This week STH covered Dell EMC World in Las Vegas. One of the major themes was hyper-converged. Solutions such as VxRail and VxRack along with new payment options and it is clear that Dell EMC is on the hyper-converged and hybrid cloud bandwagon, in a big way. Look no further than VMware CEO Pat Gelsinger’s message at Dell EMC World 2017:

That message was surely vetted in the Dell Technologies brain trust, representing the largest enterprise IT vendor in the world. It is also unequivocally clear in the direction the company sees enterprise infrastructure moving.

Looking beyond Dell EMC, HPE is also pushing hyper-converged solutions as well as composable infrastructure. Nutanix presentations in the Dell EMC solutions expo were often packed to capacity. The OpenStack Summit was also this week in Boston and a popular topic was the uptick in OpenStack deployments and adoption. These samples are not showing a slow trend away from traditional server (virtualized or metal) computing. Instead, this is an all out foot race towards a new regime.

Talking Infrastructure, Not Servers

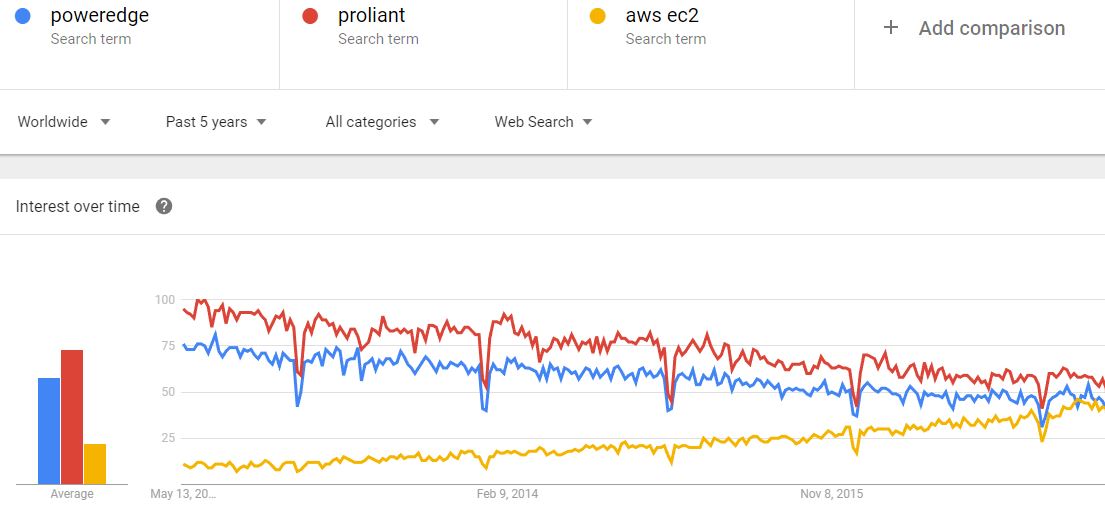

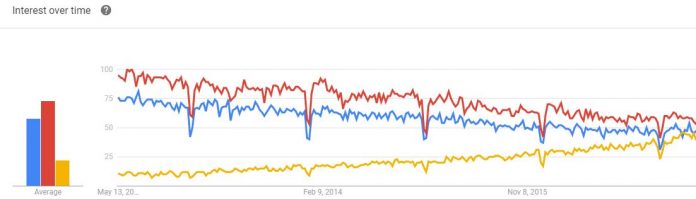

One of the major announcements of this week was the Dell PowerEdge 14th Generation family. Although it was highlighted, it seemed almost out of place with the messaging for the rest of the industry. During our interviews with Dell EMC executives, as well as executives from other major vendors recently, we showed a simple chart generated by Google Trends:

(Source: Google Trends)

To say this has raised some eyebrows would be an understatement. Those are the world’s two most popular server brands charted against AWS EC2, the leading cloud compute brand. The executives from hardware vendors gave responses that generally fell into a few categories and here were the top three that we noted in terms of frequency:

- The market did not yet understand the benefits of hybrid clouds and hyper-converged infrastructure. Once they understand the cost savings and ease-of-use of these technologies this trend will reverse.

- People have been asked to research AWS and so that is why there is an increasing amount of Google search traffic on the topic

- Hardware vendors are now selling solutions, not servers so it is not possible to compare server lines to AWS. (Note: We did point out that we specifically limited our AWS search with EC2 to match compute only as well as possible.)

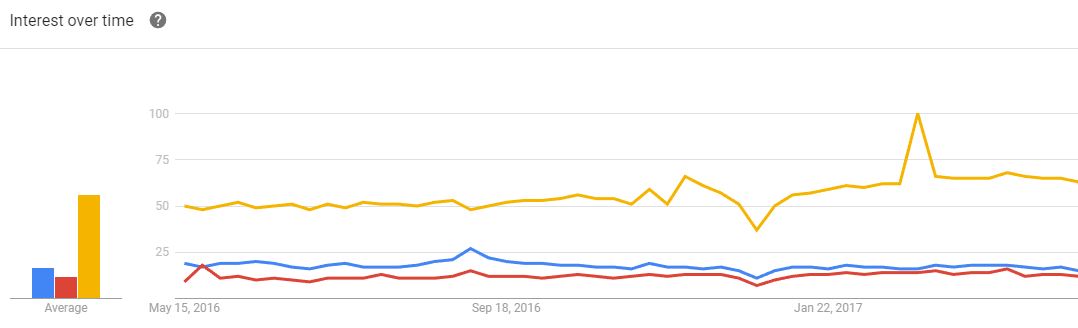

On the last point, you may be wondering Dell EMC v. HPE v. AWS (using the last 12 months due to the HPE divestiture:

(Source: Google Trends)

The themes we hear are fairly constant AWS is more expensive but it is easy. While we may end up in a hybrid-cloud world and the on-prem solutions may be a VMware-powered HCI, Azure Stack, OpenStack or something else, the balance of power has shifted. The server building block is being de-emphasized.

At STH, we do more compute server and building block reviews than anywhere else, so we wanted to share why we are hearing this shift is happening.

Generational Shifts Influencing the Trends

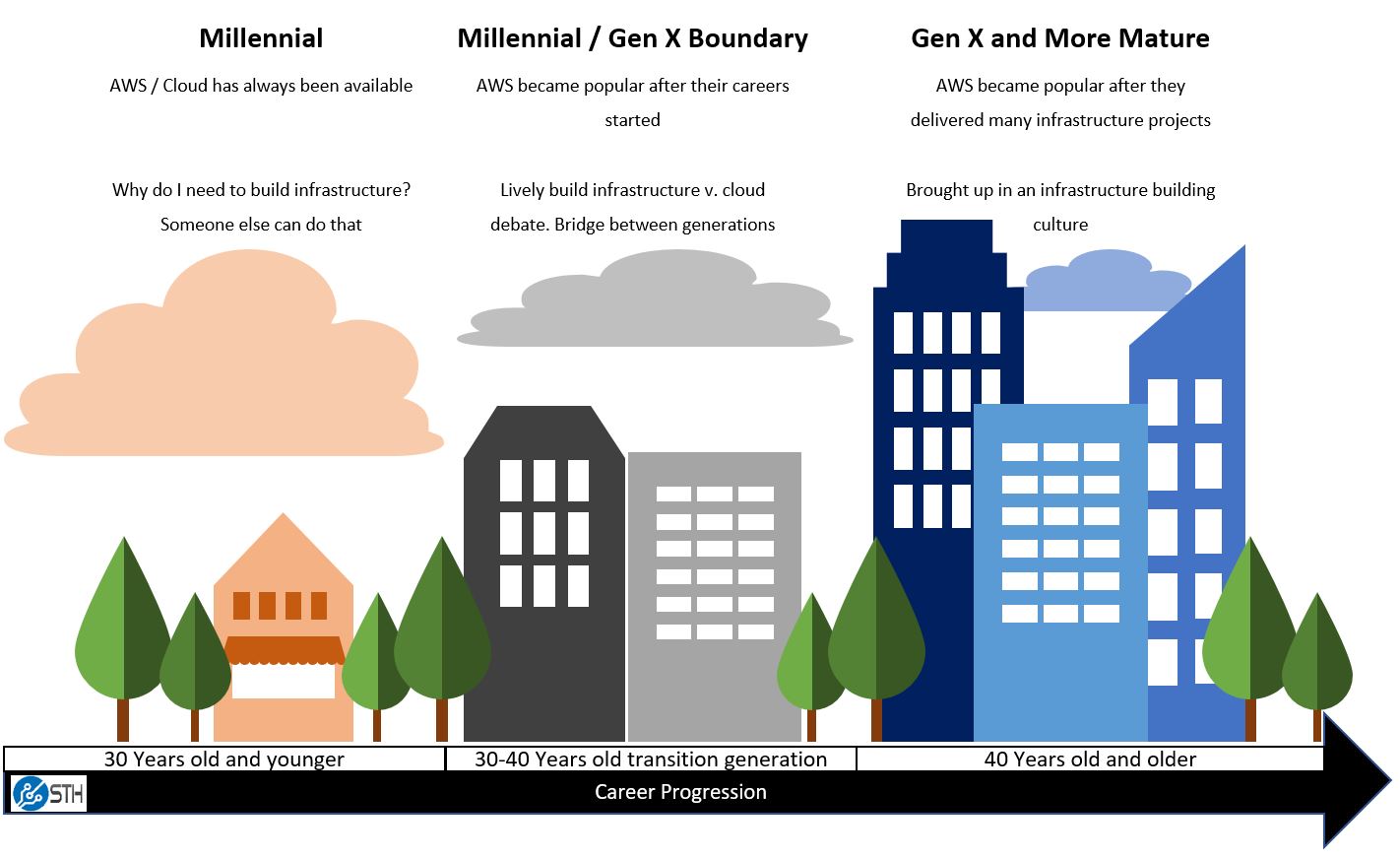

On the way back from Dell EMC World I was seated next to a large Dell Technologies customer who stated they had over 50,000 nodes in production to service their highly-regulated business. One point we discussed was that there is currently a millennial / generation X gap in how folks have experienced infrastructure. This executive’s comments mirrored many that we have heard by consumers of data center IT over the past few years. AWS is (very) expensive but there is a generational shift in the way businesses are thinking about IT.

This gap is increasingly important as millennials progress in their careers becoming larger parts of infrastructure purchasing decisions. Here is what this looks like in a 5-minute sketch:

That quick sketch has been shown to a few CIO’s over the past few weeks and we have received an overwhelmingly positive response (and quite a few requests to use it with their teams and to speak about the topic.) The next five years as the transition generation shifts into their late 30’s and early to mid-40’s, the proportion of IT professionals that think “if we need to deliver an application, we must build infrastructure” will dwindle.

Another observation that we have heard is that we are also moving towards an apps model, also favored by the millennial generation. In that model, IT will be buying apps that consume IT (public cloud or otherwise), and the net result is that companies not building apps will need fewer servers. Office365, Salesforce and other cloud applications are great examples of this.

Final Words

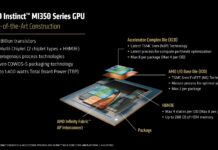

The narrative after speaking with customers and vendor executives over the past few weeks is clear: there is a generational gap thinking about infrastructure. That generational gap is de-emphasizing the building blocks (servers) while emphasizing cloud, hyper-converged, and hybrid infrastructure strategies. Even this week, NVIDIA announced a hybrid cloud offering for machine learning / AI services. Machine learning / AI has been one of the largest areas of built-your-own infrastructure as startups and larger companies can see payback periods measured in 3-4 months.

As a site focused on server building blocks, this can be daunting, but the change has already happened. One of the key messages Dell EMC broadcast during its PowerEdge 14th Generation announcement is that the new generation of servers will be the building blocks for their on-prem offerings.

Great view chart of the trend.

Most vendors, even Microsoft pushed the hybrid view of the world in the UK Cloud expo. The general consensus was for IaaS you’d be stupid to cloud base it unless you have no strong on-premise private cloud to begin with on a purely cost perspective (unless you are getting a great deal). PaaS / SaaS / FaaS etc – choose your appropriate lock-in…

I also think you need to be pretty clear on the definition of infrastructure within the article – I see anything up to and including the platform stack to be infrastructure. I would think the kids of today just want to be writing against API’s (Function as a Service). So I think the picture doesn’t quite fit the article in that it quite rightly encompasses more than the subject matter (server tin!)

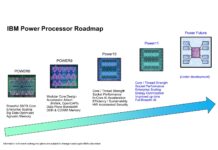

Patrick, nice article. During all this server talk, did you hear anything about Naples? And what about Power 9, Cavium, Qualcomm?

Will it continue to be all Intel?

The best quote “this will be the year Intel finally sees its market share needle dip for the first time.”

I would also like to point out that these days it’s a lot harder to build adequate infrastructure than it was “back in the day”. From my short time at a larger enterprise client (this was 2016) I still remember the people in charge of the infrastructure who were basically glorified system administrators with no developer skills whatsoever. All these people did all day was install servers via the graphical installer provided by the distribution, install packages (sometimes even via a web interface) and basically copying and pasting configuration files. One guy, veteran Linux sysadmin for years even asked my if I ever installed Linux on a laptop – everyone was using Windows… So these people would be pretty much useless if you wanted to roll out something like openstack or if you really want to be modern Kubernetes.

The “kids these days”, when it comes to infrastructure, have to think bigger – in terms of Racks, cages, data centers, not single servers. these days you’ll treat your servers as cattle, not snowflakes. And if you think in those terms, what’s the value add provided by the more expensive vendors like Dell and HPE?

So in the end you can either find, hire and train a lot of new people who are already in short supply, hope that AWS meets your needs or try your fortunes with one of the larger vendors. These days picking AWS is considered the safe choice by many (like the old saying “you don’t get fired for buying IBM”).

Nils – or you can go to a company like EMC who will do all that for you. A heap of companies offer a managed service – at a very basic level a converged system like Vblock through to a fully managed private cloud. Today there is still a choice to be made – how much of a choice in the future comes down to cost and as you point out a heap of market forces.