As has been rumored for some time, the company known for its involvement in buying Arm has purchased the other notable UK chip company, Graphcore. Graphcore, for its part, was a well-known AI company that has fallen behind NVIDIA, AMD, Intel, Cerebras, and a few others in making AI chips.

Graphcore’s Rocky Road

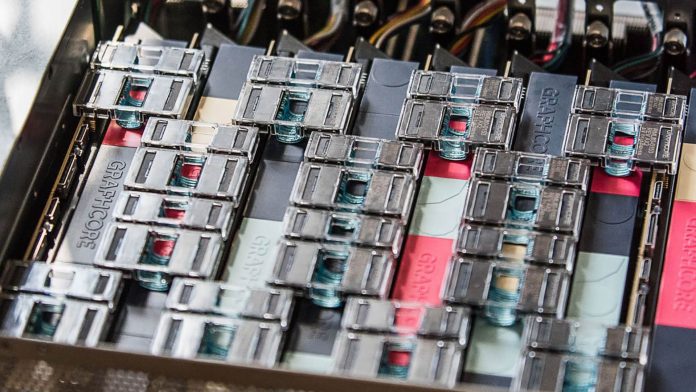

Graphcore had an interesting architecture, but one of the biggest challenges it faced as a startup was doing something similar to NVIDIA. Graphcore’s BOW-2000 was trying to compete with NVIDIA building a reticle limited chip. NVIDIA’s two big merchant silicon competitors that gained some foothold are AMD and Cerebras Both of those companies went with a strategy of building bigger compute engines. Aside from those, Intel has been pushing across its stack, and many hyper-scale companies have their own accelerators.

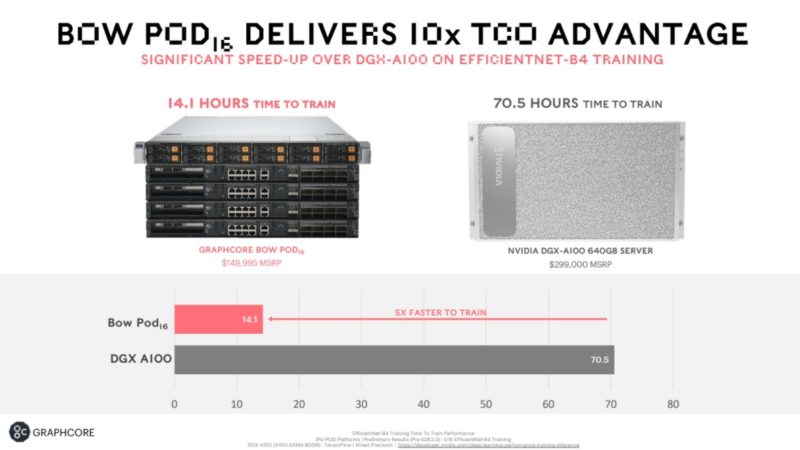

The company focused on direct TCO comparisons instead, but it is hard to out-compete NVIDIA if you are building a similar-size chip. NVIDIA earning more per chip meant that NVIDIA could build more software and research what would be next for hardware faster. We knew the company was in trouble when Graphcore Celebrated a Stunning Loss at MLPerf Training v1.0.

The net result is that after submitting its MLPerf Training result, the company earned something like $2.7M in annual revenue as the industry was introduced to ChatGPT and the AI server market took off. At $150K MSRP, that is closer to shipping 18x POD16 systems as noted in the slide above, or around 288 accelerators for revenue. A big investor in Graphcore was Dell, who participated even in the early Series A round of Graphcore. Five years ago, Dell was all-in on Graphcore and was pushing Graphcore IPUs over NVIDIA GPUs heavily at trade shows like Dell Tech World and Supercomputing. That bet meant that Dell was very late to the NVIDIA AI server market.

Despite raising what is said to be well over $700M, the company’s products never seem to have gained traction.

Final Words

It is fairly hard to imagine a world where Graphcore wins selling training chips. After seeing Dell get burned by pushing Graphcore, it seems unlikely OEMs are going to look to annoy NVIDIA by selling new IPU systems. Perhaps the best case would be if SoftBank can either have Arm license the IP or if there is a hyper-scaler that wants the IP. Although the deal’s terms were not disclosed, it would be hard to see a valuation over what has been raised. Given that valuation, that means other hyper-scalers, chip companies, and OEMs passed on the deal. Perhaps it was an acquisition at a price too good to pass up.

The big question now is, how does SoftBank make money from an AI accelerator that is not in the top 10 solutions on the market? That will be interesting to see.