This week we have a few new technologies coming out of the Xilinx Data Center Group. While we are going to focus on the new 100GbE SmartNIC dubbed the Xilinx Alveo SN1000, we are going to give you some sense of the broader portfolio update.

Xilinx Data Center Group Spring 2021 Announcements

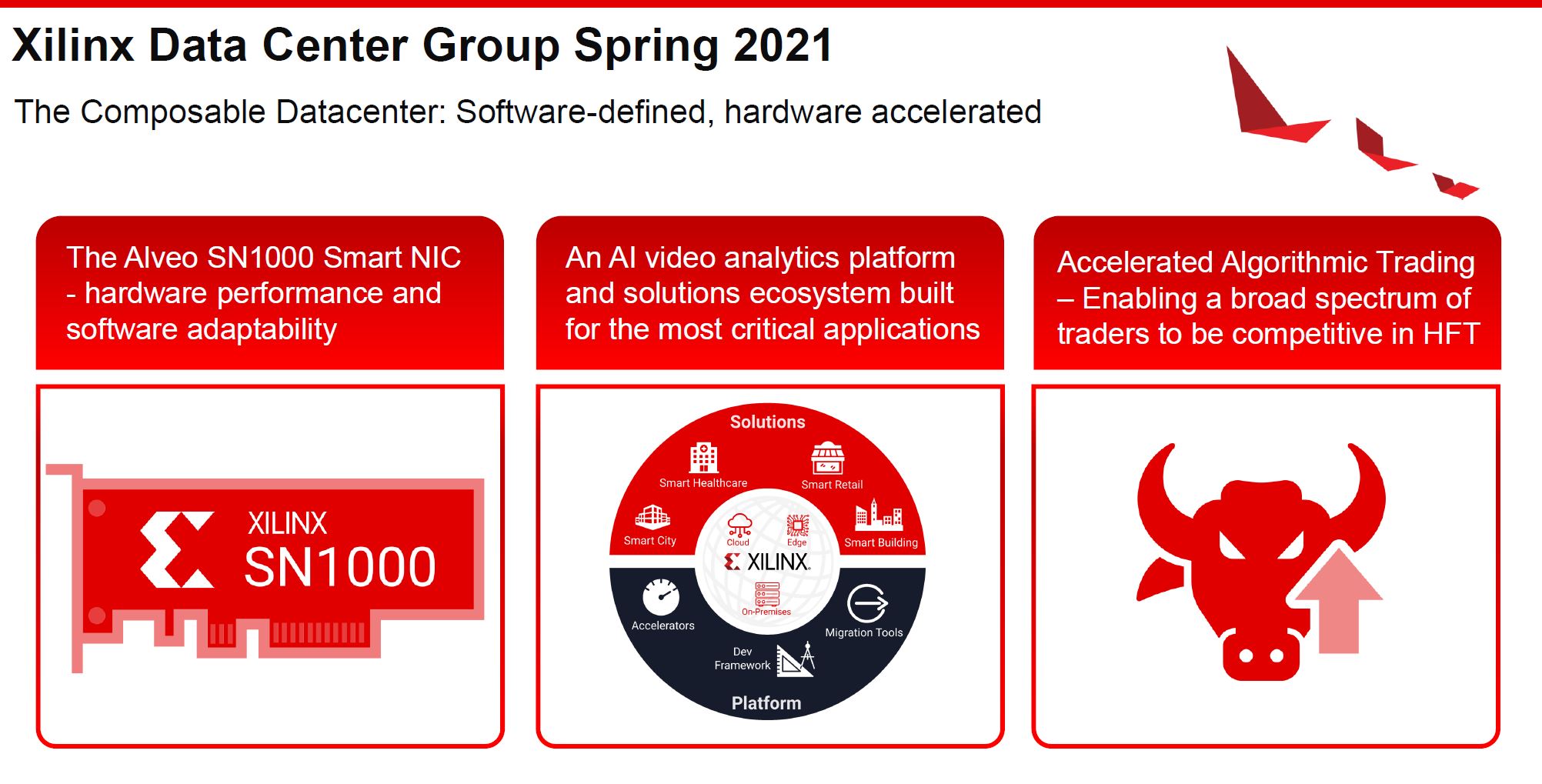

There are three main announcements for the Xilinx Data Center Group’s Spring 2021 update. First is the previously mentioned Alveo SN1000. Next is the AI video analytics platform dubbed Smart World. Finally, Xilinx has a new Accelerated Algorithmic Trading solution.

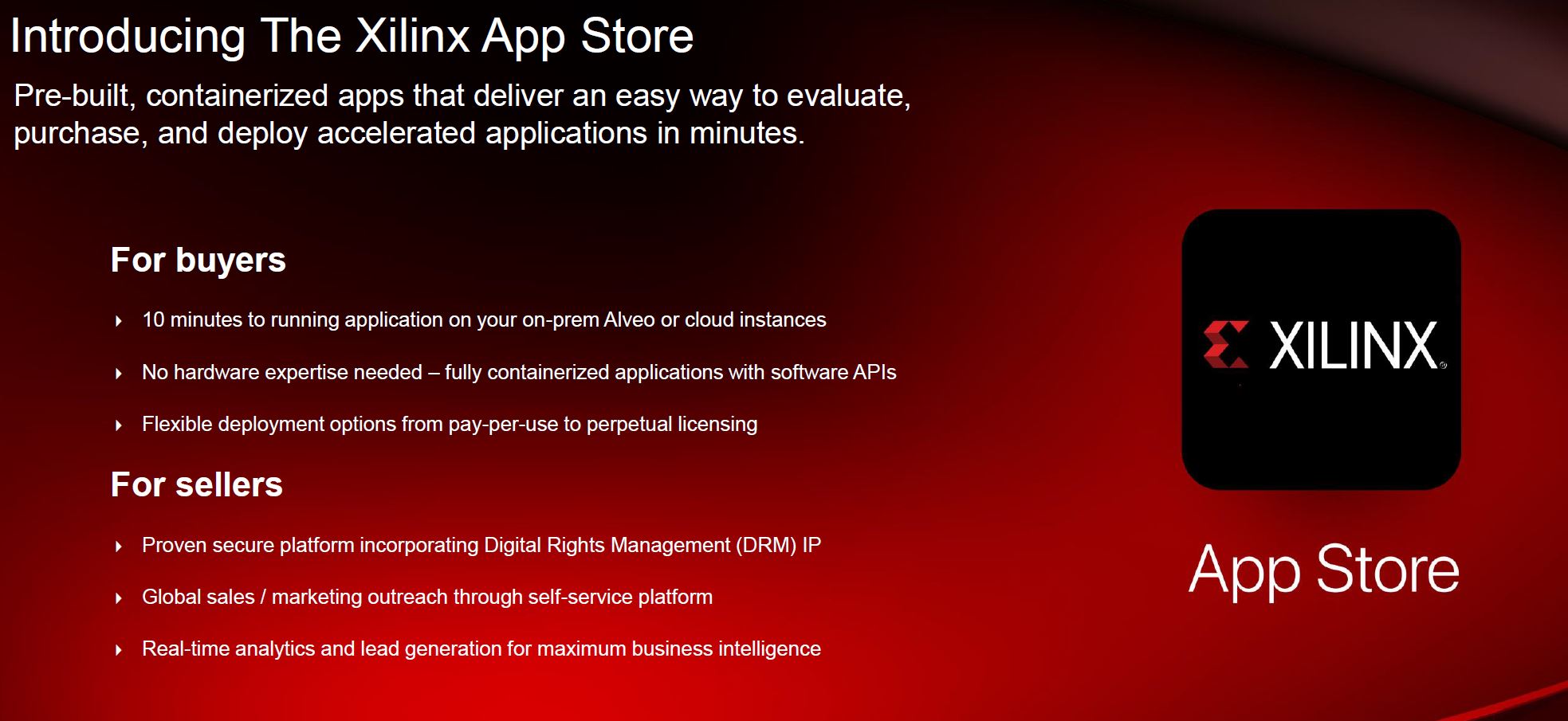

The one item, and perhaps the most impactful, is not even on that update slide. Xilinx has a new App Store. Xilinx is launching a marketplace where if you develop IP blocks/ solutions on Xilinx FPGAs you can put them on the company’s App Store. Those buying Xilinx FPGAs can then go to the App Store and get IP to use on its hardware without having to go through a development cycle.

This may end up being the largest announcement of the update, even though it was not named as a Top 3. This is something we want to try out. Still, let us cover the three announcements.

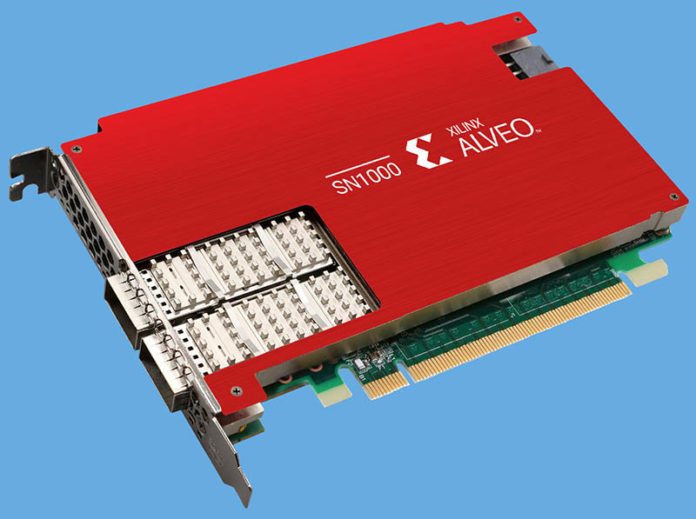

Xilinx Alveo SN1000 FPGA-powered 100GbE SmartNIC

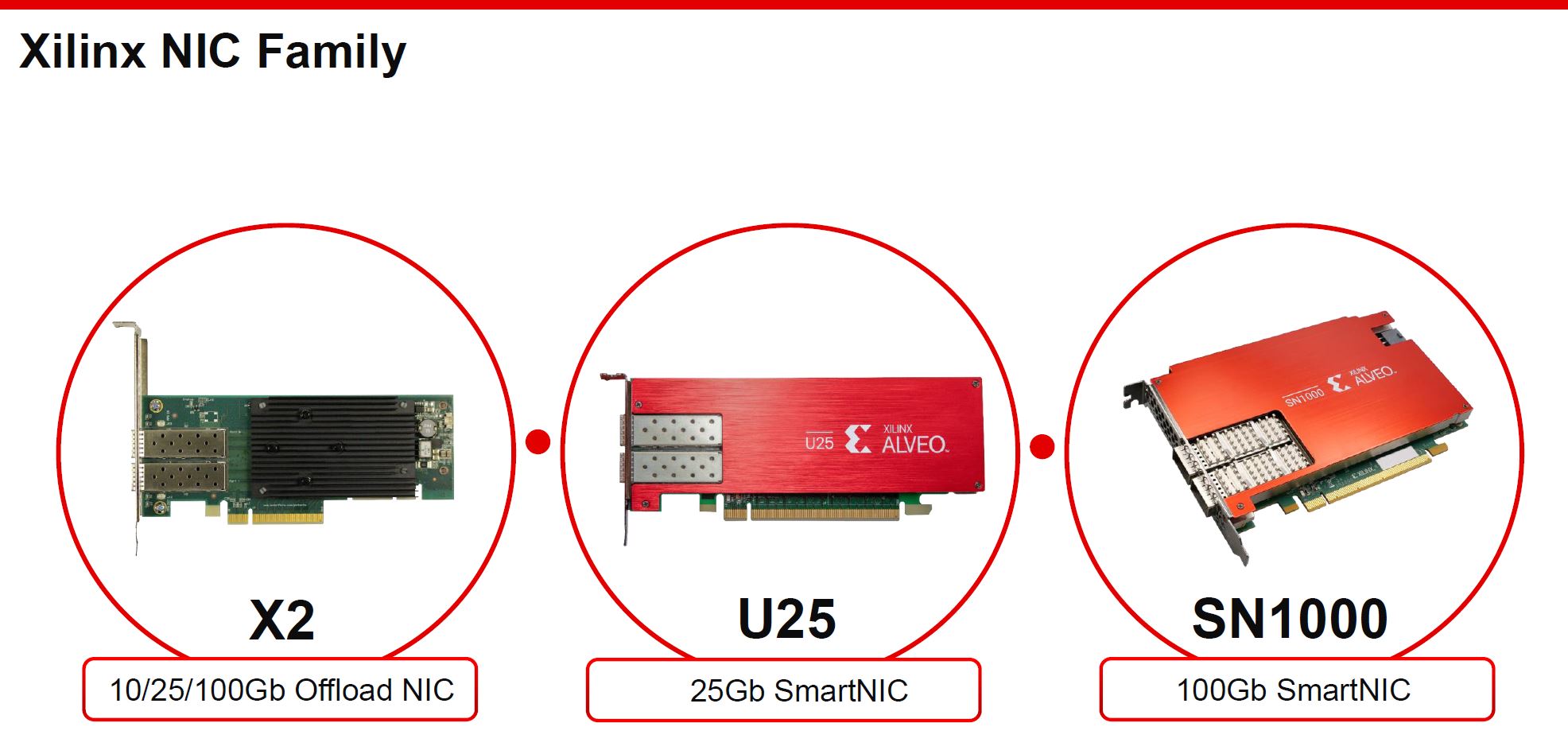

The first announcement is for the Xilinx Alveo SN1000 series. Xilinx has made a few moves in the networking space. Specifically, it purchased SolarFlare which is where its X2 offload NIC originates. After the X2, we have the Xilinx Alveo U25 SmartNIC Infused with Solarflare IP for the 25GbE generation. The Alveo SN1000 is for the 100GbE generation.

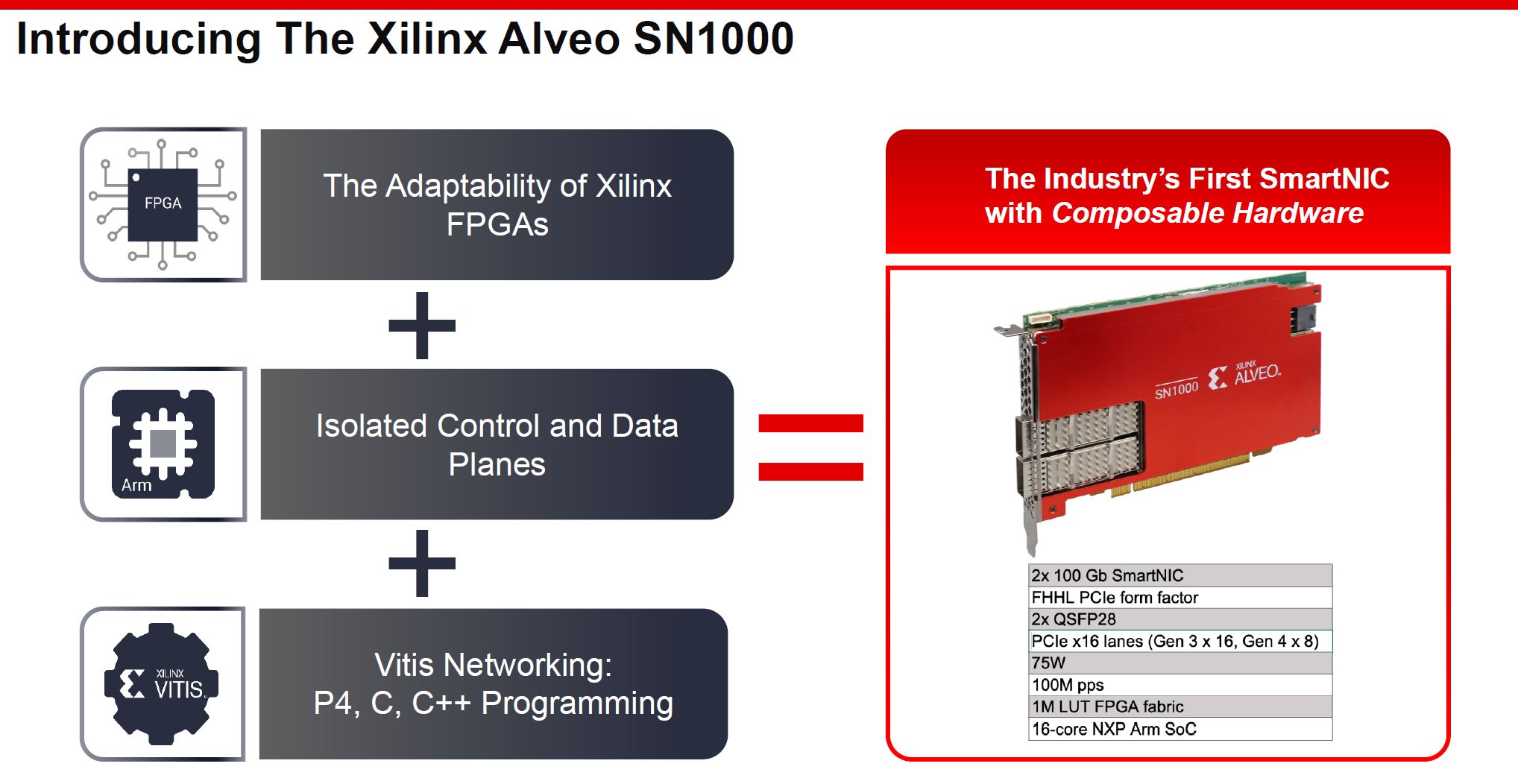

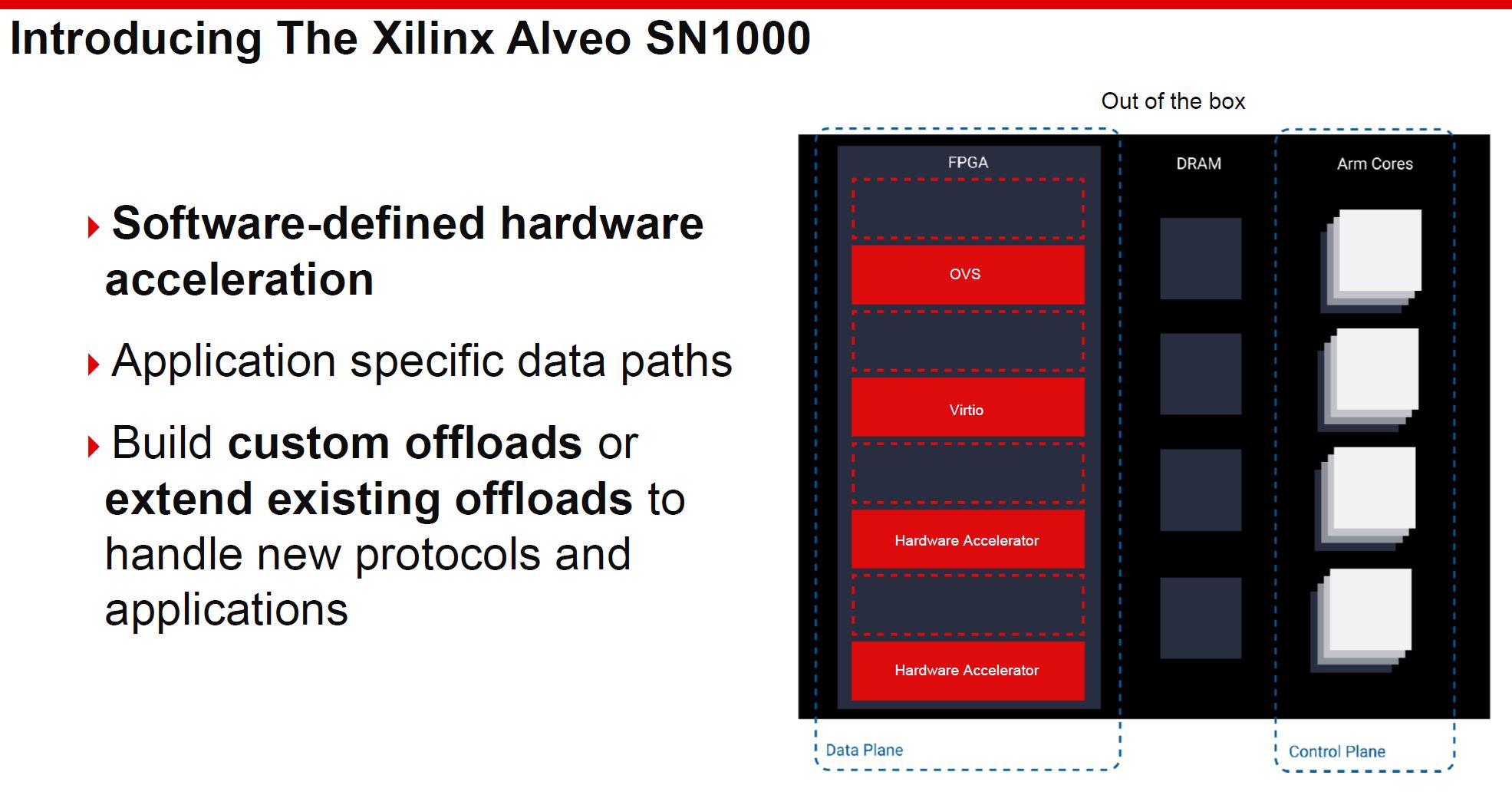

One will see this is not a lightweight solution. The Xilinx Alveo SN1000 is a 75W SmartNIC that has a 16-core NXP Arm SoC onboard. We commonly see lower-featured NICs in this space run at well under half that power. Of course, there is a good reason for this, and that is the programmability. Xilinx has an Arm CPU complex plus the FPGA which means one can have both control and data planes, similar to how we see modern switches segmented. We also can program the FPGA in a number of different methods that we will discuss later.

Part of the benefits of having a FPGA is that one gets flexibility. Traditionally, buying a FPGA from Xilinx meant one received a chip. The customer was responsible for taking that chip and making it useful. Now, Xilinx, with the Alveo line, is working to deliver not just a chip, but a chip that does something to customers in the form of a card with bundled IP. With the Alveo SN1000, one gets standard offloads with the package.

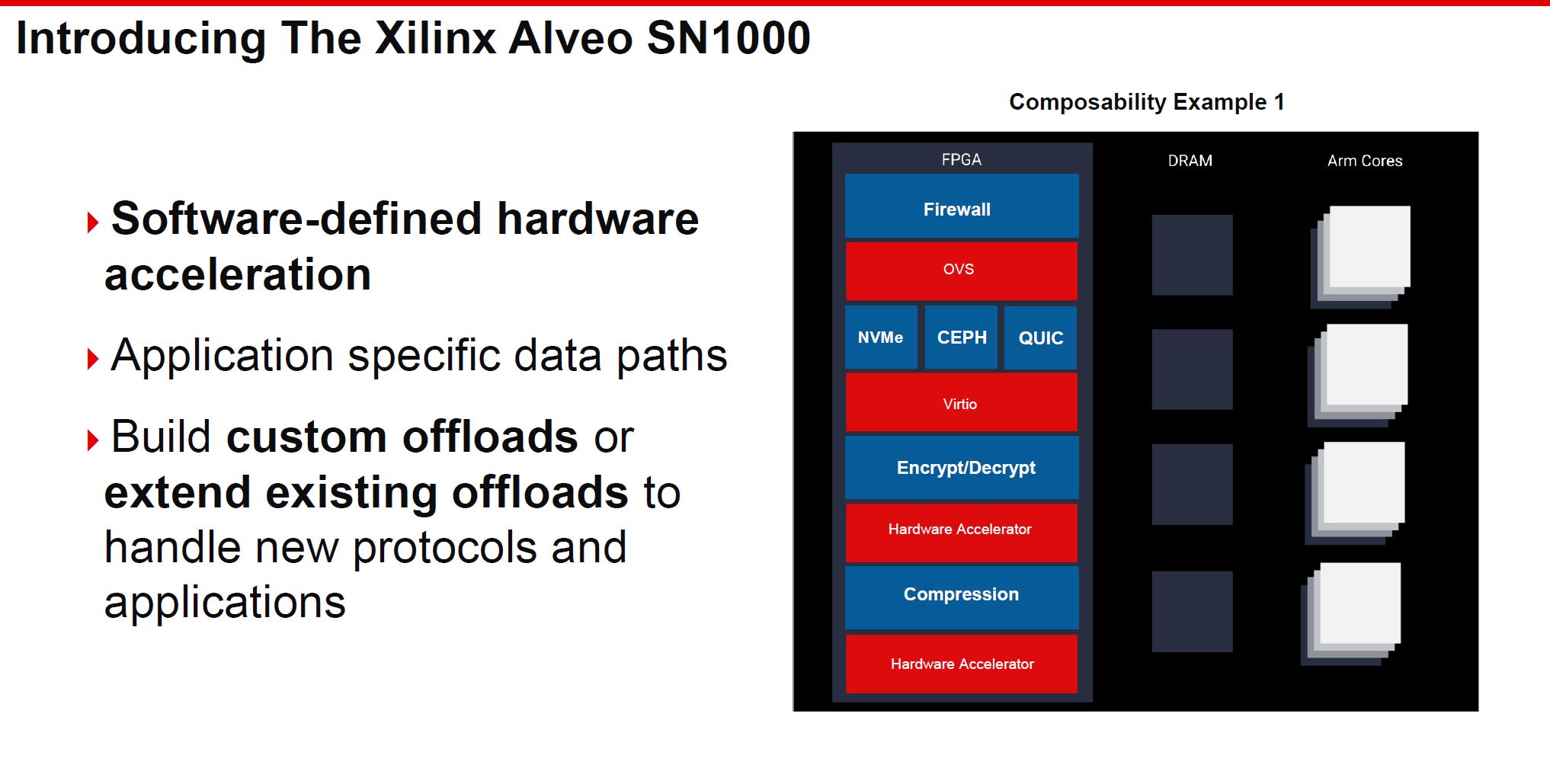

The FPGA portion allows for one to add specific offloads that are not part of the original Alveo SN1000 package. Circling back to the Xilinx App Store, this is where that model becomes powerful. One can potentially buy acceleration/ offload blocks.

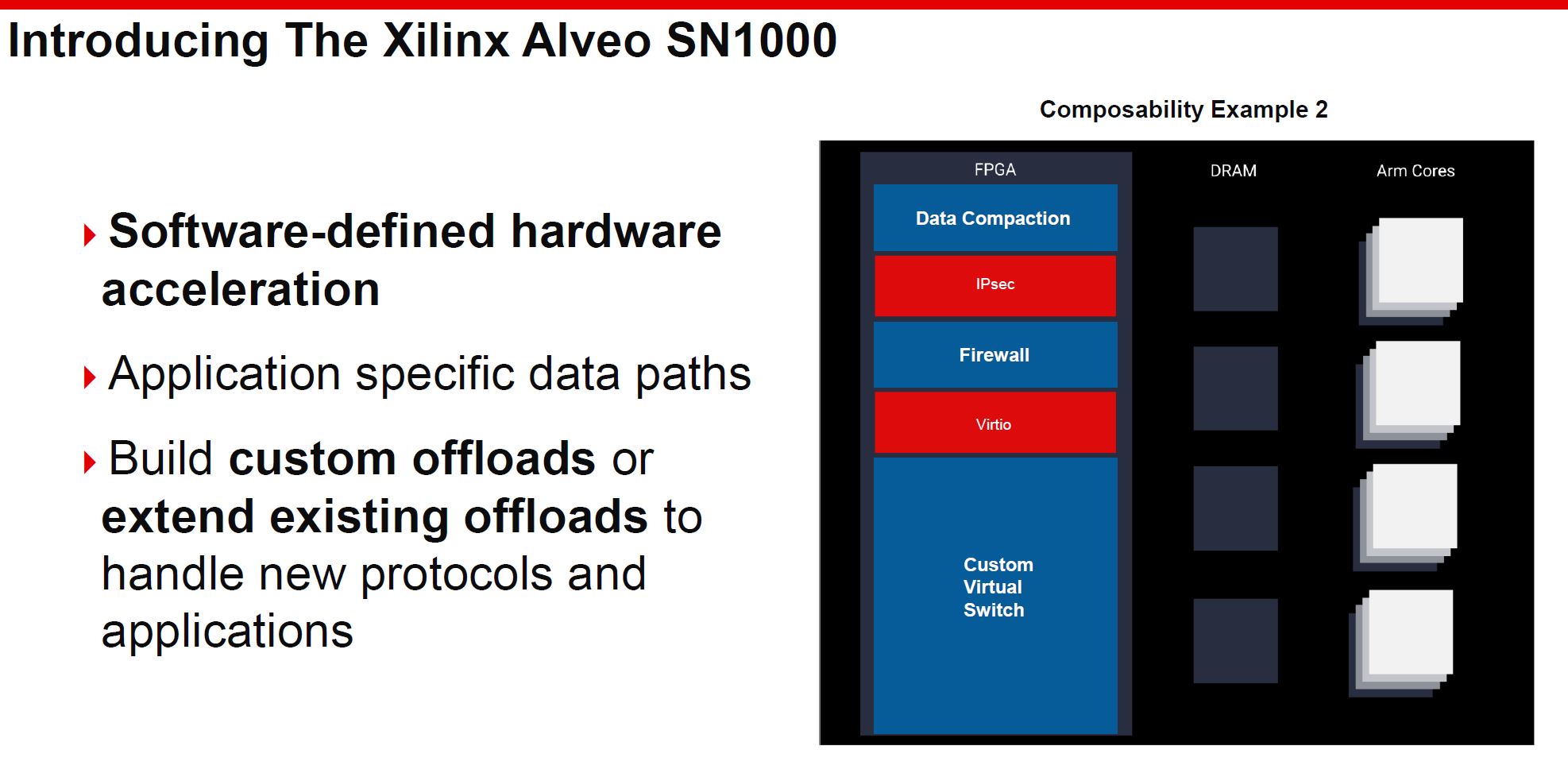

Of course, since this is an FPGA, one can customize what IP is used. While one may go to the App Store or use Xilinx pre-packaged IP for some functions, companies may program their own IP blocks. An example below is swapping standard OVS acceleration for a custom virtual switch implementation which is something a hyper-scale customer may do.

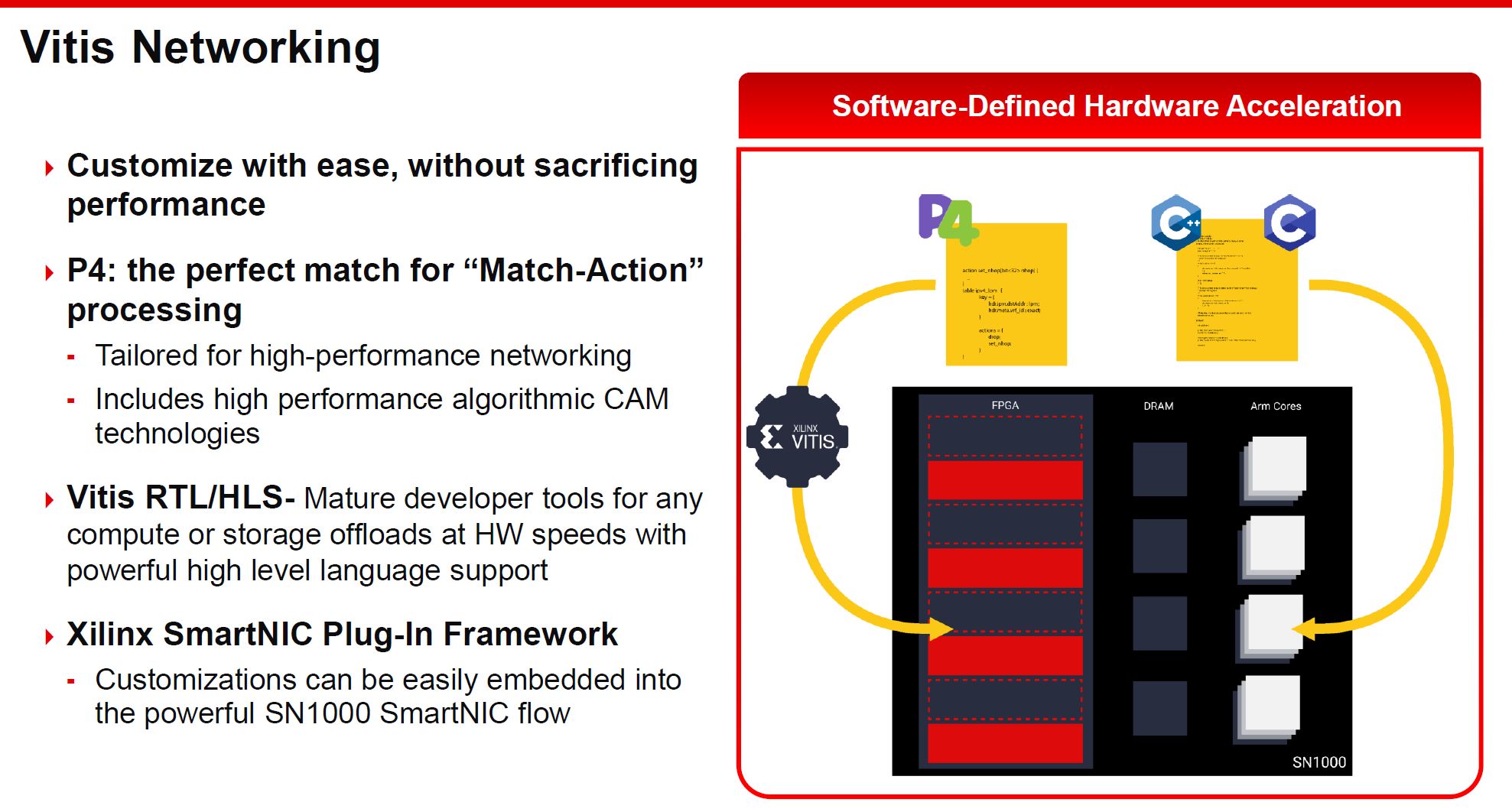

The other side to this is the Vitis Networking suite. Xilinx now has a method to program the FPGA-based SmartNIC using P4. For those who are not in the networking industry, P4 is a language for programming networking pipelines. We see P4 being used in switches and DPUs as examples.

The basic concept here is that one has not just a NIC designed to offload a few functions, but a SmartNIC that has a control plane, data plane, and can be programmed using pre-packed, App Store, or custom developed IP.

Xilinx Smart World

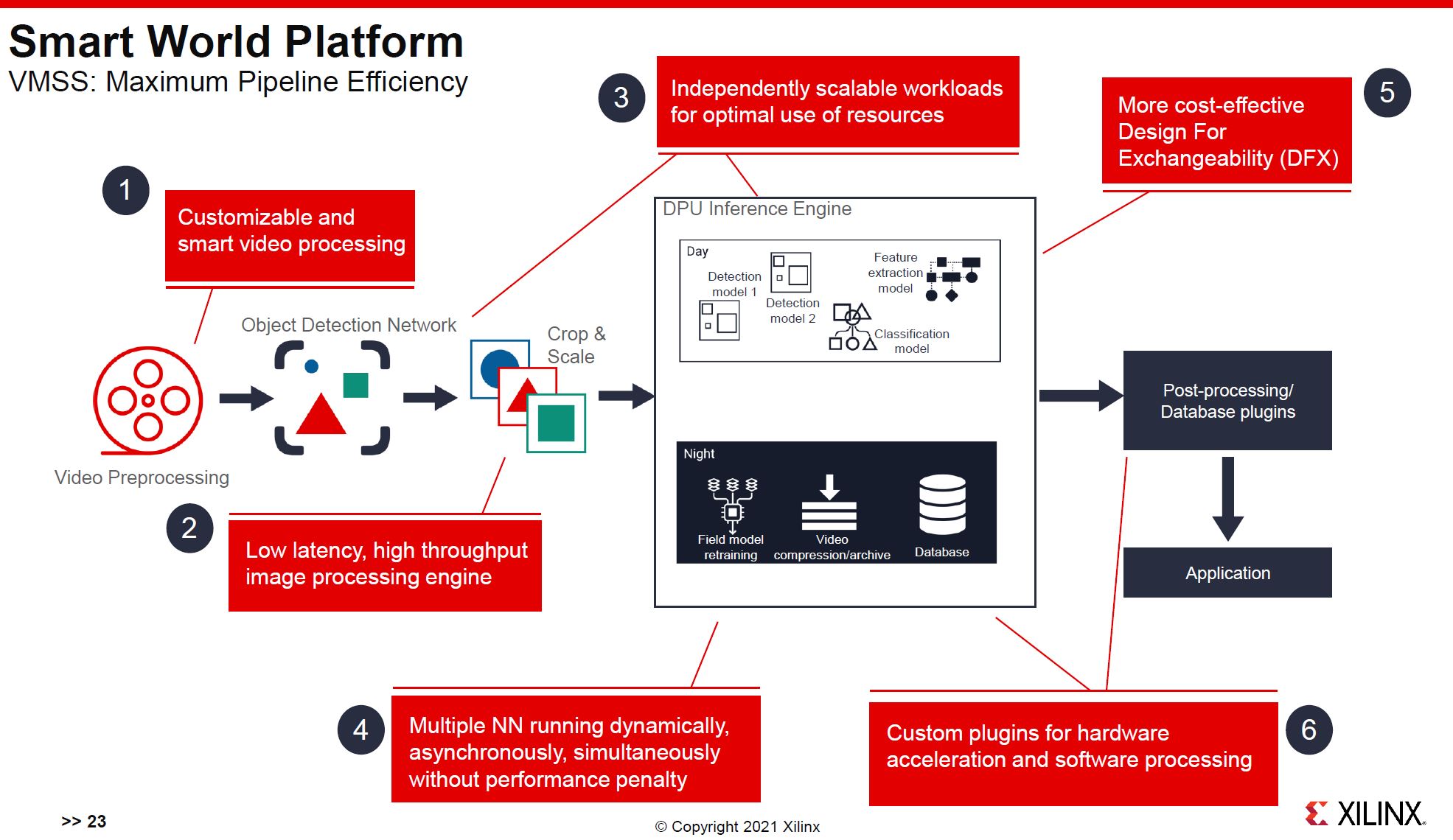

The next solution is called the Xilinx Smart World. Xilinx had many slides explaining the concept, but to save on bandwidth, let us make this easy: this is an AI video analytics platform with perhaps the most overarching name. The use case is largely if you are a government, retail operator, transportation provider, site security company, or some other use case where one may want to ingest large numbers of video feeds and track people and objects.

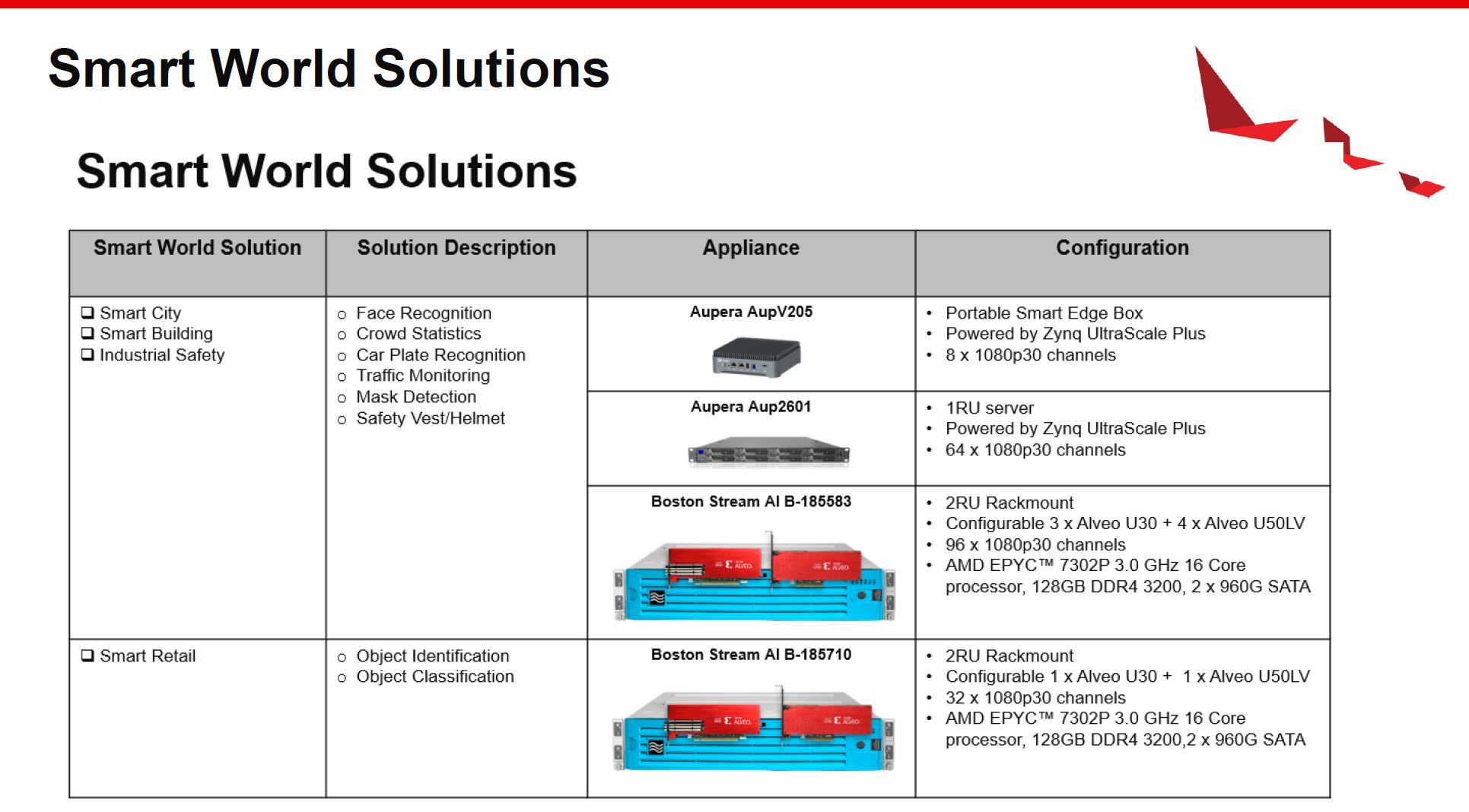

Xilinx has the outline of what may happen in the cycle above, and some of the solutions that are coming out with the Smart World platform below. If one reads into what the solutions are for, one can easily understand where in the world this is targeted and for what purposes.

Of course, given the pending AMD acquisition of Xilinx we get two AMD EPYC solutions called out with the AMD EPYC 7302P we reviewed, but the other solutions from Aupera conspicuously are missing CPU details. These are fun little bits we see in the industry.

Xilinx Accelerated Algorithmic Trading

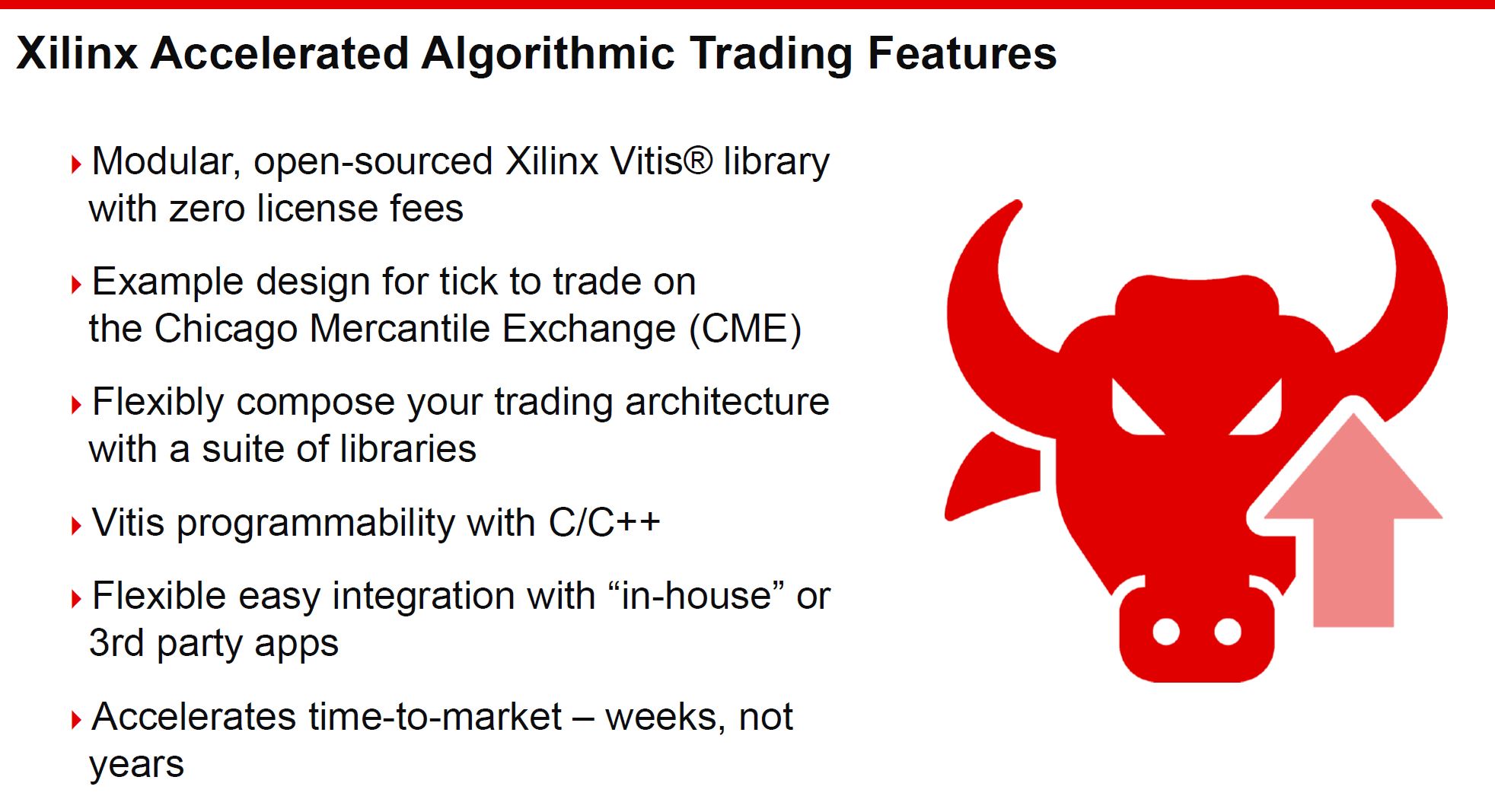

Xilinx also has a new pre-packaged high-frequency trading platform. The HFT market is one that SolarFlare was popular in because SolarFlare’s offload technology shaved latency and thus became important in the HFT world. Now, Xilinx has a platform to go after another segment of that market with its FPGAs.

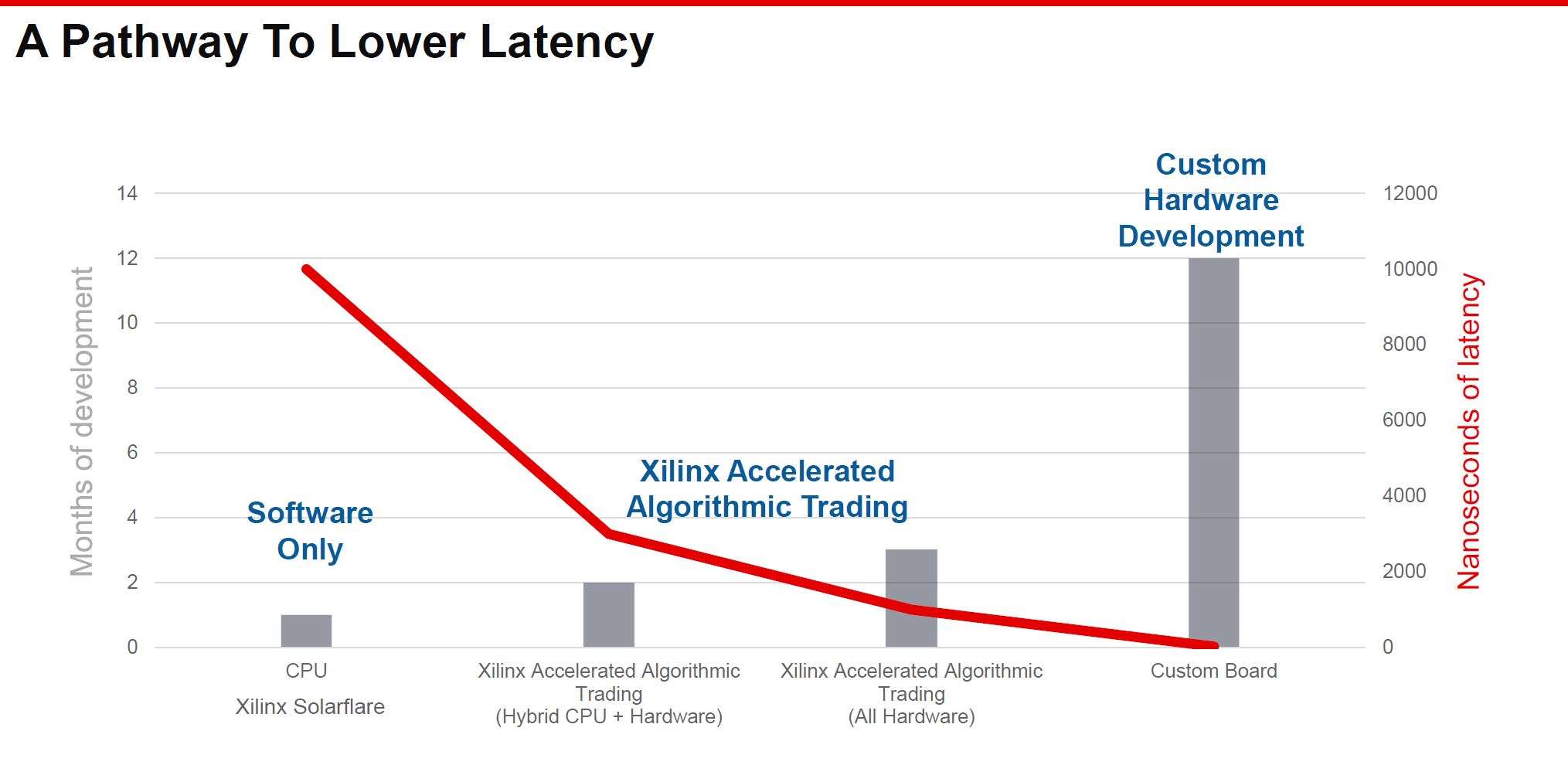

The basic concept here is that doing HFT on CPUs is higher-latency. Data comes in from the PCIe NIC to the CPU, the CPU then uses its general-purpose compute cores to crunch data with custom algorithms and make decisions. Then data has to be moved back over PCIe to the NIC. With FPGAs, trading can happen without that PCIe traversal and using a custom logic pipeline. This lowers latency. This is not a product that is designed to fully-replace the high-end custom-developed silicon/ and platforms. Instead, it is designed to get firms up and running quickly. Xilinx did not say this, but the general concept is that Xilinx is targeting a solution that gets a firm 80-90% of the fully-custom solution in <10% the time and resource expenditure.

Like the other offerings, Xilinx will have example designs for trading on the Chicago Mercantile Exchange. HFT firms typically do not share algorithms since that is the basis for their competition. Xilinx’s concept is to get a design that a firm can leverage adding its own algorithmic IP to the solution and then customize the exchange.

FPGAs in HFT are not new. This is Xilinx providing a shell to start from to accelerate adoption.

Final Words

Overall, we have some interesting items coming out of Xilinx. The Xilinx Alveo SN1000 is fascinating from a hardware standpoint, but the big announcement may not be hardware-related at all. In all three announcements, Xilinx is coming to the realization that TAM expansion for FPGAs is through making them more accessible to different application domains.

Instead of providing blank slate chips, we have PCIe cards like the Alveo SN1000 that one can plug into a standard server. Perhaps more importantly, we have the Xilinx App Store announcement that is trying to build a marketplace for IP much as we have marketplaces to purchase mobile, desktop, or cloud applications. Xilinx seems to be embracing the concept that products like an iPhone are popular because instead of being blank slates, they are able to have functionality out of the box that can be extended through a number of sources. Make no mistake, beyond the hardware lifecycle of the Alveo SN1000, this is a seismic industry change.

Impressively written. Thanks.

Will be up for sale in less than a year – especially after AMD’s Q12021 results are then backed up by Q22021… Maybe Nvidia will buy (AMD and Xilinx). MS and Sony likely to sue Su because of her utter incompetence (all eggs in 1 shaky basket) and inability to deliver the quantities Sony and MS need / contracted for.

I have doubts these are gonna go in high volumes at hyperscalers. Aren’t most of the NICs at hyperscalers just “more normal” NICs like the Intel, broadcom, Nvidia (mellanox) ones?

I guess it is supposed to help making an AWS nitro equivalent? But do Microsoft, Google, oracle have a nitro equivalent or need one?

@Bob Dobbs, not sure if you are a troll or not, but if anything, TSMC is way more reliable than others (for example Intel: 10nm years late).

Sony and Microsoft got as many SoCs as previous launches, demand is just higher.

AMD and probably even Sony/Microsoft don’t want to increase allocations in consoles at this stage and that’s smart: Sony and Microsoft can say there is high demand which is good for marketing; AMD, Sony and Microsoft can take some time to make minor revisions to improve yields, reduce costs and fix the initial batch issues (bad fans, SoCs yields etc); AMD can keep OK margins, and so on.

It’s not just that there isn’t capacity. Even if there was more capacity, at this stage they probably wouldn’t increase capacity for consoles due to trying to make minor revisions and such to optimize costs.

It is very nifty tech, but it also seems rather niche. I mean, I’d love to do high frequency trading (preferably with someone else’s money) but the cable from Wall St. to Calgary is too long and people keep tripping over it.

Seriously though, an app store ought to help get these things out of the edge case situations and into the, err, the edge.

Ziple

Reliable? You mean reliable supplies from the long fragile and currently broken supply chain?

AMD is cooked – only able to sell the contractually obligated console SOCs – and not even in the quantities that Sony and MS want – and unable to ship anything with a higher margin in any number at all – minor revenue increase from Q3 to Q4 even though their 2 topline products (Zen 3 and RDOA2) were released and should have been in the market – but they weren’t because of “reliable TSMC” being unable to source the materials it lacks to make a product ready to be boxed and sold.

LOL @ “making minor revisions to increase yields” – MS and Sony are not doing that in the least.

The problem is that TSMC is only recently a high volume manufacturer – and lacks the relationships with suppliers to get the materials they need – most of what they go to outside suppliers for – Intel makes in house – and for things like substrates – most of them likely built to service Intel – with Intel being largest customer for 30 years while TSMC was insisting that finFETs were not needed.

Has NOTHING to do with Sony and MS making changes – has to do with they are constrained by TSMC supply chain issues. Console SOCs are single digit margins and fixed cost.

Q1 is going to be a bloodbath for AMD – only high volume ultra low margins – not a good thing … week before Q1 results all the Analysts will complete the 2nd part of their AMD plan – the Dump – with Pump already in place. Q2 won’t be much better – they have doomed Xilinx – and it will be sold off like their Foundry and their designs to China.

Lisa Su is in so far over her head – she executed some of the basics – but flunked the part on diversifying its manufacturing – esp when all they make is pictures of things for TSMC to make.

Intel rolling in with MILLIONS of Ice Lake SP (regardless of the article on this site “Ice Pickle” – which is why he gets nothing to review except old stuff) – and Millions of Rocket Lake, Millions of the Golden Cove Trio and all the while Tiger Lake decimates the laptop parts from AMD (that they can’t ship).

Yeah, Reliable TSMC

I am sure you will respond with “But but but if TSMC was SO BAD, why is Intel moving it’s production to TSMC” – well moving the Core i3 to N5 and will supply TSMC with the things they cannot source for themselves to make sure Intel’s products are flying out at the same rate as Apple.

Hey Bob Dobbs – “which is why he gets nothing to review except old stuff” – Just as a heads-up we are the only site that Intel sampled for Cooper Lake and we were the first site to have Ice Lake (by many months.) We do abide by embargos/ NDAs. Ice Lake is coming out, but it was supposed to be out for a long time by now, not awaiting a late rev stepping.