Xsight Labs is a new networking startup with well over $100M in funding that is trying to break into the next-gen data center switch market. The company is betting on its new 7nm chip design and hyper-scale/ Tier 1 wins to bring its vision of a newly imagined network switch core to market. I had the opportunity to speak with the folks about their new X1 chip that is already sampling to customers.

Xsight Labs X1 25.6T Switch Chip

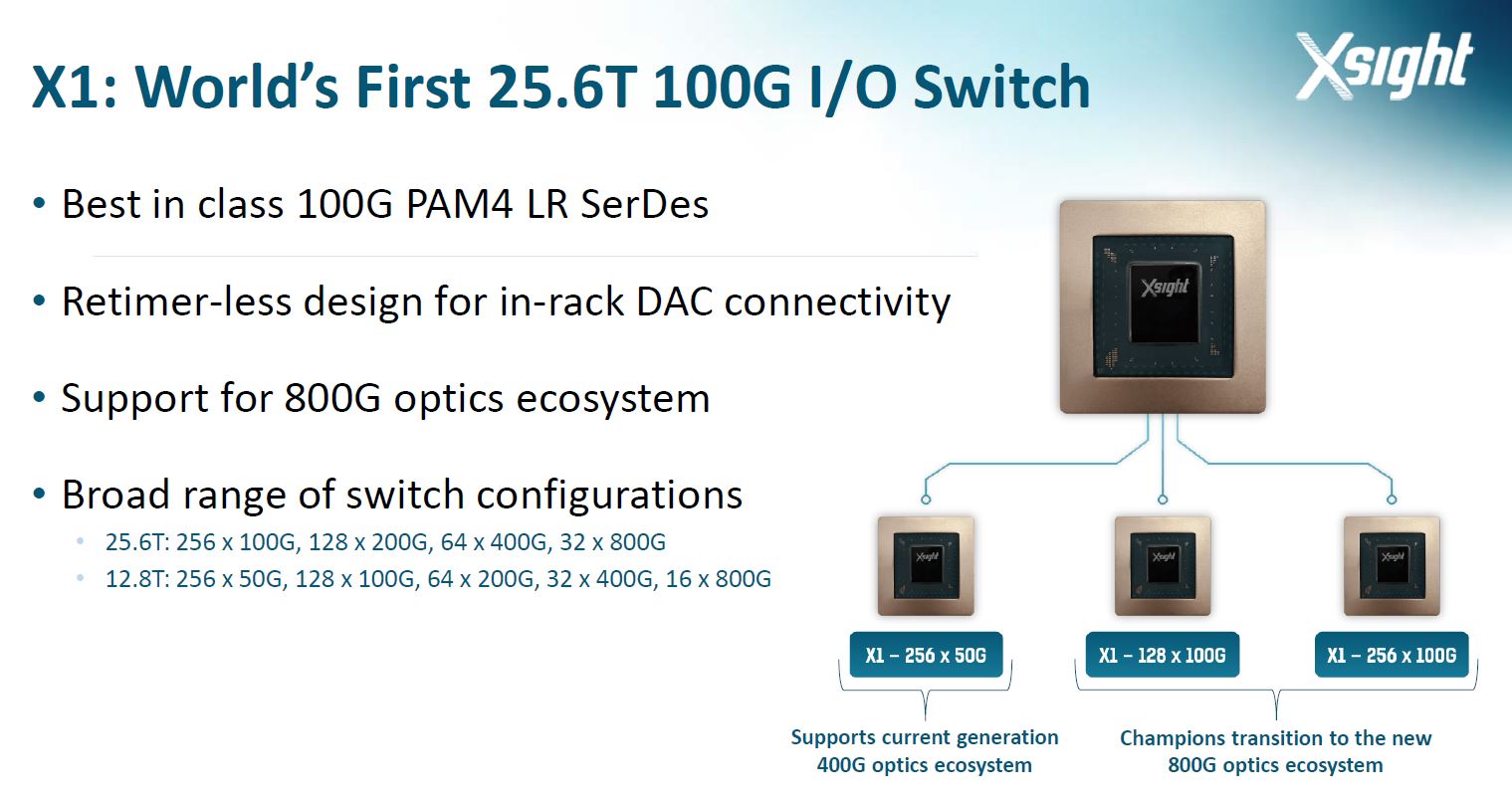

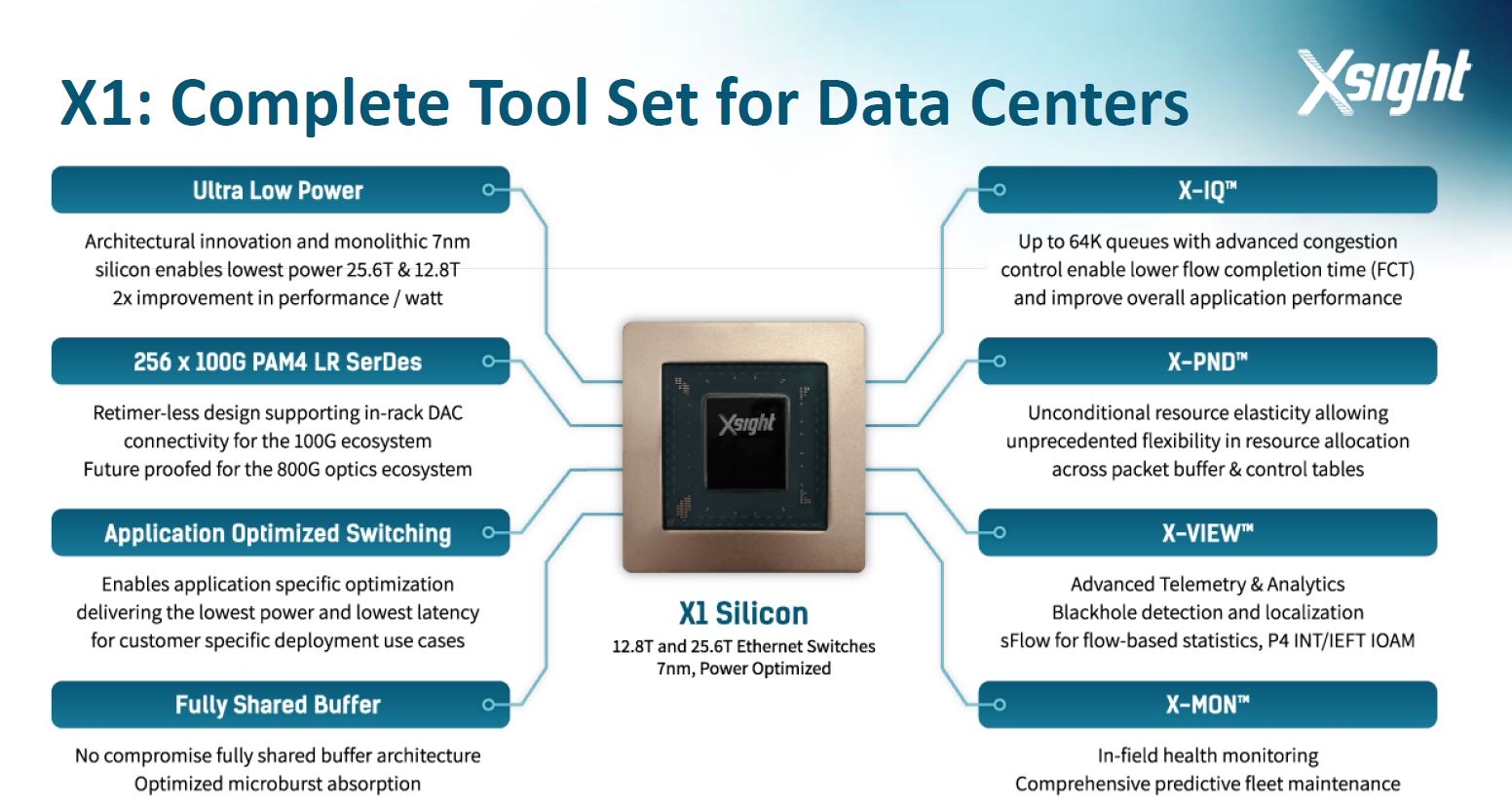

First off, the Xsight Labs X1 is a 25.6T switch. While there are others in the market saying they are sampling this next-generation of data center switch chip, Xsight says the X1 is the world’s first using 100G PAM4 LR SerDes in the 25.6T generation. This allows, for example, a 32x 800GB switches. In the STH lab, we are still using 32x100Gbps switches from several vendors making these about 8x the speed of what we are using.

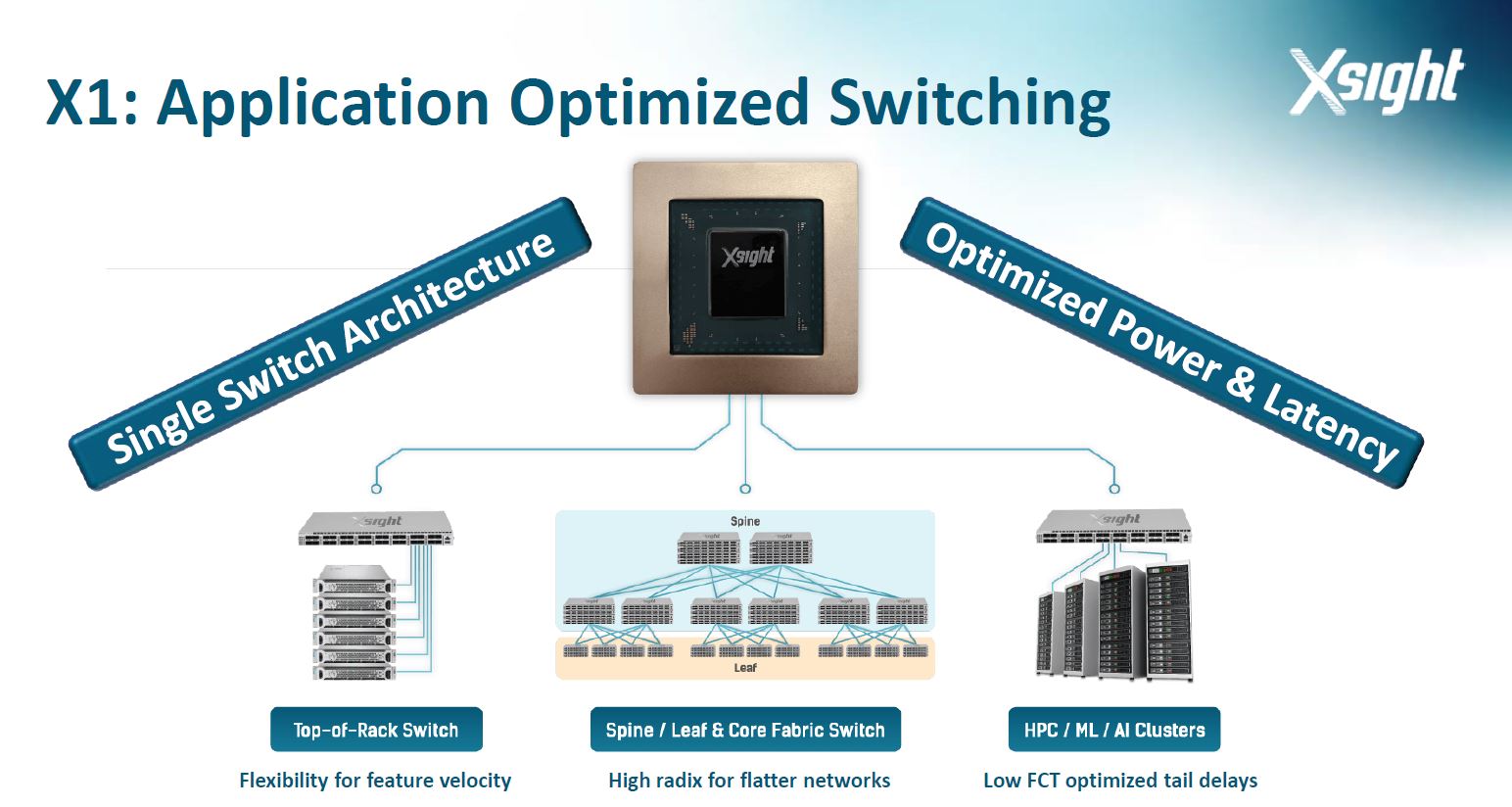

Another key feature is that the switches can support DACs for in-rack connectivity. At some point, as connection speeds increase DACs do not have the range to reach the full rack. At the same time, using DACs lowers power consumption and cost considerably so being able to use DACs is very important for many data center architectures. Xsight Labs is looking beyond the Top-of-Rack switch and looking at how it can service high-performance clusters as well as spine, leaf, and core networks all with a common architecture. Our sense after speaking with the company is that the X1 is the first in the company’s roadmap of products.

While incumbents have the luxury of supply chains, customer relationships, and years of practical deployment, newcomers have another advantage that Xsight is looking to exploit: a different entry point. By entering the market in the 12.8T/ 25.6T switch space, the company was able to specifically design its chips for these higher data rates rather than iterating on a several generation old design.

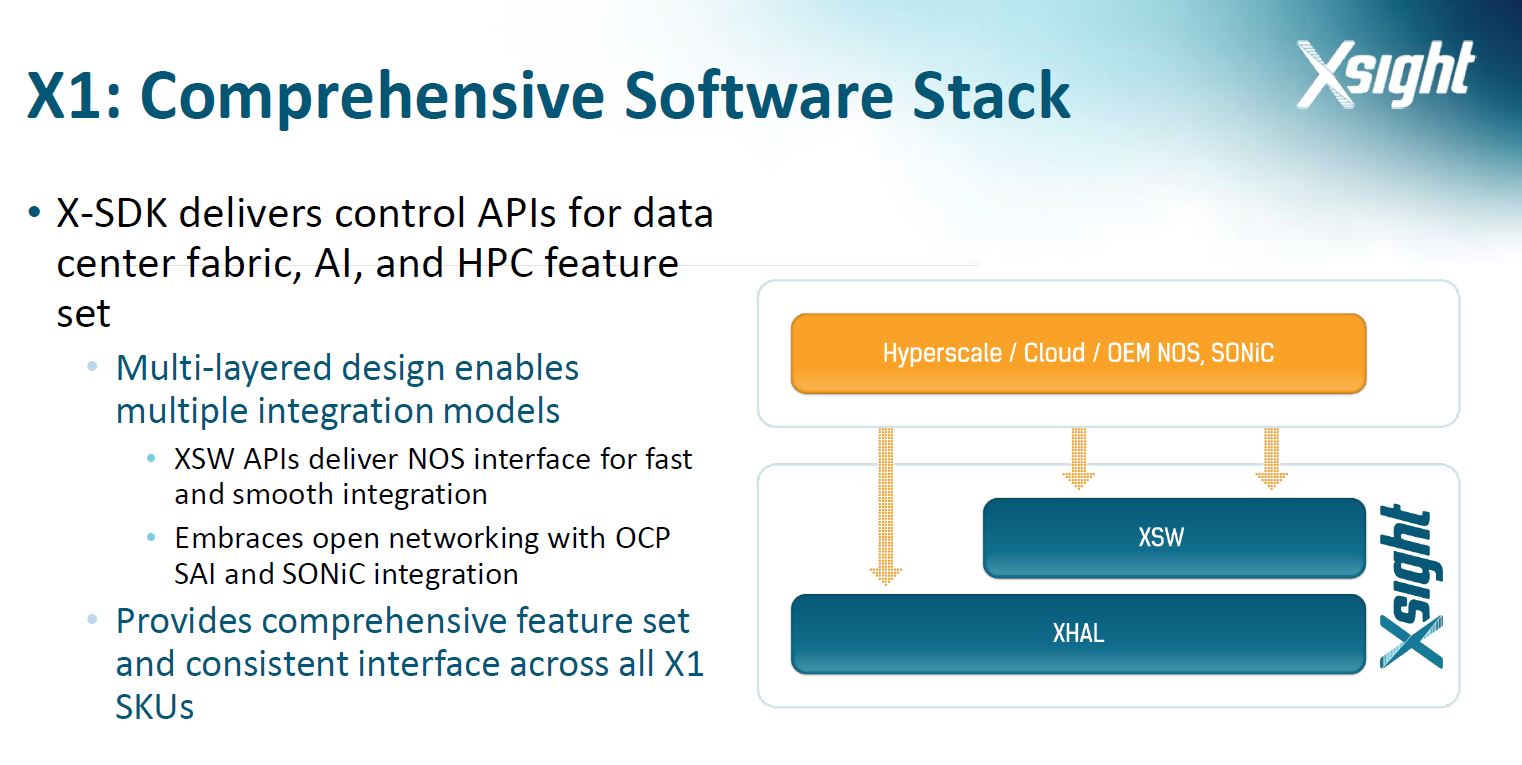

These days, it is no longer enough to product switch silicon. Instead, one needs to have a multi-layer software stack that can interface with major NOS ecosystems and development communities.

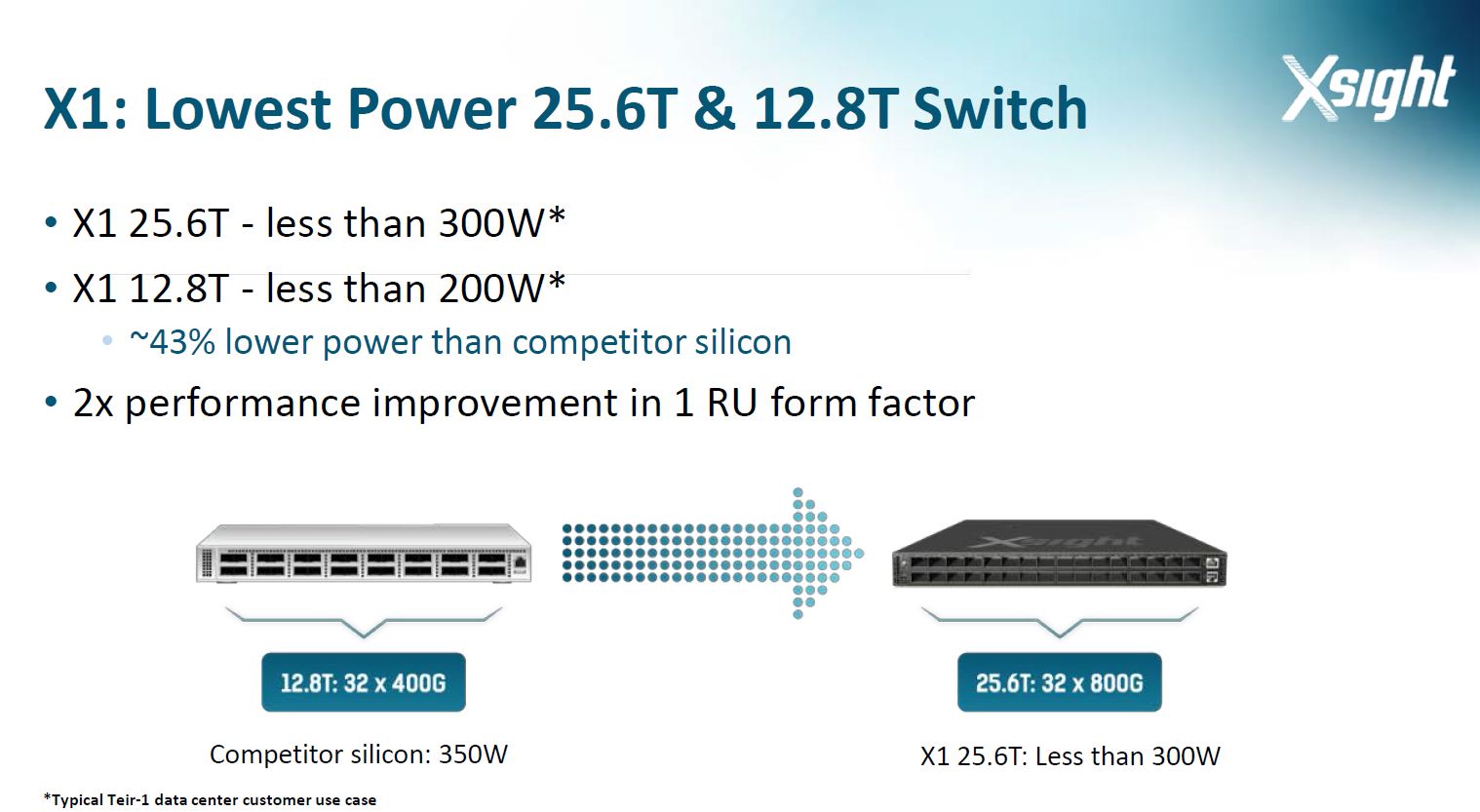

One of the biggest headline features is that the company says its switch is the lowest power. We asked, and the X1 is built as a monolithic die on TSMC 7nm process. This combined with the new architecture means that the X1 is producing sub 300W of power consumption at 25.6T while its competitors are using around 350W at half the speed or 12.8T speeds. This lower power consumption is set to lower operational costs for large customers. By using less power and generating less heat, another impact is that the company will also be launching 1U 32x 800G form-factor switches. The lower power chip helps cooling efforts which in turn means more compact switches.

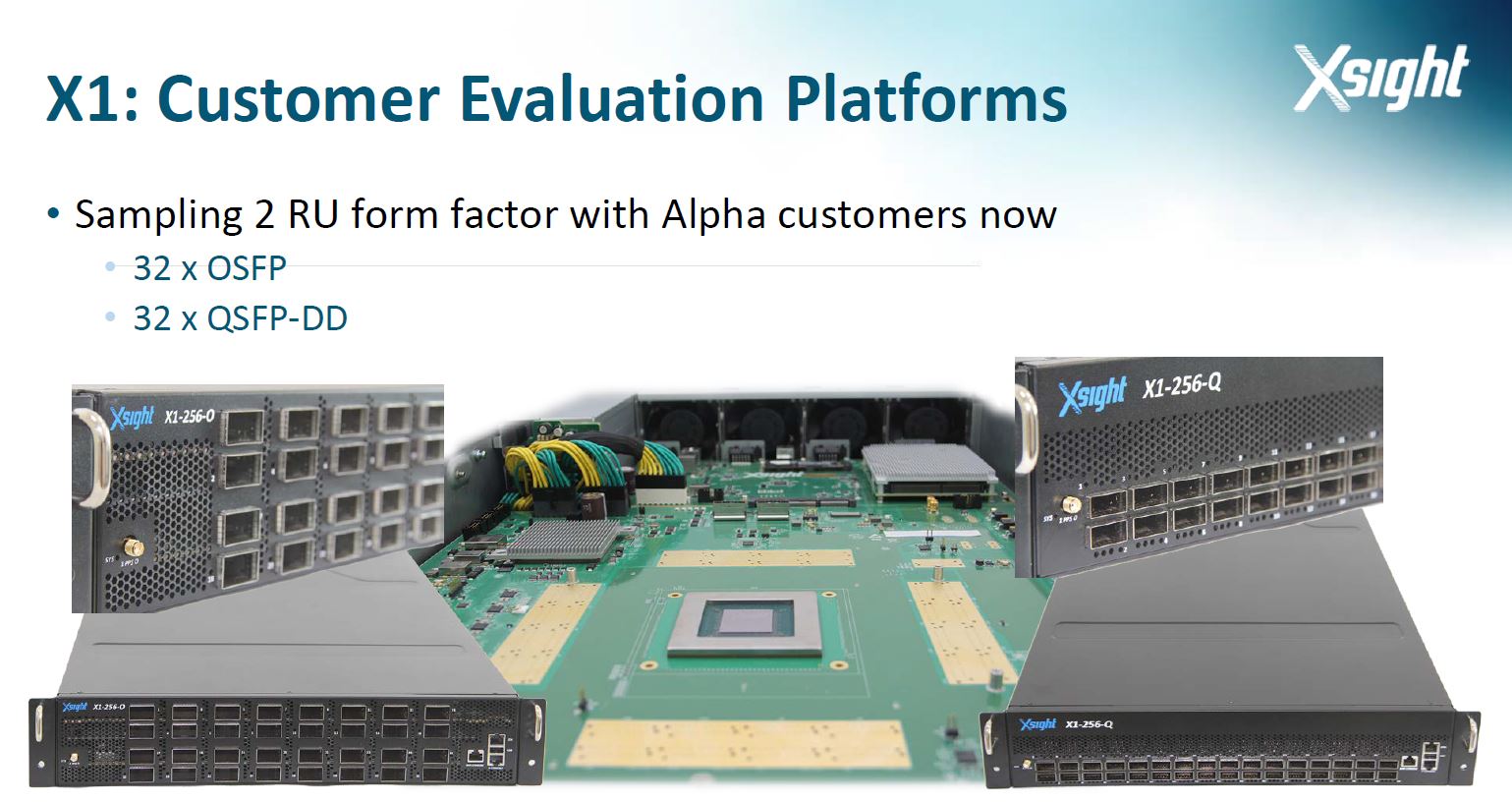

While the 1U form factor is coming, currently the company has Alpha customers on 2U 32x OSFP and 32x QSFP-DD switch platforms.

One of the big takeaways from the discussion is that this is not a design on someone’s laptop. Instead, there is working silicon being sampled to large customers today.

Final Words

Over the years, Broadcom has built a massive lead in the merchant switch silicon space. As with many markets, consolidating that much market share means that a lot of competition is brewing both large and small. We have covered Intel-Barefoot, NVIDIA-Mellanox, Innovium TERALYNX 8 25.6Tbps, and will cover Marvell’s latest efforts later this week. We asked Xsight about the competition and it thinks that its new design starting from a higher-performance starting point along with its features (such as switch silicon telemetry to predict failures) and low power consumption will lead to wins.

I also asked my favorite question. Namely, when we were going to see co-packaged optics, especially after I had Hands-on with the Intel Co-Packaged Optics and Silicon Photonics Switch earlier this year. From Xsight it sounds like they are thinking the 51.2T generation we will start to see co-packaged optics more and then the generation or two after that it will become commonplace. Xsight confirmed they have a plan for that transition which is important since it will be a massive operational and industry shift.

Overall, it is great to see innovation and competition in the switch market as having one company with too dominant of a position leads to less innovation and market concentration.

“as connection speeds increase DACs do not have the range to reach the full rack”

One can get some headroom for that if the switch is installed middle-of-the-rack instead of top-of-the-rack.

Nothing about this hardware is serving the home. Unless your home is in the janitor closet of a data center.

@Haus. Yes I agree. At some point in the last few years the “home” in ServeTheHome disappeared. =)

I don’t mean to be too negative, as I find the quality of the articles on this site very very good, and it’s always fun to read about the high-end stuff as well. But I still think it would be great to see a bit more focus on for example 2.5/5/10 Gbps stuff, high-quality reviews of NAS units (not just the regular computer magazine measures) etc.

Since the change of focus of SmallNetBuilder in 2018 I think there is a need for this. Or maybe I have missed some other good sites for home and SMB networking? Please let me know!

Hi guys. I hear you. Over 11.5 years things evolve beyond their original name. Tom has not been with Tom’s hardware in over a decade. Anand has likewise been at Apple for a long time. The Wall Street Journal does not just cover a street in New York City. Working on the mix is very much an everyday struggle. I hear the feedback.

I love hearing about this high end gear as this technology eventually filters down to the home. 10 Gbit Ethernet was common place in the data center a decade ago and costs have finally trickled down to be economical for consumers. Active optical cables for DACs are common place in the data center today but are just now starting to appear in the consumer space for high speed display connectivity (long HDMI 2.1, DisplayPort 2.0, Thunderbolt 3/4). Then we’ll see the flipping economics where higher consumer demand will also improve the economies of scale at the data center side: silicon photonics will drop down in price in a few years because of this dynamic.

I do think there needs to a bit more emphasis on how this will change things for consumers over the long run. For example, Intel’s Optane DIMM technology allows of a massive amount of addressable memory (but slow) memory for servers. What does this have to do with consumers? Right now nothing but it has the *potential* for laptops that’ll retain their memory when their batteries run out so no more special hibernation or booting up because your battery ran out. Just volumes need to go up and costs need to come down.