This morning, AMD announced that it is buying ZT Systems. For those who do not know, ZT Systems builds many of the company’s hyper-scale AI systems. In some ways, this acquisition makes sense. In others, it tells us a lot about the AI industry. This is also going to be the first piece in our Substack where we are going to go into this a bit deeper.

AMD Buys ZT Systems in a Surprise Move

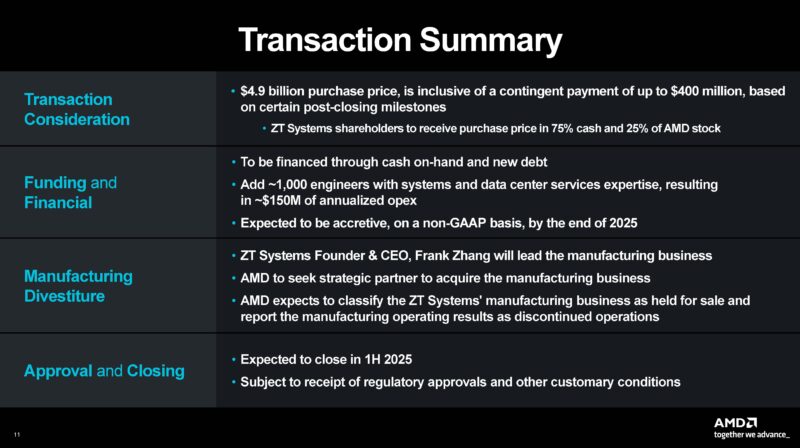

The deal is valued at $4.9B, with a $400M contingent payment due later. However, the net deal value should be much lower than that, as the companies announced that the ZT Systems manufacturing arm will be divested in the future. This is a multi-billion dollar manufacturing business, so we expect several buyers for the business.

Given what ZT Systems makes, buyers would likely be someone like a MiTAC, QCT, HPE, Dell, Supermicro, Sanmina, Flex, or another large vendor or a private equity company. For HPE this would be a decent way to get an AI story going since Supermicro and Dell are far ahead. AMD plans to classify ZT Systems’ revenue as discontinued operations and will be under some pressure to sell. While it owns the manufacturing business, it will be competing with its customers, so it will be important to divest that business quickly.

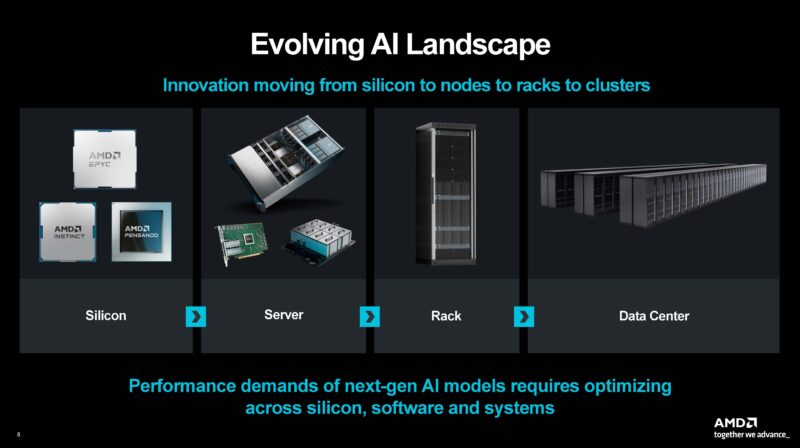

A typical large AI cluster has a few primary systems. The high-end IP ones are typically in the AI accelerators/ GPUs, CPUs, RDMA NICs, switch chips, and so forth. The lower-end IP systems are typically the liquid cooling for the data center loops and for the in-rack cooling, the power distribution in the data hall and getting power to the building, physical rack design and deployment, management networks, physical safety and security, and so forth. If you take a step back, it is easy to see this in action since few companies (usually 2-3) are making the high-end IP categories, and many (often 10+) are making those in the lower-end IP systems.

Last year we covered Supermicro Custom Liquid Cooling Rack: A Look at the Cooling Distribution. This is a key differentiator and why, while Dell can deliver many NVIDIA servers to large customers, head-to-head Supermicro is able to deliver liquid cooling when Dell is delivering air cooling today. Speed matters.

For AMD, having an 8-way GPU box is good, but it solves only part of the problem. Instead, companies need to figure out how to get the 8-way systems deployed as new sources of power and water are uncovered in places like the US and Europe.

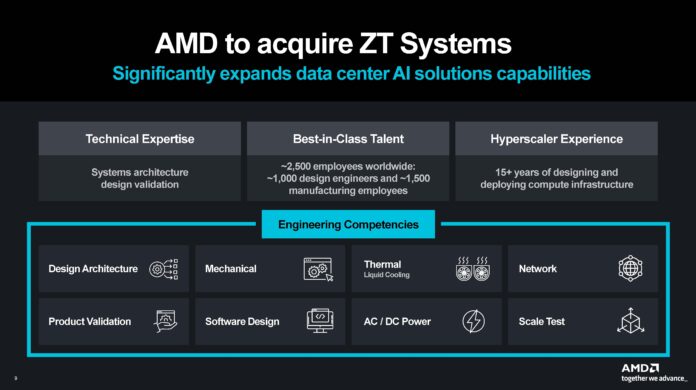

AMD buying ZT’s engineering resources gets it that type of acceleration. When AMD talks about $4-5B of AI server revenue this year, it is important to think of that only as 1-2 clusters worth of GPUs. A company like Supermicro on the NVIDIA side can deliver a full $4-5B cluster now in less than a month. If AMD is going to scale, it needs not just the technology and pricing to justify the investment over NVIDIA, it also needs to be available in the same windows. GPU clusters are now so big that a cluster taking a year to come online is not acceptable. Three years (or more) for a HPE-Cray government Exascale supercomputer feels like a laughable paleolithic pace of project planning.

Final Words

Our sense is that the net purchase price of the ZT Systems acquisition is going to be well below the $4.9B range once the manufacturing business sells. For a company like HPE, this would give it an overnight story on AI since it is lagging behind Supermicro and Dell. AMD is really getting the ability to scratch the AI STD (Speed-to-Deploy) needs of its customers, not trying to compete directly with its partners. If it does not address the AI STD metric, then it will not be able to compete in the future. That is a massive deal for any AI startup outside hyper-scalers, NVIDIA, AMD, Cerebras, and maybe Intel.

We also went into this in a bit more detail in our new (paid) Substack! If you want some additional insights to what we post on STH, we are going to start posting more in-depth pieces for those in the industry and financial communities that align with the consulting and analyst work we do.

You can find the new Substack and more insight on this acquisition here. I have been doing consultations all morning and decided to put them in a post there just to make it scalable since my time is not.

Update 2025-03-31: AMD has now completed the acquisiton.

Isn’t the 400 mill that’s contingent included in the 4.9 billion?

SD that’s how I read the article and AMD’s slide. It’s like 4.5b + .4b and 75% cash including debt issued for it 25% stock

@Sølve Dahl, no, it’s addtional award fee if ZT can achieve some targets.