Cavium released more details on its upcoming ARMv8 SoC squarely targeted at the Intel Xeon E5 processor families. While competitors such as AMD and Applied Micro are targeting the Intel Atom (Avoton/ Rangeley) and Xeon E3-1200 space, Cavium is setting its sights on Intel’s high-margin profit centers. Cavium’s approach is more complex, but should put Intel on notice that competition is coming.

Where ARM vendors have been focusing efforts

Recently we published a piece on how ARM vendors are set to struggle in the microserver segment over the next few years. The simple thesis is that targeting a small segment with many SKUs from many vendors will give Intel a significant economies of scale advantage. Whereas vendors such as AMD, AppliedMicro and others have been targeting an under-performing (compared to expectations) marketing segment, Cavium is looking upstream to the higher margin business. Cavium has a unique business model with the ThunderX as it is propositioning the part above.

Cavium ThunderX

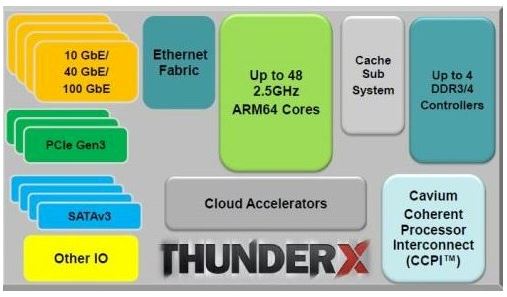

The Cavium ThunderX configurations span a number of configurations. Like we have seen in other ARM applications, the focus is building as much into the SoC as possible. Cavium has two product families, one for lower-end single socket configurations and another for single or dual socket configurations. Based on a 28nm process, and expected in the second half of 2014, these processors are going to be facing off against Haswell-EP, Intel’s second generation 22nm process CPU. ThunderX is able to pack up to 96 64-bit ARMv8 cores in a single system which is a major departure from previous design announcements.

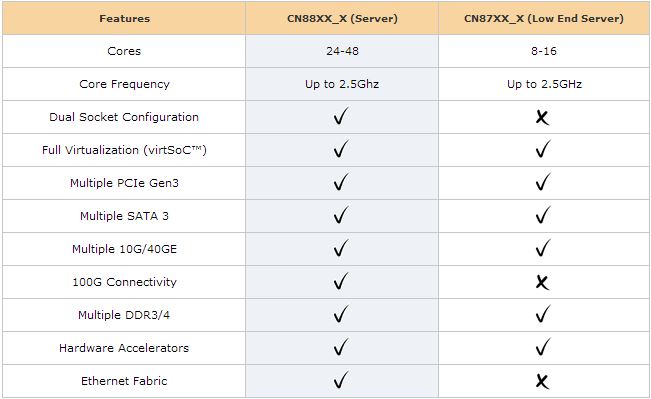

From the below table, one can see that the ThunderX will have several key features such as integrated high-speed networking, the ability to support DDR4 (up to 1TB in some configurations) and significant expansion options along with SoC Hardware Accelerators.

When we look at the basic functionality blocks, one thing is clear, Cavium is targeting not just the Intel Xeon E5, but also Intel, Broadcom and others’ networking business. If networking moves to the CPU, that is another $400-$1000 per server that can be replaced by a ThunderX SoC. AMD is taking a similar path integrating 10GbE networking but Cavium has 40GbE and 100GbE options.

The days of requiring a separate 8w+ controller onboard or discrete controller card may be gone for many servers if this trend catches on.

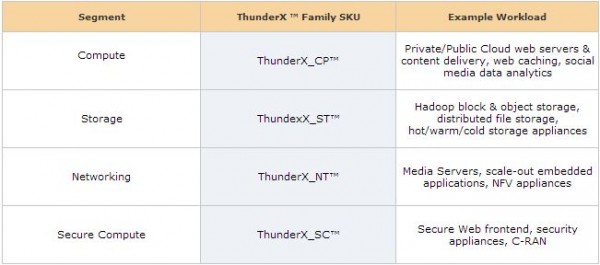

In terms of segments, it seems as though Cavium is targeting four main segments with different SKU families. Compute, storage, networking and Secure Compute. It sounds like the company will incorporate different accelerator IP blocks based on the SKU’s target workload.

One area that is still not disclosed is exactly how many SKUs there will be. Four families of processors, with two different series and two different series there are 8 possible base parts in terms of accelerators. Even if we take the min/ max core counts as the only options, and assume only 10GbE networking and DDR4, that is already 16 possible SKUs which is getting closer to the Intel Xeon E5 lineup’s magnitude, yet with lower starting market share. It will be interesting to see how the company deals with manufacturing volumes of each SKU.

Overall, this is an exciting development in the space. We already have sent feelers to some of the partner vendors building the platform about getting one closer to when they hit Silicon.