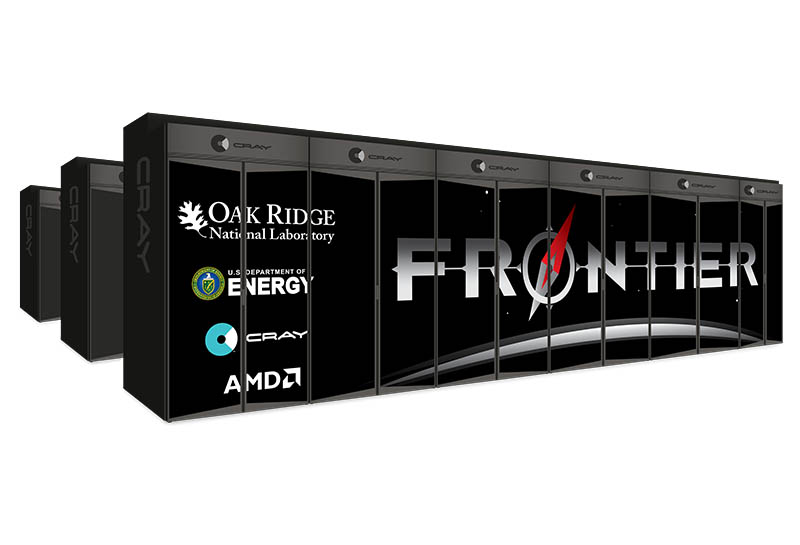

In some major HPC news today, HPE and Cray announced a definitive agreement whereby HPE would purchase Cray for around $1.3 billion. This comes on the heels of both the latest major supercomputer win last week where Cray and AMD Win Big Contracts for 1.5 Exaflop Frontier Supercomputer. That deal alone is worth around $600M. One thing is clear: building a business in the HPC space does not give the same multiples in terms of valuation on revenue that software gives.

HPE to Acquire Cray to Bolster HPC Capabilities

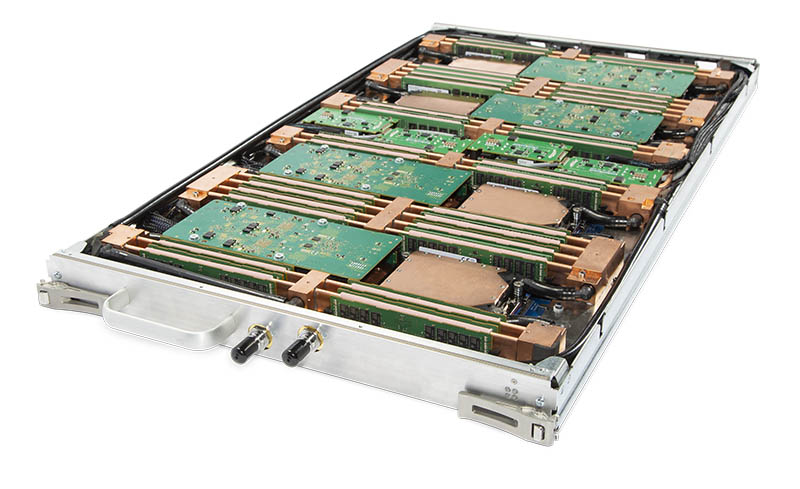

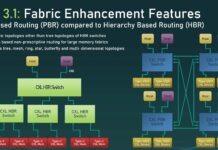

Almost three years ago, HPE acquires SGI for $275M. HPE has been pushing the SGI 8600 as a Cray Shasta platform competitor. With the Frontier win, Cray took a major system that will have market fallout. Other HPC clusters will look to Frontier leadership and use similar architectures, potentially seeing Cray Slingshot as the path forward briding a HPC interconnect with 100GbE. There is a non-zero chance that HPE recognized that this will be a leading technology and platform and decided it was worth owning the platforms as well as the teams. For the SGI 8600, this may spell trouble if the company decides to double-down on the Shasta platform.

One other really interesting aspect is the positioning of Shasta. Cray has positioned Shasta and the Slingshot interconnect as being ideal for crossing over to the emerging HPC and AI training markets that many non-traditional enterprise customers will explore in the near future. HPE happens to have a massive sales organization. It is intriguing to think about what can happen if HPE’s sales organization can be trained to use Shasta as its go-to answer for all of its customers that want on-prem AI and HPC capabilities. Further, HPE has the financing resources to sell these solutions to enterprises in different ways such as with consumption models. Cray clearly brings engineering talent and the prospect of a start platform. HPE brings a much larger sales force and capabilities to bring the platform to the enterprise.

It will certainly make for an interesting ISC 2019, or better stated, a more interesting Supercomputing 2019 as we learn more about how the combination plans its G2M strategy.

That is kind of a cheap way to buy a good and fast interconnect, $1.3B for Slingshot where NVidia paid $6.9B for Mellanox.

@Misha the big difference is that Cray is historically not very profitable and only posted a $456M revenue with a $72M loss for 2018 while Mellanox posted $1.09B with a $134M profit for the same year.

The real question is how quickly will HPE mess up Cray by applying its corporate crap to a company where many people have some origins in academics which traditionally is a big market for HPC. My money is on a significant writeoff on this acquisition within 2 years as this deal overvalued Cray by about 20% based on their EBITDA while the Mellanox acquisition is right on the money.

@David, wise words from Jeff Bezos, eventually Amazon will go bankrupt.

When HPE and Cray put their strenghts together.. their future might be bright.

Slingshot and HPE’s top managment will be the decisive factors for the future, like infinity fabric and Lisa Su are for AMD.

Intel, Cisco and Juniper have been very profitable for the last decade(by cutting corners with security and handing over backdoors). Let’s blame Huawei and ZTE is their new strategy.

I guess we have to wait and see what the future brings.

@Misha while profits are not everything generally a company making an acquisition is looking for some ROI. In HPEs case this may be market share, refinancing of Crays debt or patents.

While I don’t think that the acquisition is necessarily bad for the market or HPe I have big question marks at their valuation which generally does not bode well for future developments. Historically I can name Compaq, DSE, Autonomy, Palm and 3com as equally overvalued and underperforming companies they acquired.

Time will tell, but I would’ve liked a merger or acquisition by (for example) SolarFlare a hell of a lot more.