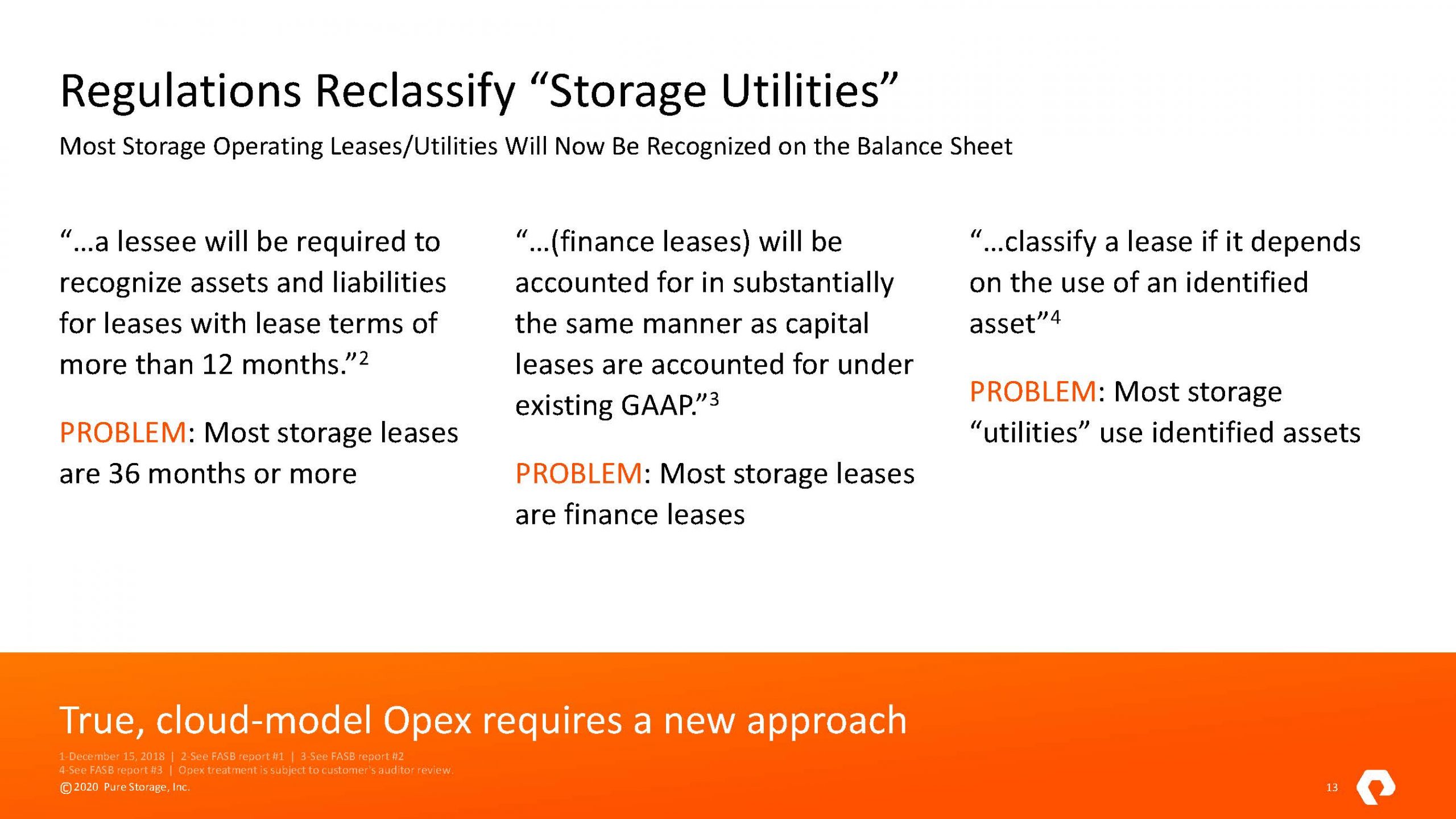

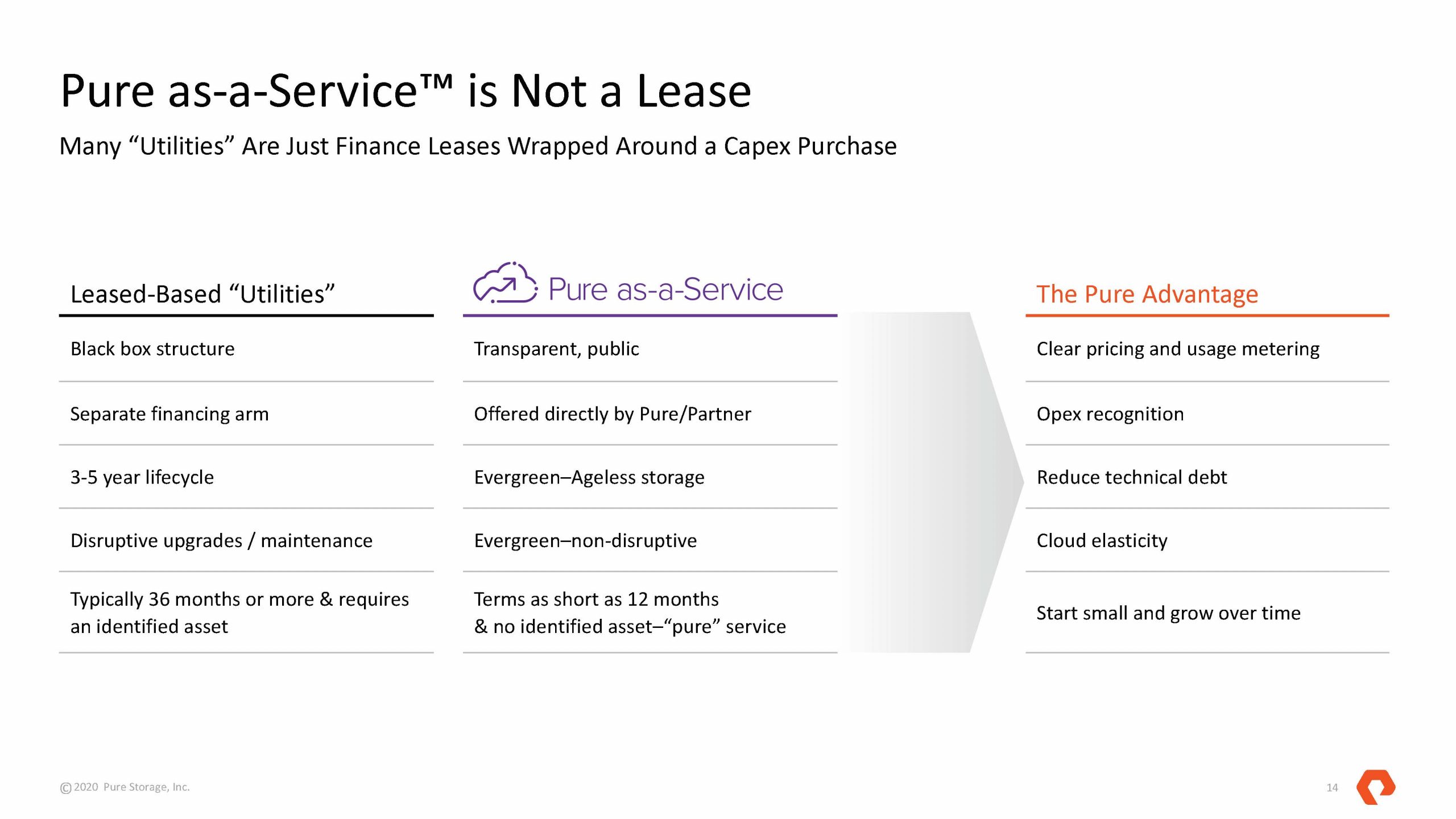

Something that Pure is highlighting is that there are accounting changes that can change how leases are treated. At the end of the day, the big vendors understand this and are all adapting.

Pure is pushing the angle that its service is not the same as traditional leasing models or new models that effectively are leases/ financing packages described as “PaaS” offerings.

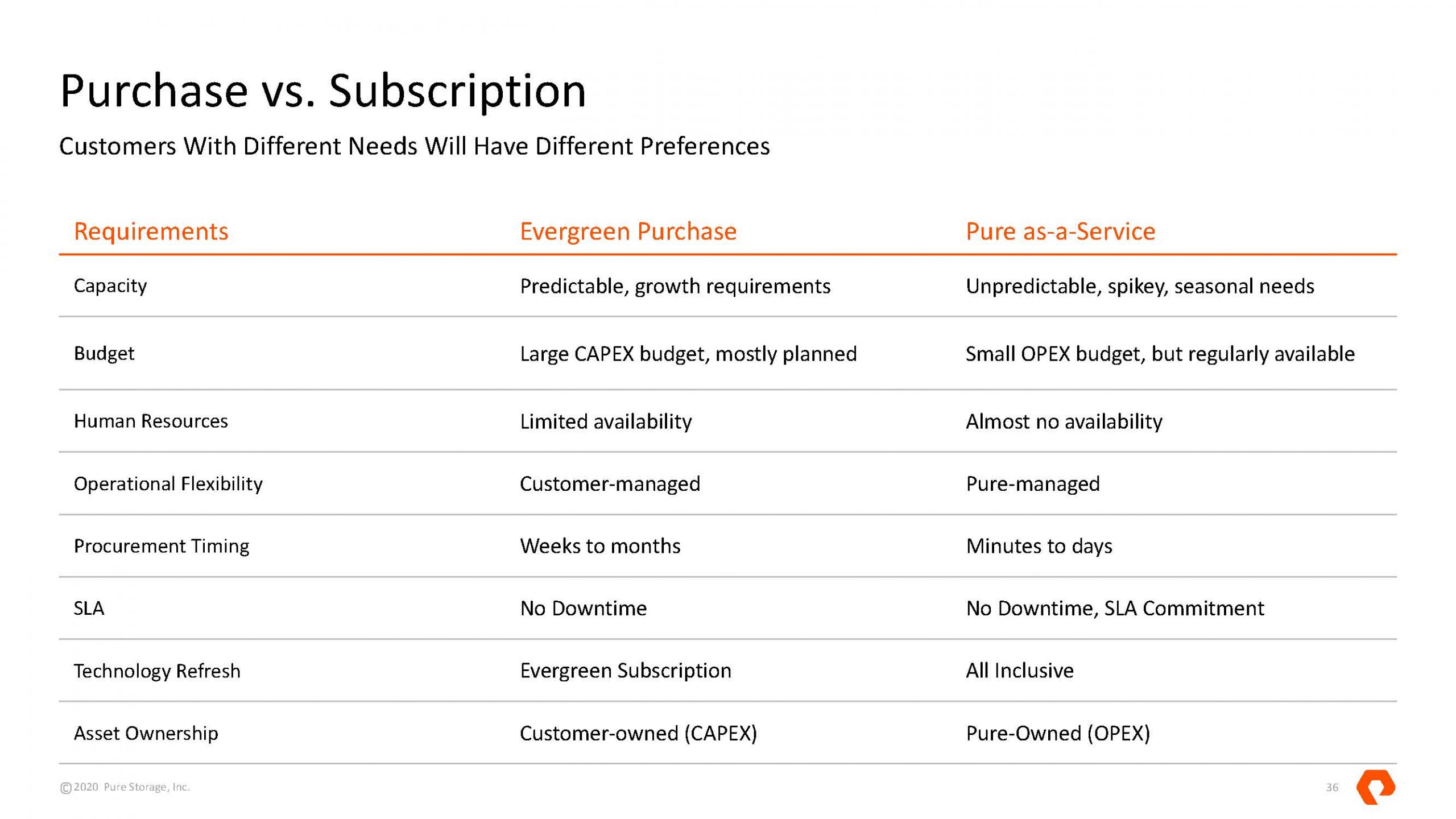

The company is still happy to sell in a traditional model, so Pure-as-a-Service is seen as an extension to grow the customer base or meet emerging customer needs.

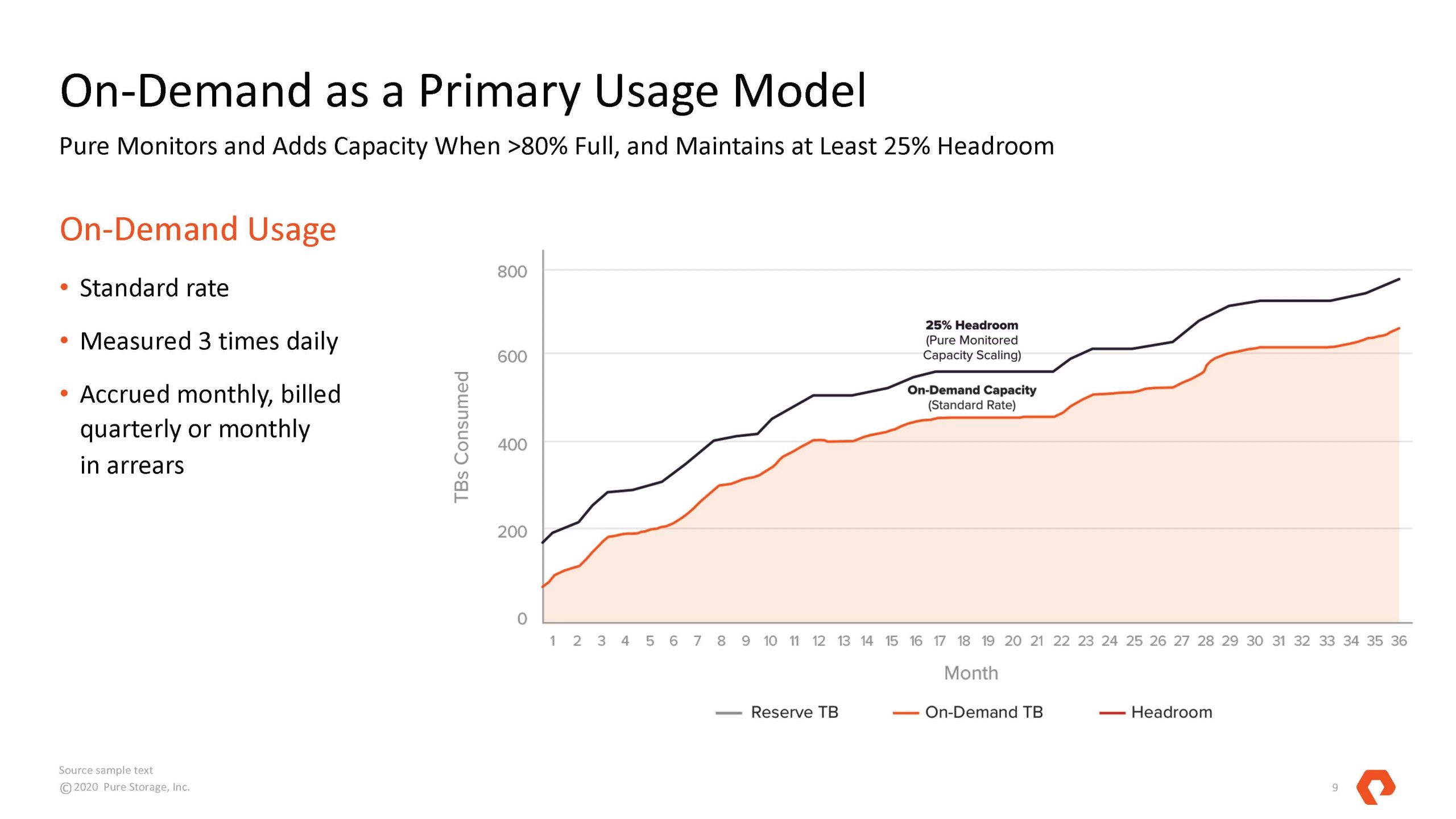

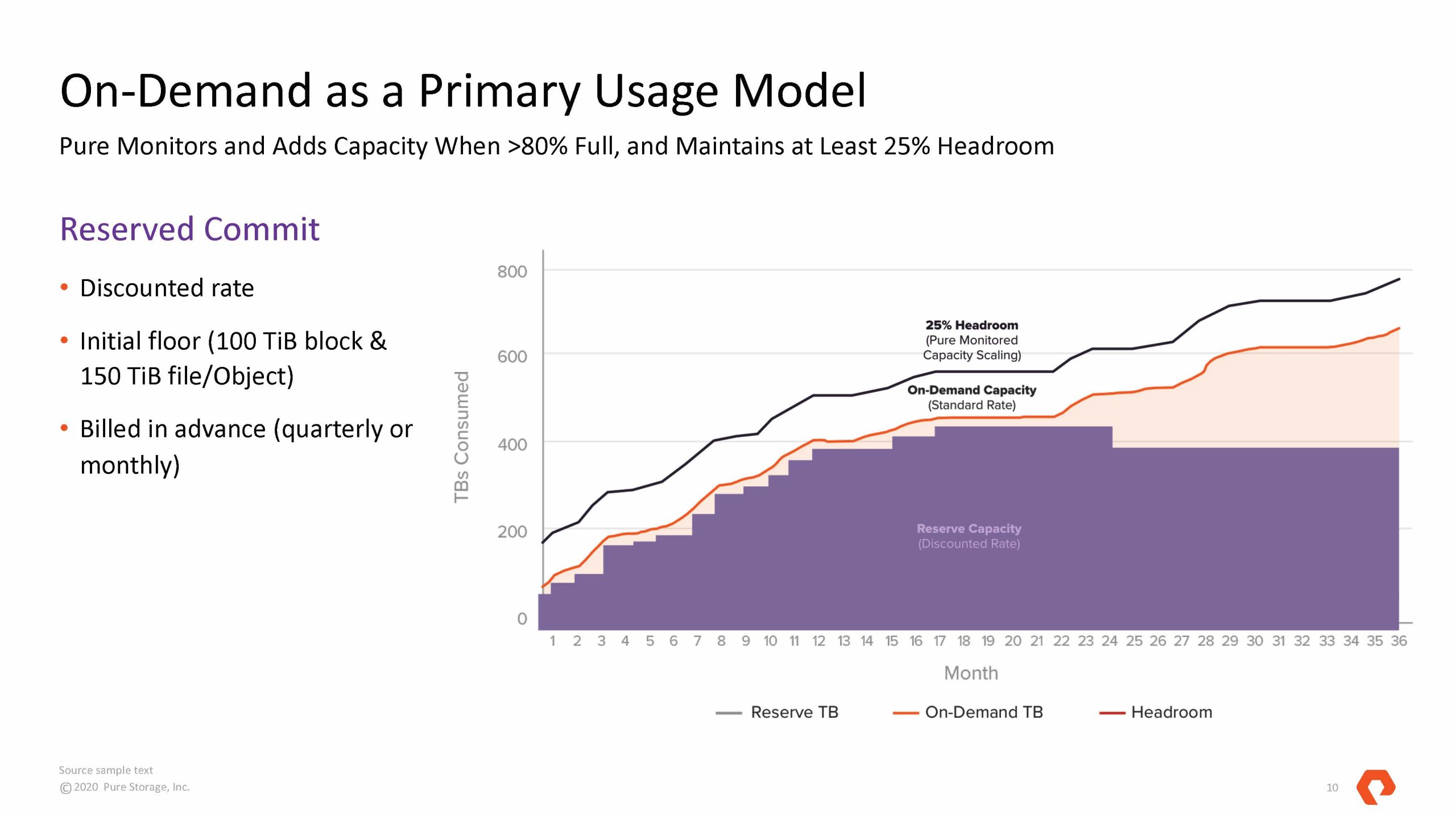

Perhaps the difference is that the model is designed to offer on-demand pricing. Pure will manage a 25% reserve capacity as they manage the hardware.

Pure also has a reserve commit option for lower costs. This is very similar to how a public cloud capacity planning occurs.

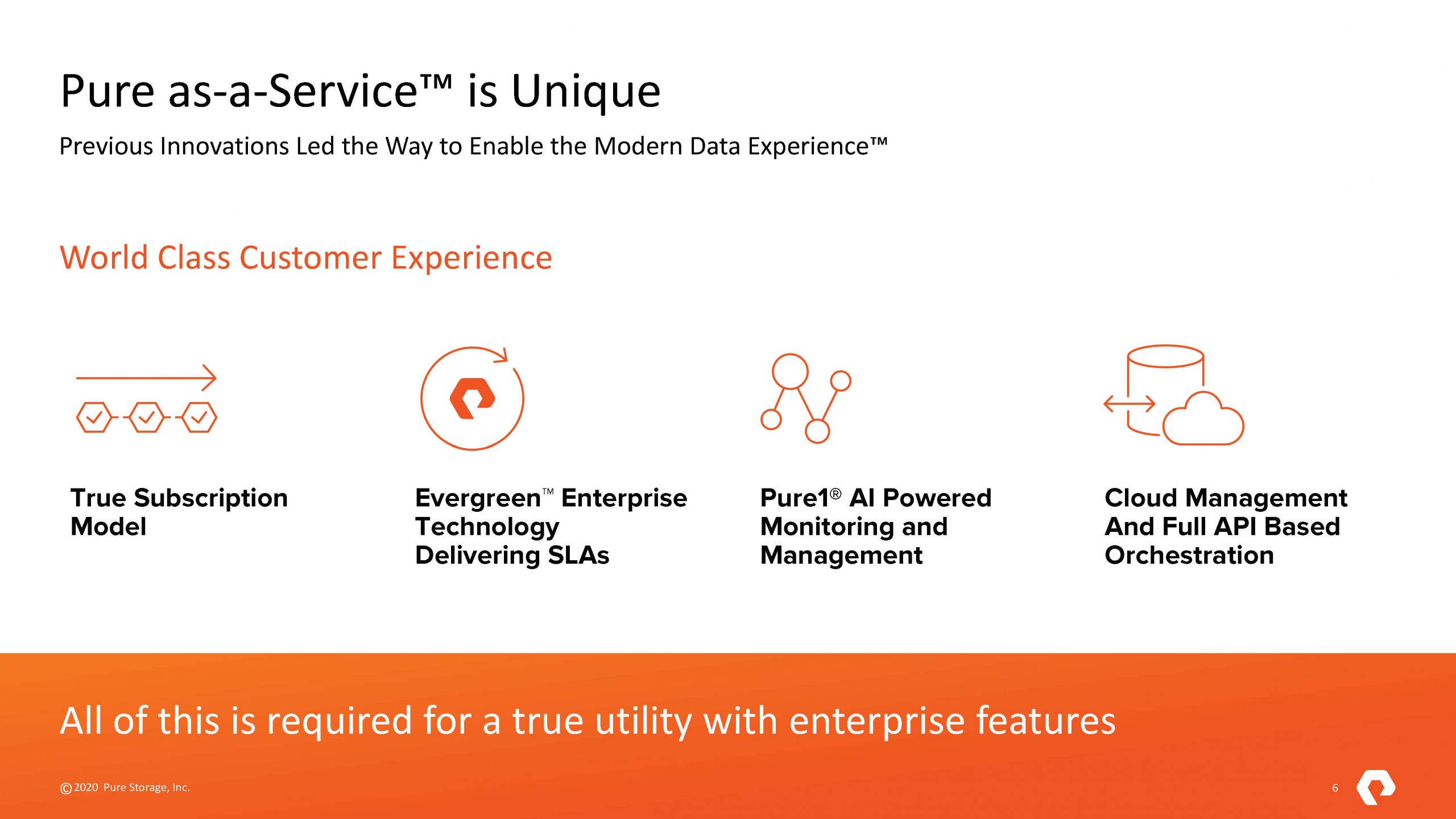

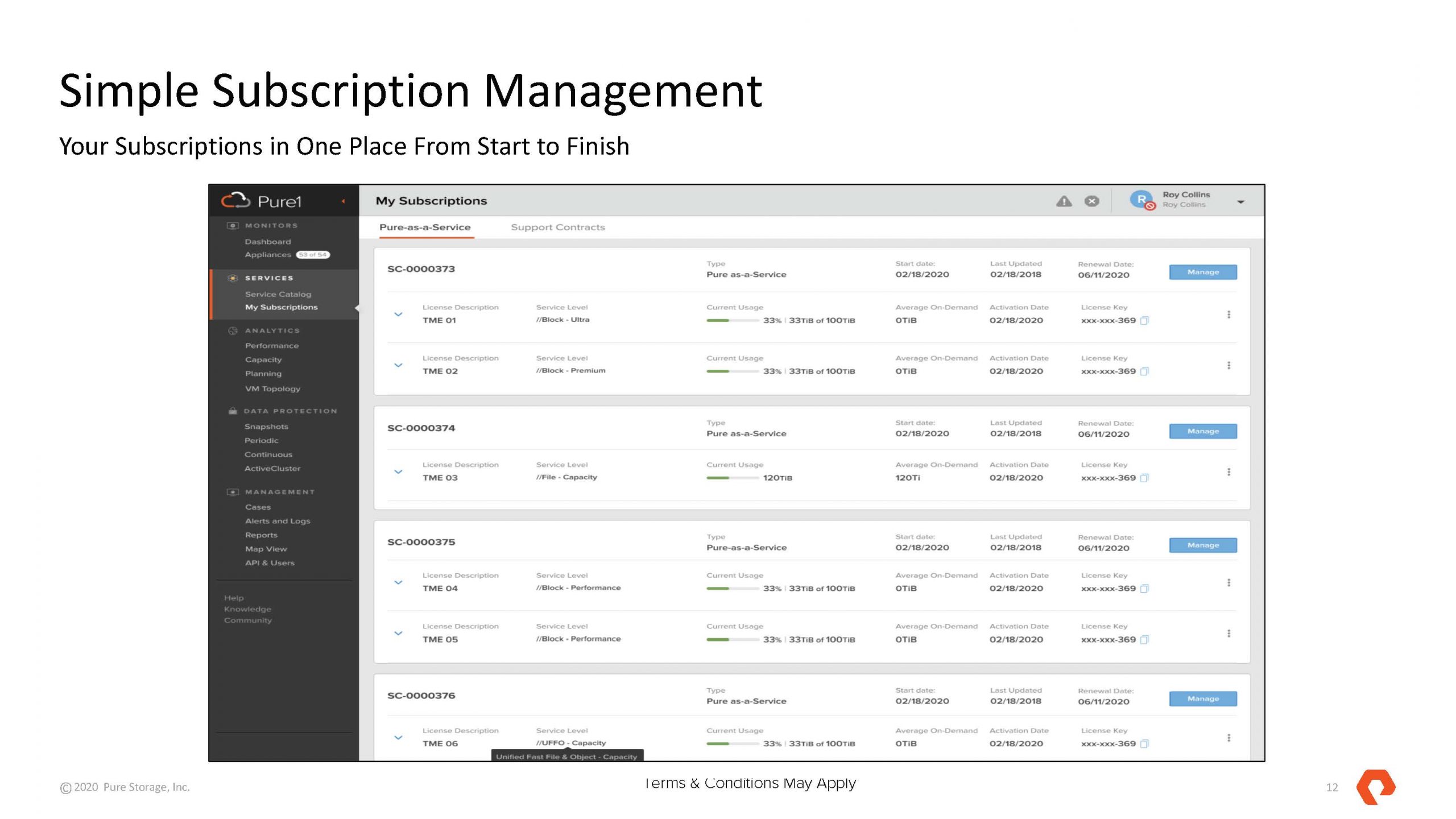

The big changes for this update are a new service catalog and lower entry points.

The full-stack as a service offering is more focused on a Cisco-based compute and networking solution. We are going to instead get into some of the new offering details since publishing MSRP (pre-customary discounts) is an awesome step towards more transparent pricing as we get in the cloud.

Pure-as-a-Service Catalog and Pricing

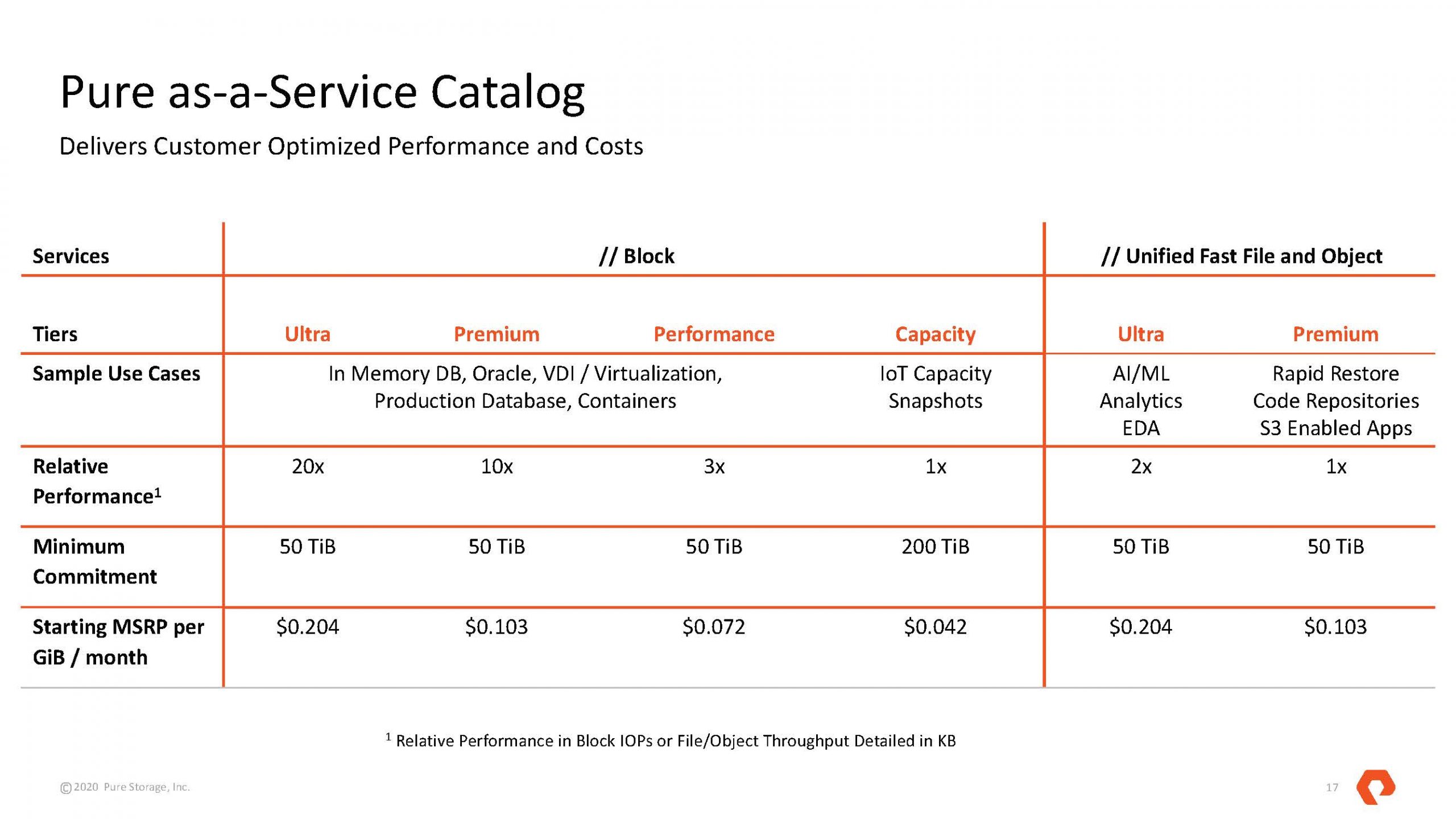

Pure is publishing a formal catalog with pricing and minimum capacity commitments for its service:

This is a simple menu to choose from, similar to how cloud providers are pricing. The important aspect here is that, like a cloud provider, Pure is managing the hardware and capacity to differentiate the offerings versus traditional lease models. Let us go through the above offerings.

Pure-as-a-Service Block Offerings

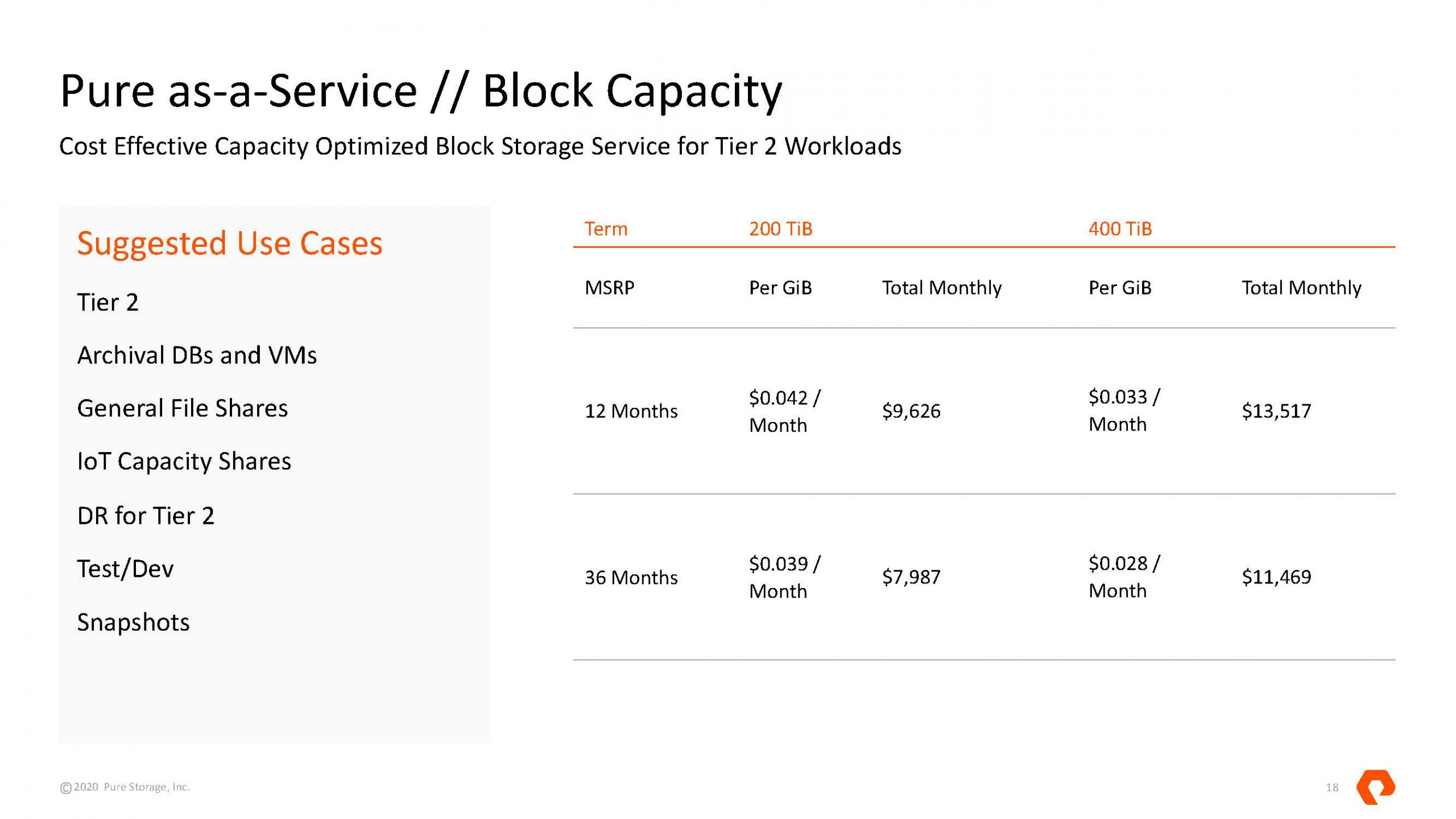

Starting with the block storage, we have the lower-priced capacity tier which Pure calls its Block Capacity offering. Here is the table with capacity, term, and monthly price with two different capacity points. For this offering, the 200TB is the minimum commitment.

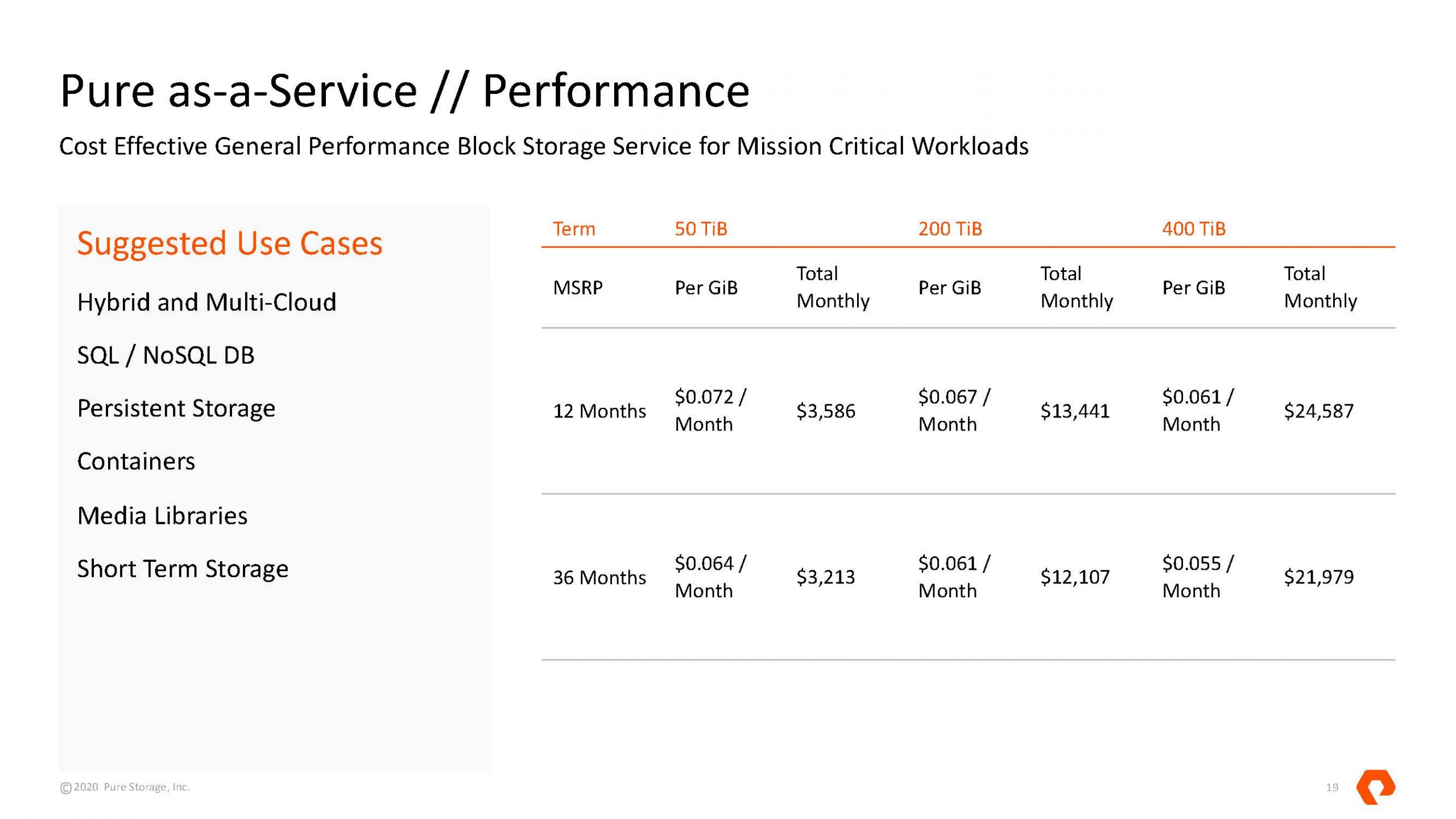

Next, we have the higher performance option. Here is the interesting aspect, one can start at only 50TB/ month committed for 12 months which implies a sub $43K (in 1 year) price point to get into using Pure’s products. This is still not the lowest price on the market, remember this is pre-discounting, but it is a lot lower than many of our readers would likely expect from a high-performance array vendor.

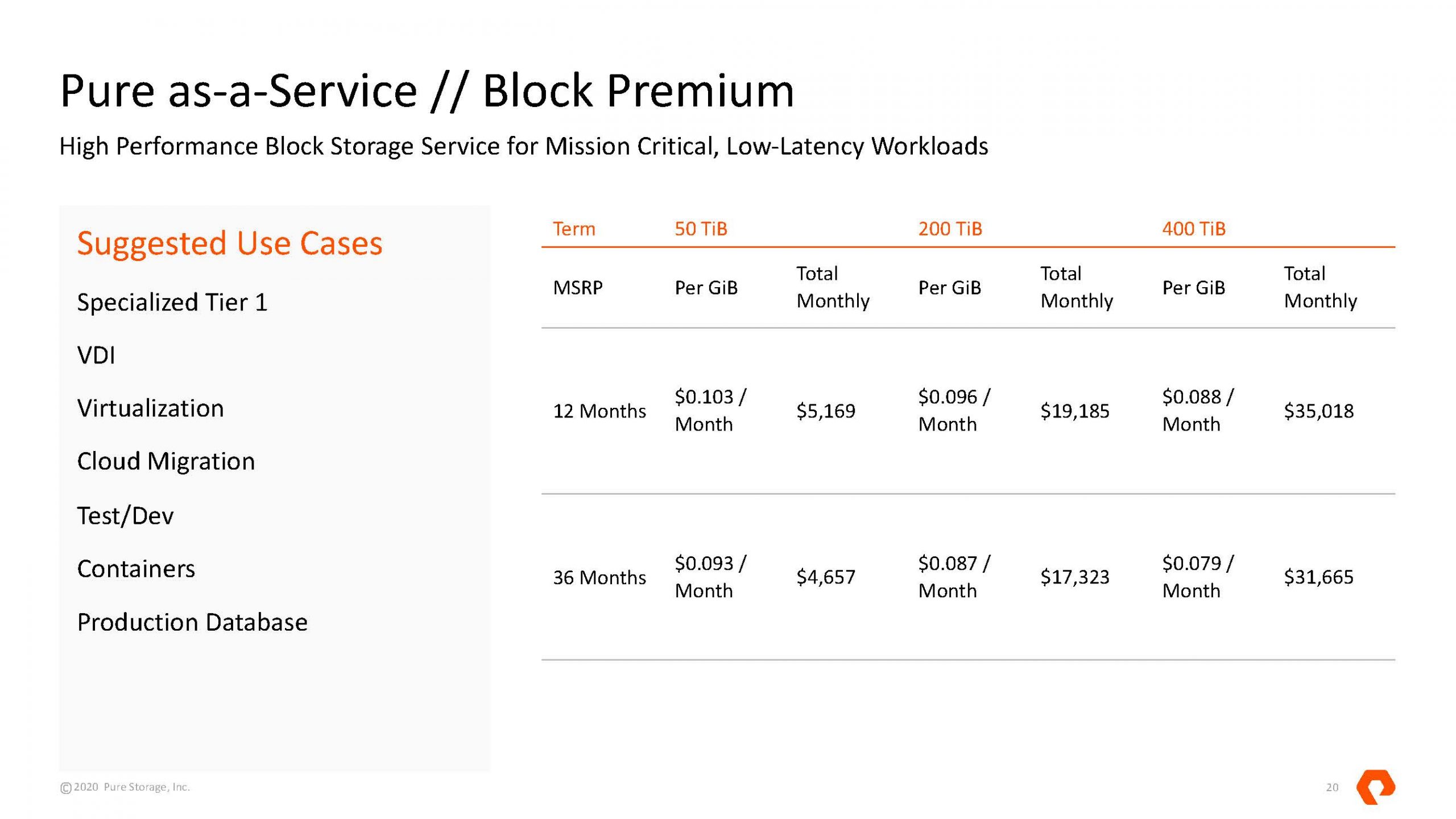

Moving up to premium we get the same 50TB/ 12-month floor. Although Pure is differentiating itself from a common 36-month lease, it is still offering discounts for a 36-month term.

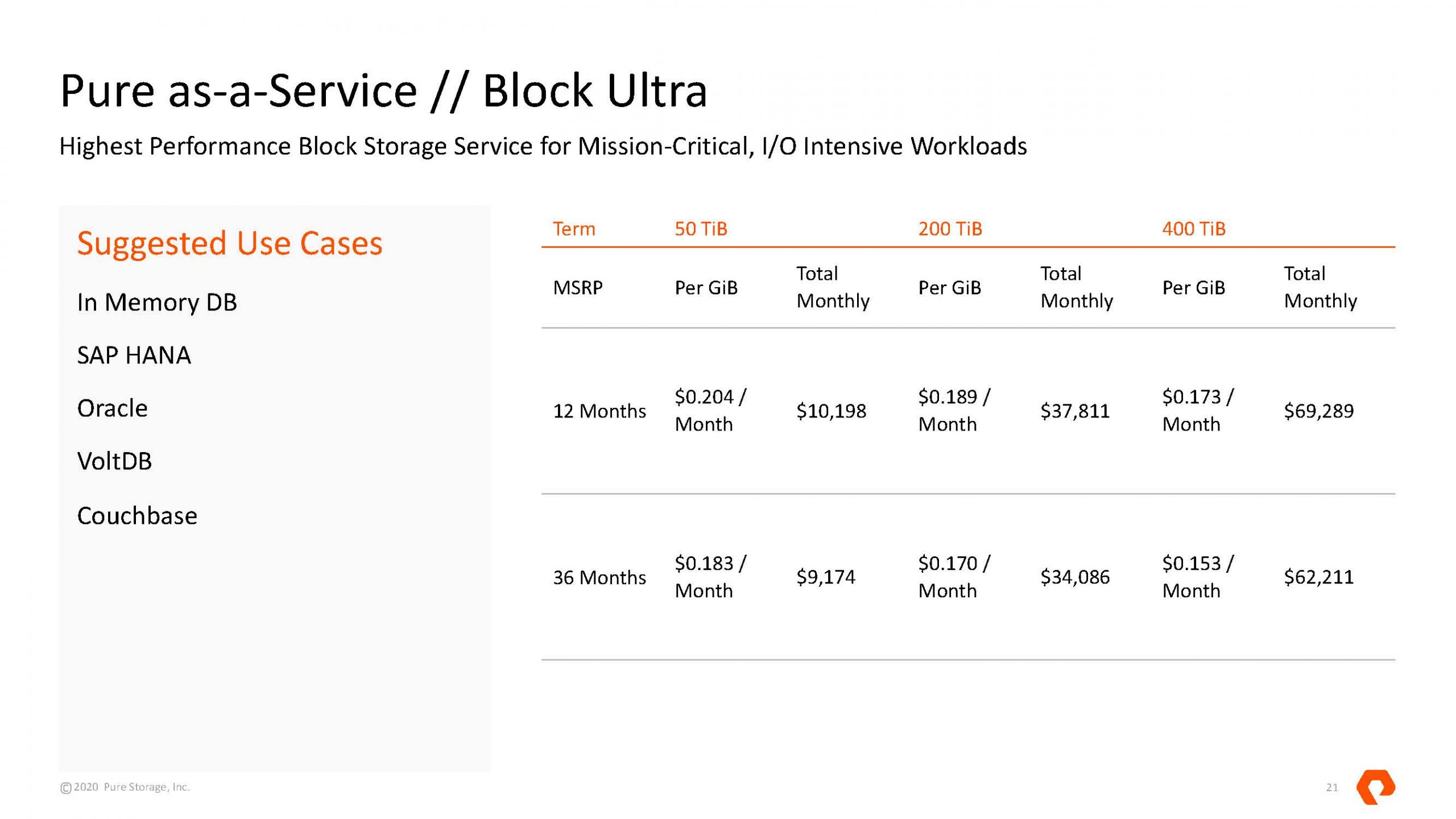

Moving up to Block Ultra, we have the higher-performance block storage which is perhaps what Pure is best known for.

It would be nice if there was something like an IOPS/ TB or something rating for each. Cloud vendors like AWS can have IOPS provisioned and while suggested use cases are great, for a four-tier system it seems like this is a critical component missing.

Pure-as-a-Service Ultra-Fast File and Object Offerings

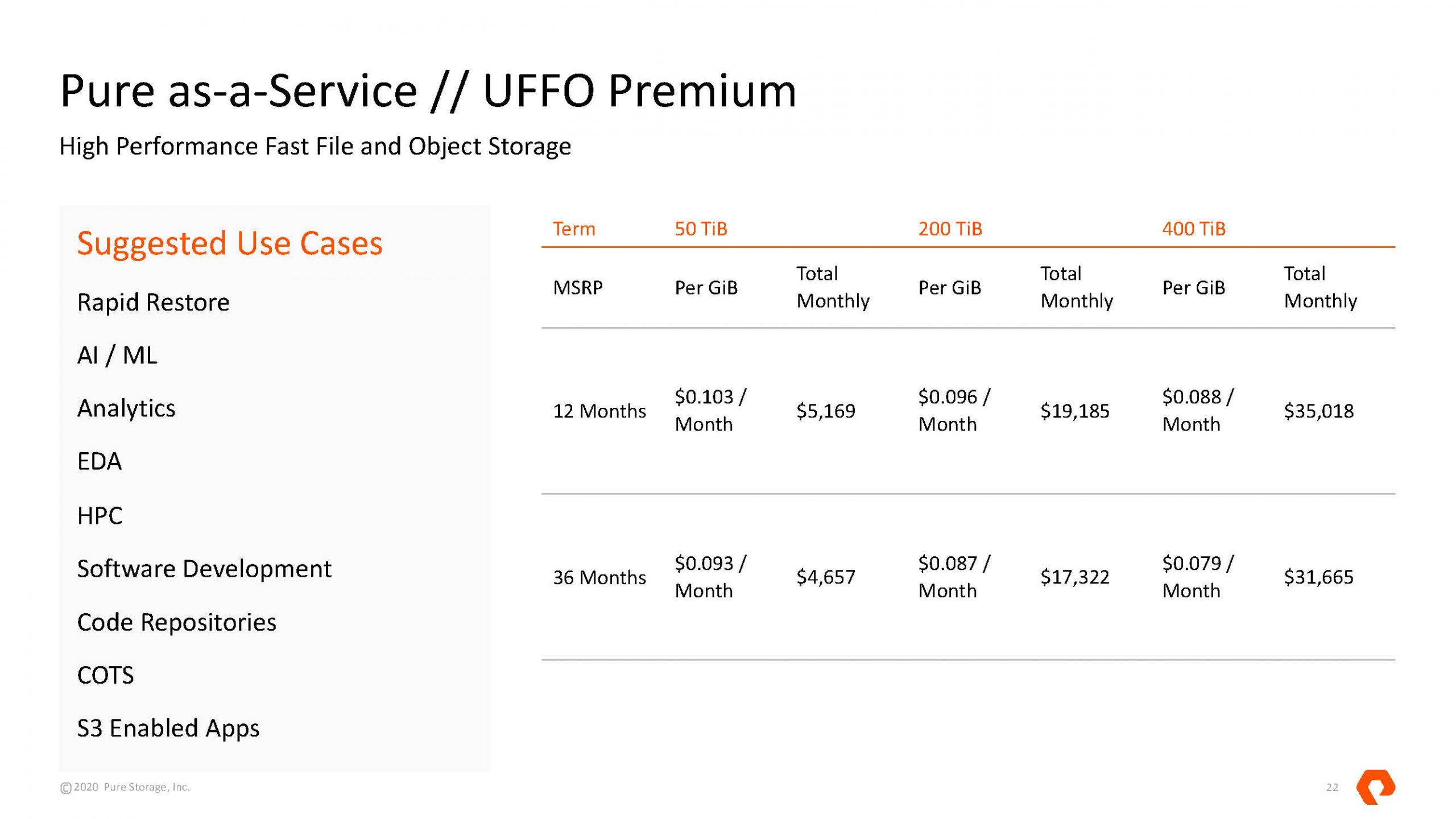

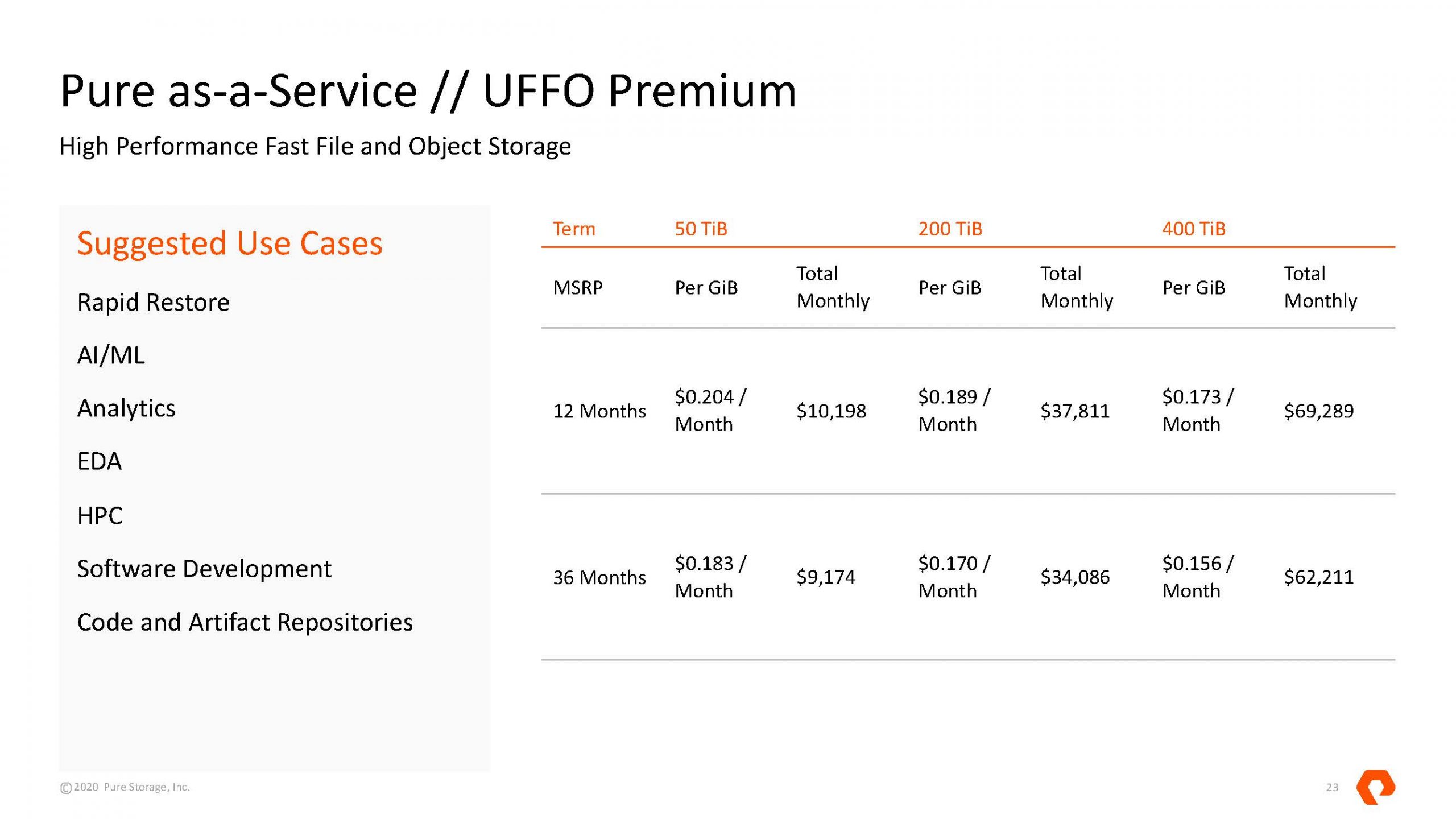

Along with block storage, Pure has its Ultra-Fast File and Object storage offerings or UFFO. The first tier is UFFO Premium. As one can see, we have pricing that is similar to Block Premium. We are not entirely sure why one cannot have a UFFO Capacity for example.

The next slide we think is mislabeled by Pure. We think, based on the catalog shown above that this should be UFFO Ultra, not UFFO Premium as that is what the pricing aligns to.

Perhaps the two strange parts, aside from the apparently mislabeled slide, is that the “Suggested Use Cases” are almost identical except the lower-cost premium has more use cases. It feels like UFFO needs Capacity and Performance tiers to match block and that these tiers need differentiation. Of course, IOPS or other performance metrics would help as we discussed with the Block offerings.

Final Words

Overall, this is a great model for those customers who want the Pure offerings and want a consumption model. The go-to-market with Cisco makes a lot of sense and we can certainly see this as the storage backing racks of Cisco UCS C4200 systems as we reviewed.

In a future update, we would like to see a few items. First, is block storage and UFFO tiers to be unified or better differentiated. Second, we would like to see some IOPS ratings on the menu or other performance metrics. The third is some sort of discussion on how Pure will upgrade systems in the field.

Building on that third point, a key challenge for longer-term IT services is not necessarily what one buys today. It is instead what happens in the future. Large and long-term contracts have been known for decades to be areas rife with delayed upgrades. AWS and cloud providers tend to lower the price of a given service level over time and introduce new service levels. That is a lot to ask of Pure, but that is what changes this from a DXC Technology like IT outsourcing agreement to a more cloud-like consumption model.