In a huge semiconductor and tech deal, AMD has now completed its acquisition of Xilinx. The combined company has a larger portfolio of IP that will allow it to target more markets and offer an alternative to Intel.

AMD Completes its Acquisition of Xilinx

The AMD Xilinx deal was largely predicated on improving AMD’s financial model, as much as it is offering a larger product portfolio.

The deal was largely focused on the data center, 5G, and embedded markets as FPGAs are less widely used for devices like gaming PCs.

Here is AMD’s TAM, or total addressable market. While PCs and Gaming have been big revenue drivers in the past, Data Center and Embedded are the bigger markets and the ones that Xilinx helps.

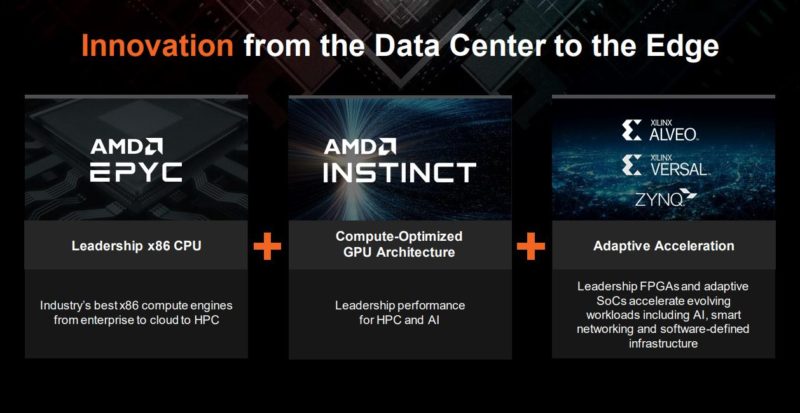

Xilinx adds three important features to AMD’s product line. First, is the traditional FPGA and its flexible model that is used in many industries. Second, Xilinx has specific IP around accelerators and connectivity given the markets it serves. This includes IP for AI and video encode/ decode acceleration as well as things like high-speed SerDes. Third, AMD is also getting some notable networking IP. Xilinx to acquired SolarFlare and started integrating the IP into its products like the Xilinx Alveo U25 SmartNIC. At some point, AMD will need to decide if it wants to play in the SmartNIC/DPU/IPU space, and Xilinx gets AMD further into that market than it was before the deal.

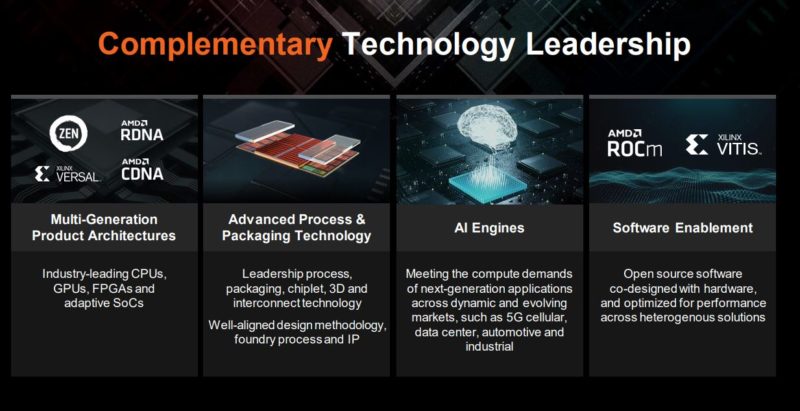

One of the more interesting pieces to watch in all of this is the ROCm and VITIS development. We noted recently that AMD ROCm was updated to include FPGAs in potentially supported technologies.

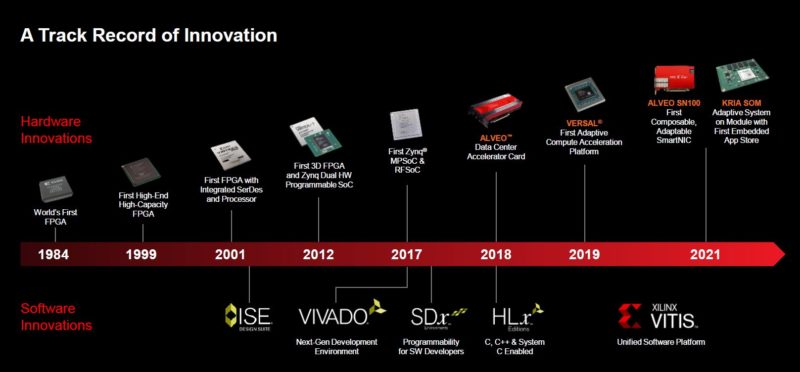

At STH, we only started covering Xilinx in early 2017, but we have seen the Versal and Alveo lines grow since then.

The newest product to make the timeline above is Kria. You can learn more about the Xilinx Kria SOM in our article and video:

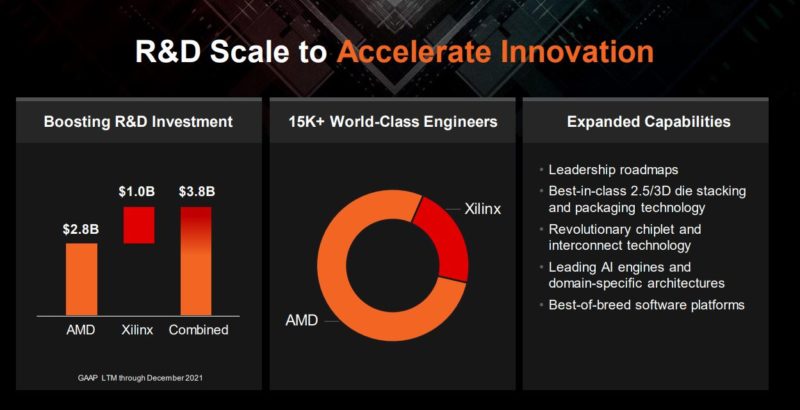

Aside from the TAM and current IP, Xilinx brings a new set of engineers that are top-tier in their fields.

We do not expect to see significant volume products for AMD-Xilinx in 2022, but starting in 2023 we may see more. Many of the hyper-scalers are pushing for chiplet designs in CPUs, and standards to do so. As a result, integrating AMD and Xilinx IP should become easier than it would have been 10 years ago given the focus on chiplets at AMD.

Final Words

To be clear, the integration of the two companies is important, but it also brings some other strategic options. For example, in the embedded business, instead of going after Intel Atom, AMD will be able to use something like Kria SOMs based on Arm CPUs, with hardened accelerators and IP, and flexible FPGA fabric to target markets that are not great fits for x86 CPUs and GPUs. Another example is that AMD’s networking IP may be better served by just using what Xilinx has today. Between this portfolio expansion, integration in the future, and the ability to present a larger breadth of silicon to customers, this is a big day for AMD (and Xilinx.)

This is beyond huge for the market as this is the gateway for AMD to really start branching off into different industry segments with a much more mixed portfolio of products. Intel has had their fingers in most everything tech related for years, now AMD is turning some of that Zen capital into diversification. Good on them!