We do not always cover earnings releases, but since we covered the relatively somber Intel Q4 2022 Earnings and the Data Center Challenge, AMD, as we expected, posted some results that were similar but others that were different than what we saw from Intel. AMD took a big GAAP hit due to Xilinx-related amortization this quarter, but its results are impressive.

AMD EPYC Selling Like Hotcakes Shown in the AMD Q4 2022 Earnings

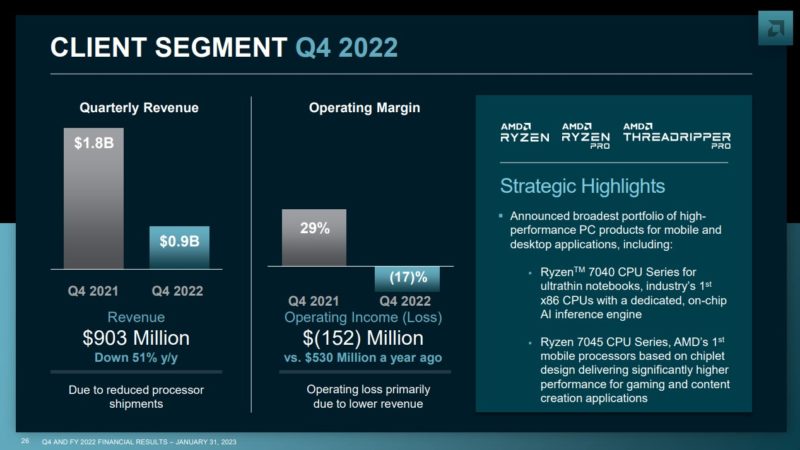

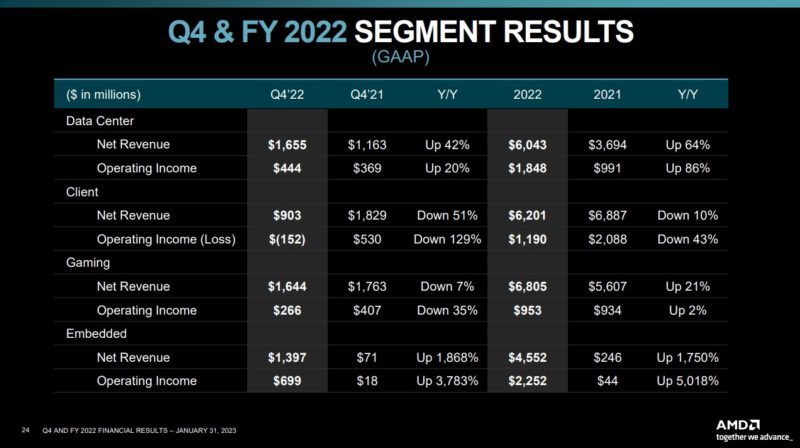

First, let us get to the bad of AMD’s release: client. The AMD client business saw revenue down to $903M or less than half year over year. AMD noted that its ASPs remained flat. That should be scary for AMD since it means that AMD shipped half the client CPU volume. HP, Dell, and Acer, for example, were down 28-37% in Q4 PC shipments. It seems like on the Client side, AMD needs a strategy update.

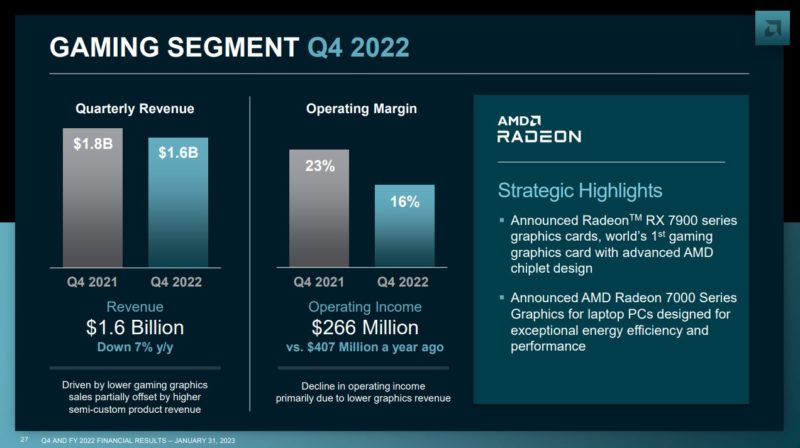

Gaming was down to $1.6B, but that was only a 7% decrease.

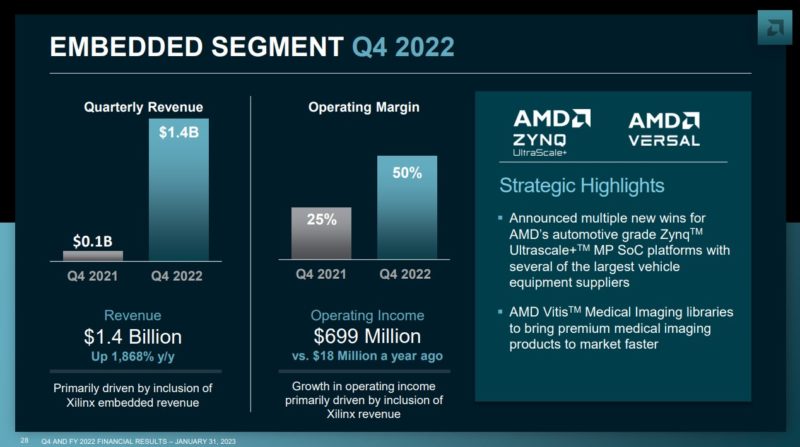

The Embedded segment was $1.4B. AMD says that is up 1,868%, but that is primarily driven by Xilinx embedded revenue being added to the mix. Xilinx acquisition costs were also the majority of the $1.4B “All other” operating loss, but that is normal for acquisition-related accounting charges. Intel had intangible assets subject to amortization with Altera. It is normal accounting for a transaction.

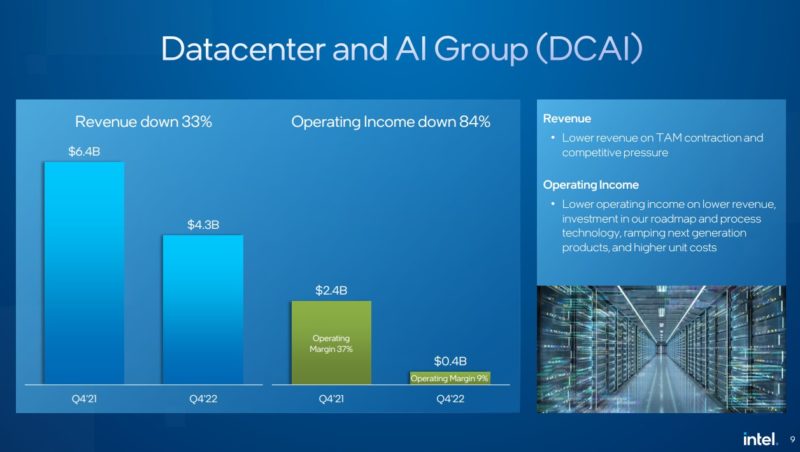

Now to Data Center. AMD is now at $1.7B of revenue with $444M. That $1.7B is 42% higher than a year ago. (Note: AMD’s charts have bars that must not have a 0 base on the Y axis so you need to read the numbers.)

That means AMD is earning roughly the same dollar amount as Intel’s DCAI business on less than 40% of Intel’s DCAI revenue.

That does highlight an interesting trend where Intel’s -$2.1B in revenue only saw a ~$0.5B gain for AMD. AMD said it roughly doubled its North American cloud sales doubled in the last year, HPC grew, but Enterprise slowed. AMD said it has 40% more server models in development by large OEMs for Genoa over Rome/Milan.

Here is the summary slide for AMD’s segments:

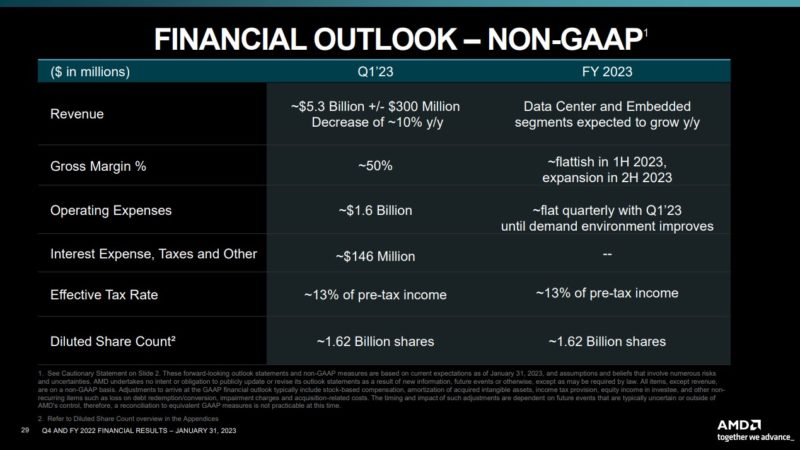

AMD says that Data Center and Embedded will slow in 2023 but should grow from 2022 levels. AMD is citing inventory at cloud customers for slowing EPYC in the first half of the year, but then expects to have a strong second half. One has to wonder if that is due to Bergamo and Genoa-X as well.

Client and gaming should be down next year. AMD is also being cautious about giving too tight of guidance for FY 2023 because of macroeconomic concerns.

Final Words

The AMD EPYC parts seem to be selling very well, but there seem to be headwinds that were reiterated several times on the call for the first half of 2023. AMD did not mention marketing programs to get Genoa into the enterprise segment on the call. The company did mention marketing programs to clear older client inventories.

AMD said that it sees EPYC 7003 Milan instances still ramping today, even with the EPYC 9004 Genoa being out. It also says that it expects Milan to remain an important product in 2023 because it is on a more mature platform.

Night and day DC results comparing to Intel.

AMD need to sell chips to enterprise. It’s absent there. Dell and Cisco aren’t really pushing Genoa

Hans

There is no demand for AMD in the datacenter – likely strength has more to do with Xilinx than Epyc.

Intel still dominates the DC handily.

Patrick,

Sorry to bother you but you still have (C) 2020 in the footer. Looks funny

@Hans, I think the problem is AMD’s Genoa is a huge socket with huge core counts. They don’t have good competition in the 8-24 core range right now. Intel, with multiple die sizes, can compete better in this space.

@Wes V & @ Disident agressor , I own a company doing websites hosting, e-commerce, webapps etc.. And I can tell you that Intel is way behind AMD regarding performance and price per core area. Intel still dominate of course, because of lack of knowledge from IT managers and old belief when Intel was better than AMD on performance (Bulldozer time). It’s a no match from AMD to be very fair.

The headwinds are the OEMs and large suppliers, Dell, HPE, Lenovo, etc. I’ve seen a massive down swing in enterprise server and client availability with AMD anything inside the box. They have maybe 1-2 options for every 5-10 Intel in any segment, and only if you’re lucky. I can’t find an AMD laptop to deploy to my workforce which matches the current Intel offering from Dell, as an example. Server actually has better options, but our preferred vendors kill us with pricing/steep discounts compared to AMD offers, so purchasing is hard pressed to see a relevant difference when all they care about is bottom line…

It’s a real shame. AMD is winning the hardware war, but losing the marketting war still. But Intel’s last report shows how costly that second front actually is.